Question: TGY has a defined contribution pension plan for its employees. The plan is trusteed, and each year the company makes an annual contribution, matching employee

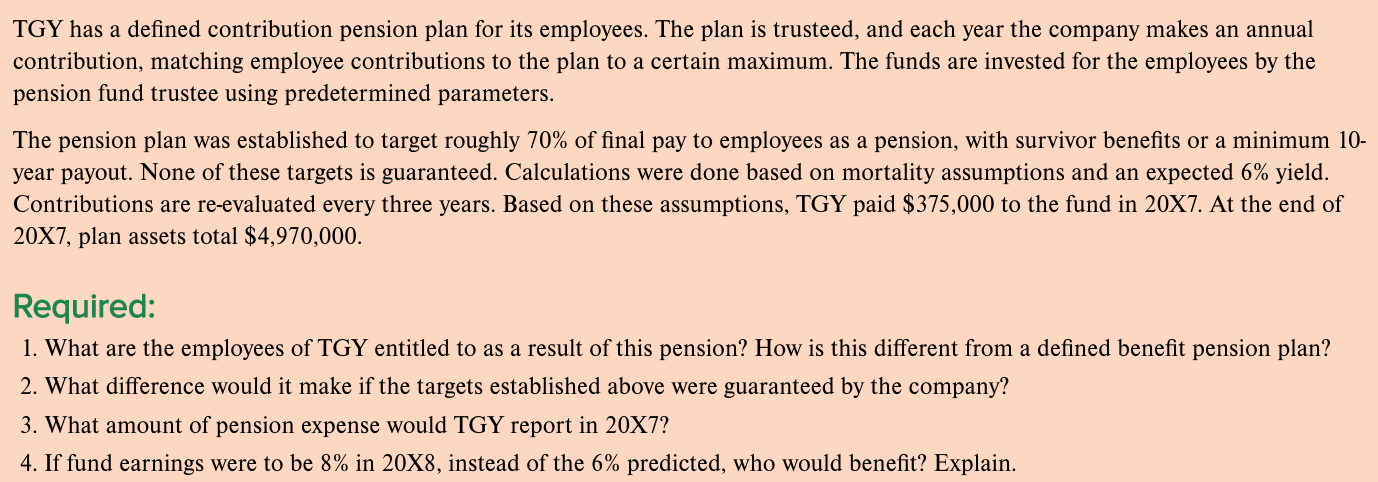

TGY has a defined contribution pension plan for its employees. The plan is trusteed, and each year the company makes an annual contribution, matching employee contributions to the plan to a certain maximum. The funds are invested for the employees by the pension fund trustee using predetermined parameters. The pension plan was established to target roughly 70% of final pay to employees as a pension, with survivor benefits or a minimum 10- year payout. None of these targets is guaranteed. Calculations were done based on mortality assumptions and an expected 6% yield. Contributions are re-evaluated every three years. Based on these assumptions, TGY paid $375,000 to the fund in 20X7. At the end of 20X7, plan assets total $4,970,000. Required: 1. What are the employees of TGY entitled to as a result of this pension? How is this different from a defined benefit pension plan? 2. What difference would it make if the targets established above were guaranteed by the company? 3. What amount of pension expense would TGY report in 20X7? 4. If fund earnings were to be 8% in 20X8, instead of the 6% predicted, who would benefit? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts