Jones Manufacturing Company makes two products. The company's budget includes $471,750 of overhead. In the past,...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

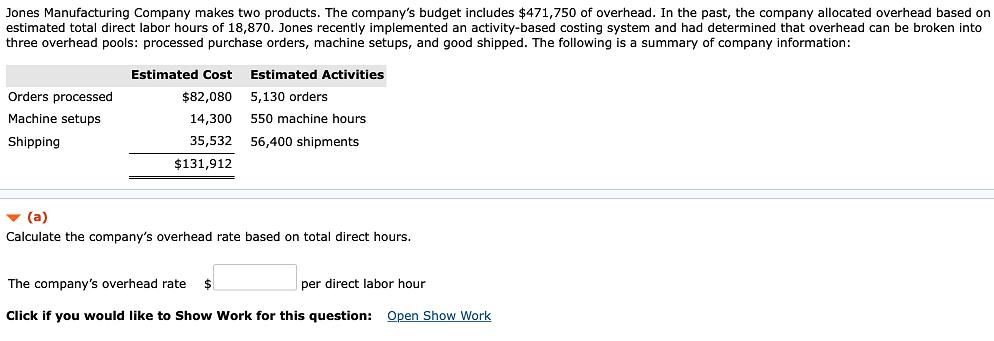

Jones Manufacturing Company makes two products. The company's budget includes $471,750 of overhead. In the past, the company allocated overhead based on estimated total direct labor hours of 18,870. Jones recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: processed purchase orders, machine setups, and good shipped. The following is a summary of company information: Estimated Cost Estimated Activities Orders processed $82,080 5,130 orders Machine setups 14,300 550 machine hours Shipping 35,532 56,400 shipments $131,912 v (a) Calculate the company's overhead rate based on total direct hours. The company's overhead rate $ per direct labor hour Click if you would like to Show Work for this question: Open Show Work Jones Manufacturing Company makes two products. The company's budget includes $471,750 of overhead. In the past, the company allocated overhead based on estimated total direct labor hours of 18,870. Jones recently implemented an activity-based costing system and had determined that overhead can be broken into three overhead pools: processed purchase orders, machine setups, and good shipped. The following is a summary of company information: Estimated Cost Estimated Activities Orders processed $82,080 5,130 orders Machine setups 14,300 550 machine hours Shipping 35,532 56,400 shipments $131,912 v (a) Calculate the company's overhead rate based on total direct hours. The company's overhead rate $ per direct labor hour Click if you would like to Show Work for this question: Open Show Work

Expert Answer:

Related Book For

OM4 operations management

ISBN: 978-1133372424

4th edition

Authors: David Alan Collier, James R. Evans

Posted Date:

Students also viewed these accounting questions

-

The Erlanger Manufacturing Company makes two products. The profit estimates are $35 for each unit of product 1 sold and $50 for each unit of product 2 sold. The labor-hour requirements for the...

-

Spring Manufacturing Company makes two components identified as C12 and D57. Selected budgetary data for 2010 follow: The firm expects the average wage rate to be $25 per hour in 2010. Spring...

-

Kunkel Company makes two products and uses a traditional costing system in which a single plantwide predetermined overhead rate is computed based on direct labor-hours. Data for the two products for...

-

When something burns, a. it combines with phlogiston b. it gives off phlogiston c. it combines with oxygen d. it gives off oxygen

-

At a large urban college, about half the students live off campus in various arrangements and the other half live in dormitories on campus. Is academic performance dependent on living arrangements?...

-

If you are using a rope to raise a tall mast, attaching the rope to the middle of the mast as in Figure Q8.4a gives a very small torque about the base of the mast when the mast is at a shallow angle....

-

Use information from Section 6.7 to estimate which form of electromagnetic radiation is the lowest energy ionizing radiation. Data from section 6.7 When we first introduced the concept of the...

-

Mount Snow operates a Rocky Mountain ski resort. The company is planning its lift ticket pricing for the coming ski season. Investors would like to earn a 16% return on the companys $109,375,000 of...

-

Find the value of an investment of $14,771 for 14 years at an annual interest rate of 5.27% compounded continuously.

-

(a) A homogeneous solid body of arbitrary shape is initially at temperature T, throughout. At t = 0 it is immersed in a fluid medium of temperature T. Let L be a characteristic length in the solid....

-

Moscot manufactures high-end sunglasses that it sells in retail shops and online for $310, on average. Assume the following represent manufacturing and other costs. Variable Costs per Unit Fixed...

-

How can information be used to improve peoples decision making? There are several factors in life we cant control and stressing about things like coronavirus and global emergencies isnt unusual. We...

-

Calculate nominal GDP in 2021 and 2022. Tropical Republic produces only bananas and coconuts. The base year is 2021, and the table gives the quantities produced and the market prices. Quantities...

-

What is meant by integrated marketing communications? Explain the advantages of taking an integrated approach to marketing communications.

-

Explain why GDP might be an unreliable indicator of the standard of living.

-

Which scheme will (i) increase economic inequality? (ii) reduce economic inequality? (iii) have no effect on economic inequality? The table shows three redistribution schemes. Before-tax income (yen)...

-

You have learned a great deal about the Internet Protocol (IP). IP is a set of rules for how data is sent across networks and arrive at the intended destination. An IP address is a numeric identifier...

-

Write a paper about medication error system 2016.

-

(1) Do you think the following jobs require standard times? Explain your reasoning. a. Carpet installers b. Software programmers c. Cable T.V. installers d. Hotel maids e. Bank tellers f. Airline...

-

Bushnell's Sand and Gravel (BSG) is a small firm that supplies sand, gravel, and topsoil to contractors and landscaping firms. BSG maintains an inventory of high-quality, screened topsoil for...

-

A manufacturer's average work-in-process inventory for Part #2934 is 500 parts. The workstation produces parts at the rate of 200 parts per day. What is the average time a part spends in this...

-

How many board members did Ramalinga Raju implicate in the fraud?

-

How much money did the Rajus earn from sales of Satyam stock in the eight years preceding the fraud revelation?

-

When the fraud was revealed who took control of the company?

Study smarter with the SolutionInn App