Question: Thank you. Each student is required to use a computer spreadsheet to develop a complete set of formal financial statements (Income Statement, Retained Earnings Statement,

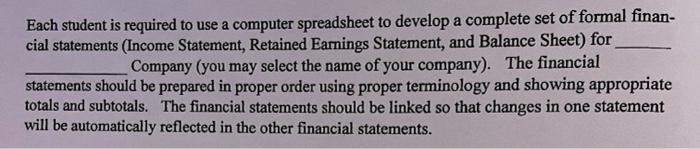

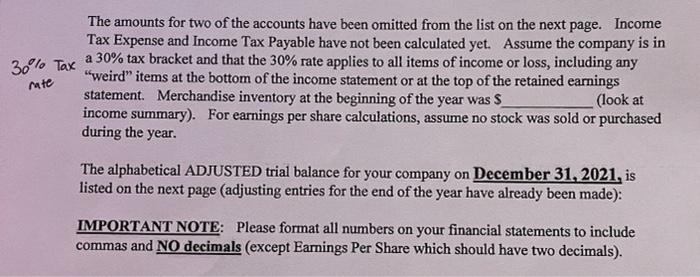

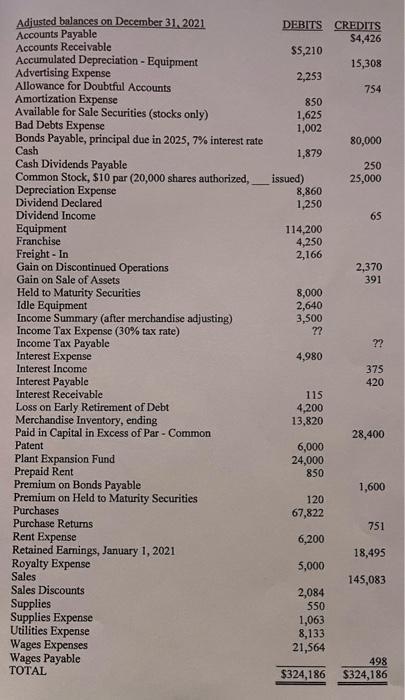

Each student is required to use a computer spreadsheet to develop a complete set of formal financial statements (Income Statement, Retained Earnings Statement, and Balance Sheet) for Company (you may select the name of your company). The financial statements should be prepared in proper order using proper terminology and showing appropriate totals and subtotals. The financial statements should be linked so that changes in one statement will be automatically reflected in the other financial statements. The amounts for two of the accounts have been omitted from the list on the next page. Income Tax Expense and Income Tax Payable have not been calculated yet. Assume the company is in a 30% tax bracket and that the 30% rate applies to all items of income or loss, including any "weird" items at the bottom of the income statement or at the top of the retained earnings statement. Merchandise inventory at the beginning of the year was s (look at income summary). For earnings per share calculations, assume no stock was sold or purchased during the year. The alphabetical ADJUSTED trial balance for your company on December 31, 2021, is listed on the next page (adjusting entries for the end of the year have already been made): IMPORTANT NOTE: Please format all numbers on your financial statements to include commas and NO decimals (except Earnings Per Share which should have two decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts