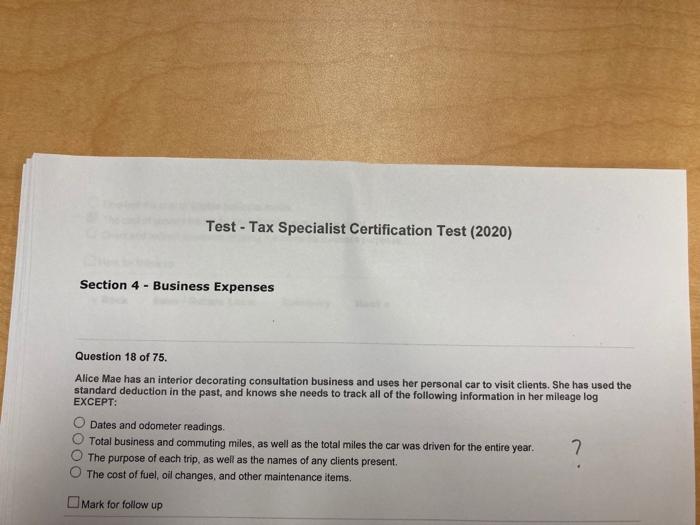

Question: Test - Tax Specialist Certification Test (2020) Section 4 - Business Expenses Question 18 of 75. Alice Mae has an interior decorating consultation business and

Test - Tax Specialist Certification Test (2020) Section 4 - Business Expenses Question 18 of 75. Alice Mae has an interior decorating consultation business and uses her personal car to visit clients. She has used the standard deduction in the past, and knows she needs to track all of the following information in her mileage log EXCEPT: Dates and odometer readings. Total business and commuting miles, as well as the total miles the car was driven for the entire year. 7 The purpose of each trip, as well as the names of any clients present. The cost of fuel oil changes, and other maintenance items. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts