Question: Thank you for your help in advance! Required information Problem 912 (Algo) Retail inventory method; various applications [LO9-3, 9-4, 9-5] [The following information applies to

![Retail inventory method; various applications [LO9-3, 9-4, 9-5] [The following information applies](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e7b0c55c02b_10066e7b0c4f0886.jpg)

![to the questions displayed below.] Raleigh Department Store uses the conventional retail](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e7b0c5ed826_10166e7b0c58cf2f.jpg)

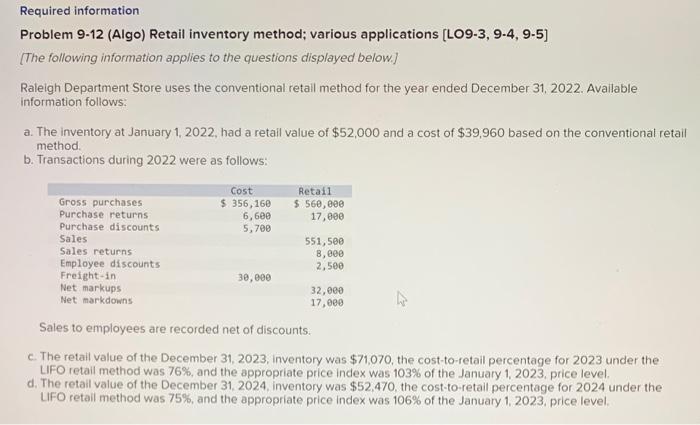

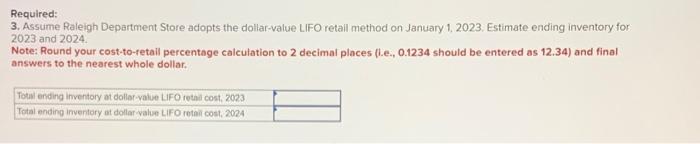

Required information Problem 912 (Algo) Retail inventory method; various applications [LO9-3, 9-4, 9-5] [The following information applies to the questions displayed below.] Raleigh Department Store uses the conventional retail method for the year ended December 31, 2022. Available information follows: a. The inventory at January 1, 2022, had a retail value of $52,000 and a cost of $39,960 based on the conventional retail method. b. Transactions during 2022 were as follows: Sales to employees are recorded net of discounts. c. The retail value of the December 31, 2023, inventory was $71,070, the cost-to-fetail percentage for 2023 under the LIFO retall method was 76%, and the appropriate price index was 103% of the January 1,2023 , price level. d. The retail value of the December 31, 2024, inventory was $52,470, the cost-to-retail percentage for 2024 under the LIFO retail method was 75%, and the appropriate price index was 106\% of the January 1, 2023, price level. Required: 1. Estimate ending inventory for 2022 using the conventional retail method. Note: Amounts to be deducted should be indicated with a minus sign. Round your cost-to-retail percentage calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34) and final answers to the nearest whole dollar. Note: Amounts to be deducted should be indicated with a minus sign. Round your cost-to-retail percentage calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34 ) and final answers to the nearest whole dollar. Required: 3. Assume Raleigh Department Store adopts the dollar-value LIFO retall method on January 1, 2023, Estimate ending inventory for: 2023 and 2024 Note: Round your cost-to-tetall percentage calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34) and final answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts