Question: thanks a bunch Hawthorne Manufacturing (HM) installed a computerized machine in its factory at a cost of $490,000 on January 1,2023 . The machine has

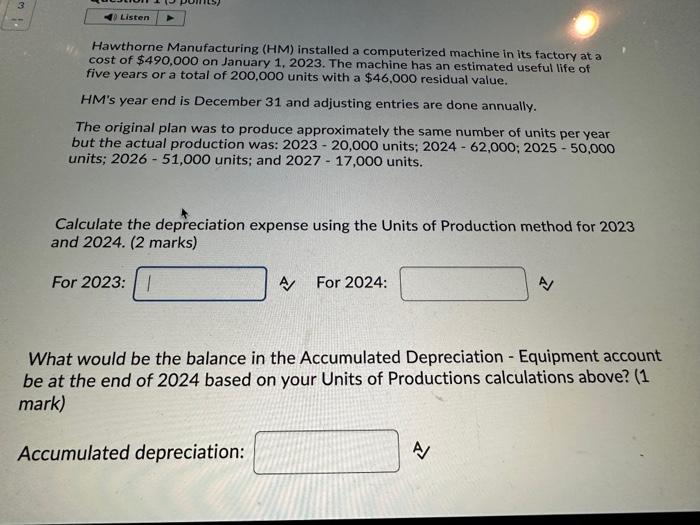

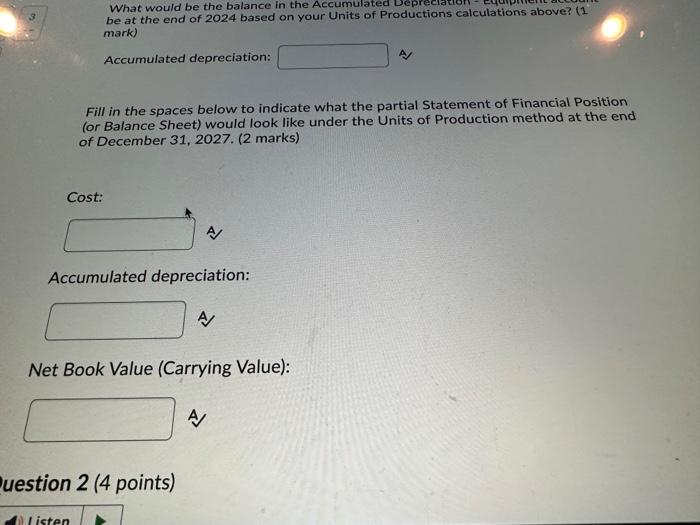

Hawthorne Manufacturing (HM) installed a computerized machine in its factory at a cost of $490,000 on January 1,2023 . The machine has an estimated useful life of five years or a total of 200,000 units with a $46,000 residual value. HM's year end is December 31 and adjusting entries are done annually. The original plan was to produce approximately the same number of units per year but the actual production was: 2023 - 20,000 units; 202462,000;202550,000 units; 2026 - 51,000 units; and 2027 - 17,000 units. Calculate the depreciation expense using the Units of Production method for 2023 and 2024. (2 marks) For 2023 A. For 2024: What would be the balance in the Accumulated Depreciation - Equipment account be at the end of 2024 based on your Units of Productions calculations above? ( 1 lark) ccumulated depreciation: A What would be the balance in the Accumulated Proprections calculations above? ( 1 ) mark) Accumulated depreciation: Fill in the spaces below to indicate what the partial Statement of Financial Position (or Balance Sheet) would look like under the Units of Production method at the end of December 31,2027. ( 2 marks) Cost: Accumulated depreciation: Net Book Value (Carrying Value): A. uestion 2 (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts