Question: Text Insert unction AutoSum Recently Financial Logical Used Date & Lookup & Math & Time Reference Trig More Functions 1 fx P8-27 B D E

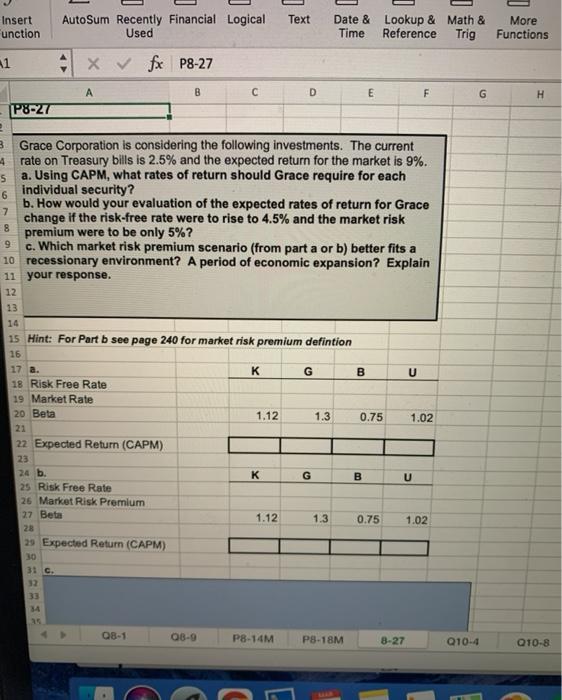

Text Insert unction AutoSum Recently Financial Logical Used Date & Lookup & Math & Time Reference Trig More Functions 1 fx P8-27 B D E F G P8-27 7 3 Grace Corporation is considering the following investments. The current 4 rate on Treasury bills is 2.5% and the expected return for the market is 9%. 5 a. Using CAPM, what rates of return should Grace require for each 6 individual security? b. How would your evaluation of the expected rates of return for Grace change if the risk-free rate were to rise to 4.5% and the market risk 8 premium were to be only 5%? c. Which market risk premium scenario (from part a or b) better fits a 10 recessionary environment? A period of economic expansion? Explain 11 your response. 12 9 13 U 1.02 14 15 Hint: For Part b see page 240 for market risk premium defintion 16 17 a. G B 18 Risk Free Rate 19 Market Rate 20 Beta 1.12 1.3 0.75 21 22 Expected Return (CAPM) 23 24 b. K B 25 Risk Free Rate 26 Market Risk Premium 27 Beta 1.12 1.3 0.75 28 29 Expected Return (CAPM) 30 31 c. G 1.02 08-1 08-9 P8-14M PS.18M 8-27 Q10-4 Q10-8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts