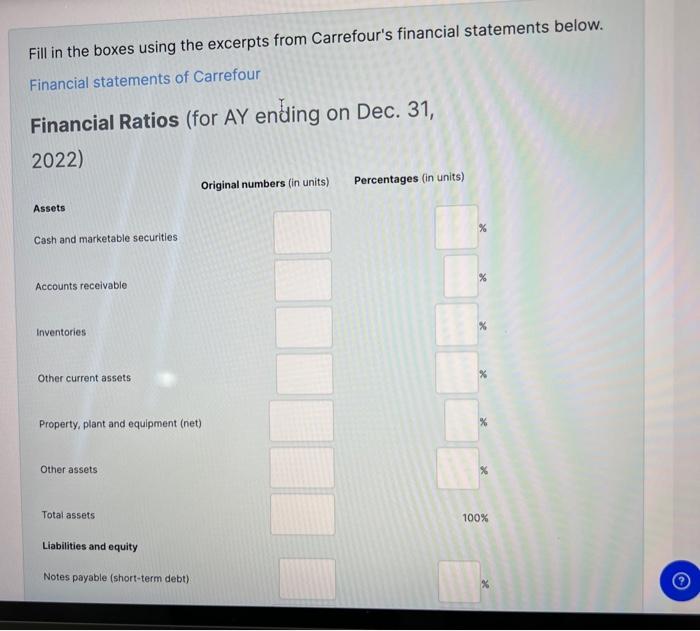

Question: thanks Fill in the boxes using the excerpts from Carrefour's financial statements below. Financial statements of Carrefour Financial Ratios (for AY enling on Dec. 31,

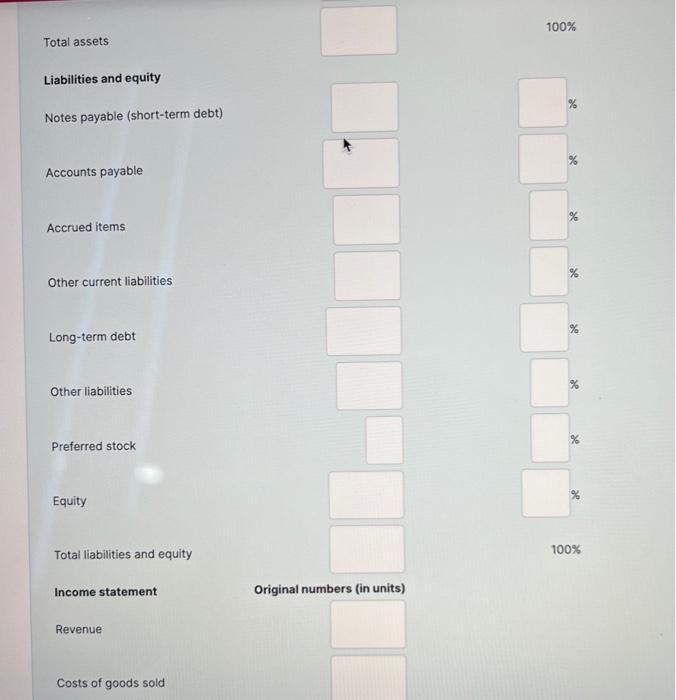

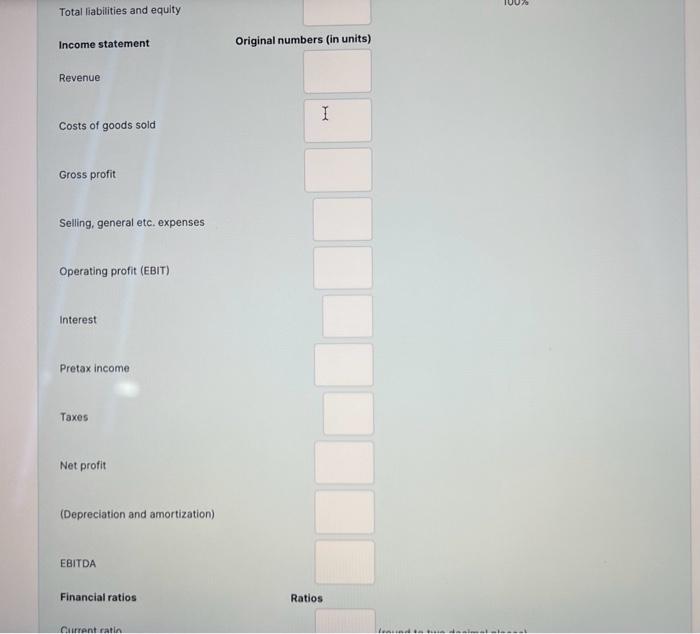

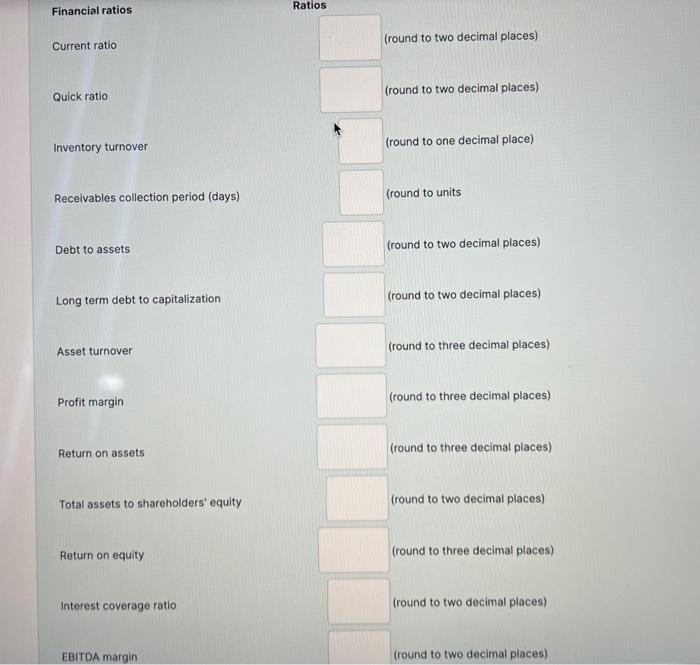

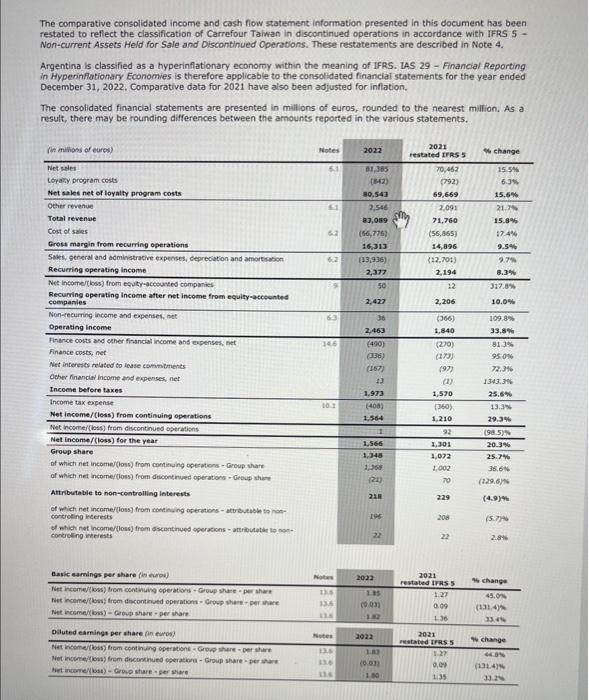

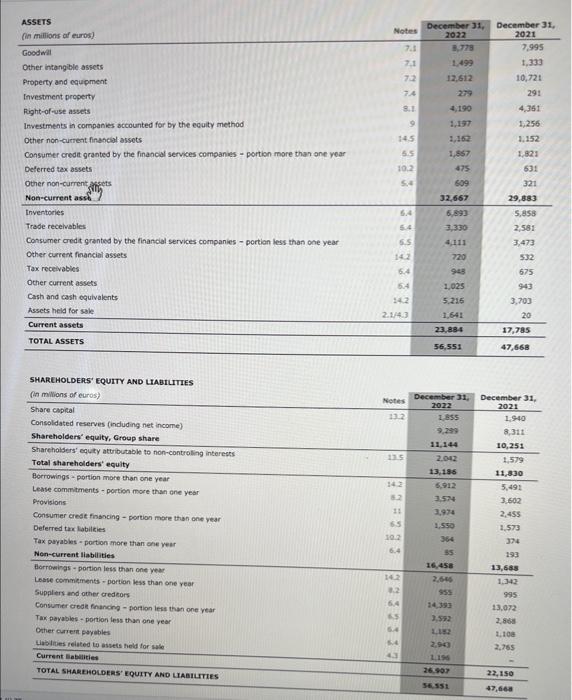

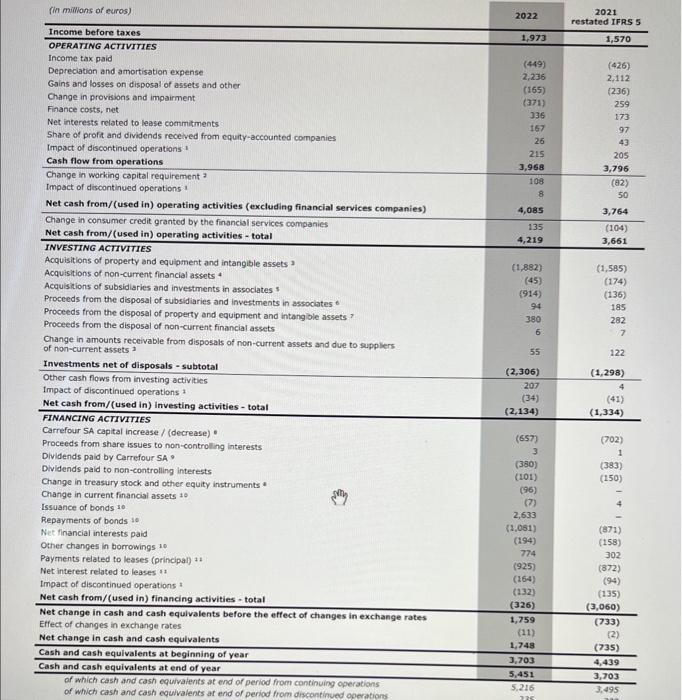

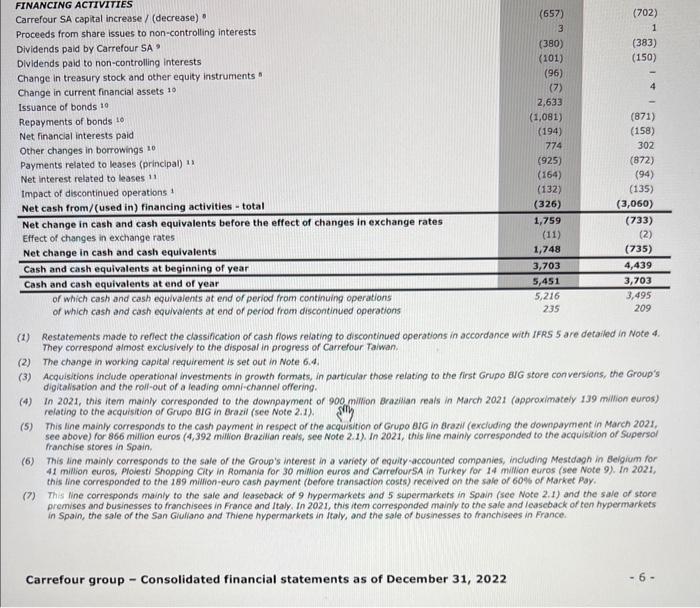

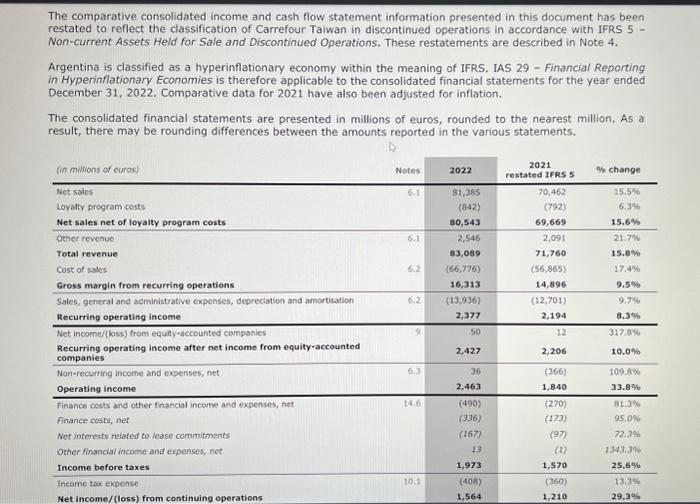

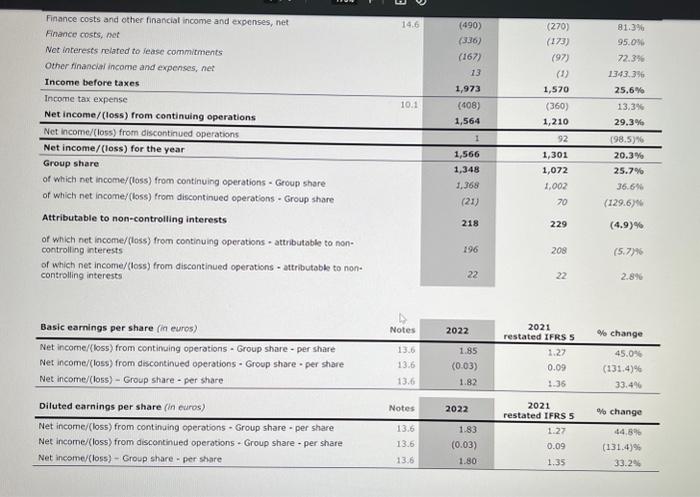

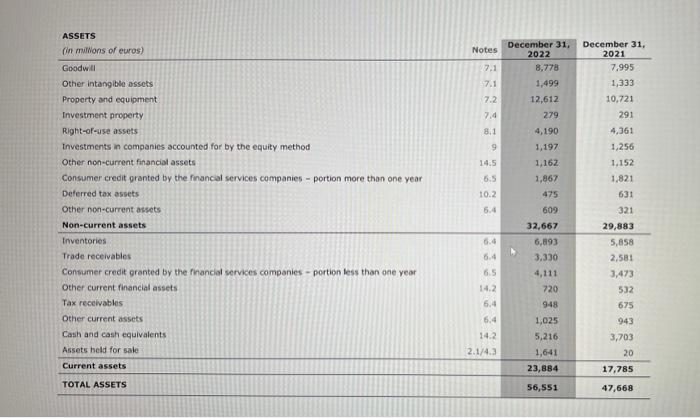

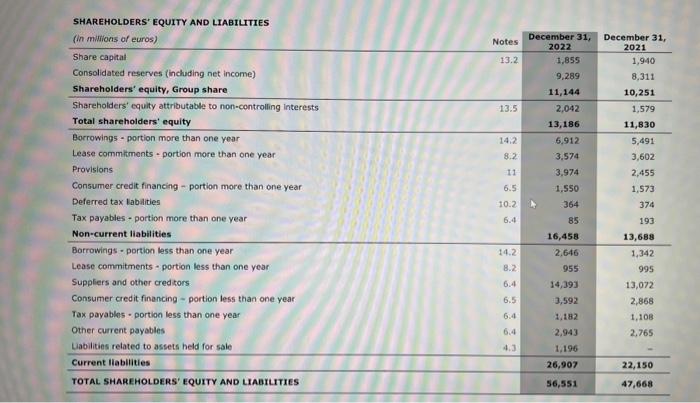

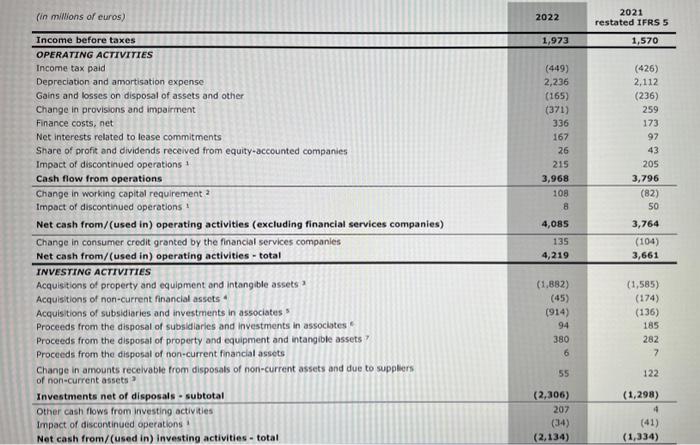

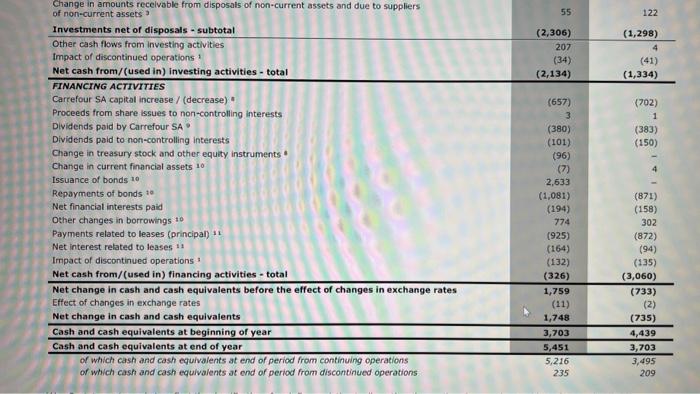

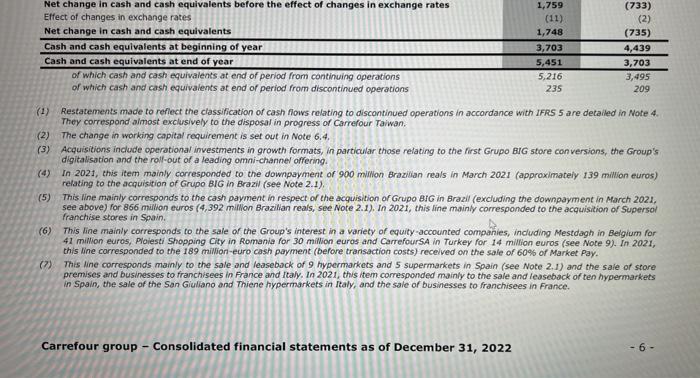

Fill in the boxes using the excerpts from Carrefour's financial statements below. Financial statements of Carrefour Financial Ratios (for AY enling on Dec. 31, 100% Total assets Liabilities and equity Notes payable (short-term debt) Accounts payable Accrued items Other current liabilities Long-term debt Other liabilities Preferred stock Equity Total liabilities and equity 100% Income statement Original numbers (in units) Revenue Costs of goods sold Total liabilities and equity Financial ratios Ratios Current ratio (round to two decimal places) Quick ratio (round to two decimal places) Inventory turnover (round to one decimal place) Receivables collection period (days) (round to units Debt to assets (round to two decimal places) Long term debt to capitalization (round to two decimal places) Asset turnover (round to three decimal places) Profit margin (round to three decimal places) Return on assets (round to three decimal places) Total assets to shareholders' equity (round to two decimal places) Return on equity (round to three decimal places) Interest coverage ratio (round to two decimal places) EBITDA margin (round to two decimal places) The comparative consolidated income and cash fiow statement information presented in this document has been restated to reflect the classification of Carrefour Taiwan in discontinued operations in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operabons. These restatements are described in Note 4. Argentina is classified as a hyperinflationary economy within the meaning of IFRS. LAS 29 - Financial Reporting in Hyperinfationary Economies is therefore applicable to the consolidated financial statements for the year ended December 31, 2022, Comparative data for 2021 have also been adjusted for inflation. The consolidated financial statements are presented in millions of euros, rounded to the nearest milion. As a result, there may be rounding differences between the amounts reported in the various statements. SHAREHOLDERS' EQUITY AND LIABTUTIIES (in mimions of euros) Acquisitions of property and equipment and intangible assets 3 Acquisitions of non-current financial assets * Acqulsitions of subsidiaries and investments in associates s Proceeds from the disposal of subsidiaries and investments in associates 6 Proceeds from the disposal of property and equipment and intangible assets? Proceeds from the disposal of non-current financial assets Change in amounts receivable from disposals of non-curnent assets and due to supplers of non-current assets ? FINANCING ACTIVITIES Carrefour SA capital increase / (decrease) " (657) (702) Proceeds from share issues to non-controlling interests Dividends paid by Carrefour 5A ? Dividends paid to non-controlling interests Change in treasury stock and other equity instruments " Change in current financial assets 10 Issuance of bonds 10 Repayments of bonds 10 Net financial interests paid Other changes in borrowings 10 Payments related to leases (principal) is Net interest related to leases 11 Impact of discontinued operations 1 \begin{tabular}{l} Impact of discontinued operations 1 \\ Net cash from/(used in) financing activities - total \\ (3,060) \\ (326) change in cash and cash equivalents before the effect of changes in exchange rates \\ Effect of changes in exchange rates \\ (733) \\ Net change in cash and cash equivalents \\ (2) \\ (1159) \\ (735) \\ \hline Cash and cash equivalents at end of year \\ \hline \end{tabular} (1) Restatements made to reflect the classification of cash flows relating to discontinued operations in accordance with IFRS 5 are detailed in Note 4. They correspond aimost exclusively to the disposal in progress of Carrefour Taiwan. (2) The change in working capital requirement is set out in Note 6.4. (3) Acquisitions indude operational investments in growth formats, in particular those relating to the first Grupo BlG store conversions, the Group's digitalisation and the roll-out of a leading omni-channel offering. (4) In 2021, this item mainly corresponded to the downpayment of 900 mimon Brazilan reats in March 2021 (approximately 139 mikion euros) relating to the acquisition of Grupo BIG in Brazil (see Note 2.1). (5) This line mainly corresponds to the cash payment in respect of the acquisition of Grupo arG in Brazil (exciuding the downpayment in March 2021, see above) for 866 milion euros (4,392 milion Brazilian reais, see Note 2.1). In 2021, this line mainiy corresponded to the acquisition of Supersol franchise stores in Spain. (6) This line mainly corresponds to the sale of the Group's interest in a variety of equity-accounted companies, induding Mestdagn in Belgium for 41 million euros, Plolesti Shopping City in Romania for 30 million euros and CarrefoursA in Rurkey for 14 mullion euros (see Note 9). In 2021, this line corresponded to the 189 million-euro cash payment (before transaction costs) received on the sale of 60% of Market Pay. (7) This line corresponds mainly to the sale and leaseback of 9 hypermarkets and 5 supermarkets in Spain (sce Note 2.1) and the sale of store premises and businesses to franchisees in France and Italy. In 2021, this item corresponded mainly to the sale and icascback of ten hypermarkets in Spain, the sale of the San Giuliano and Thiene hypermarkets in ftaly, and the sale of businesses to franchiseets in France. Carrefour group - Consolidated financial statements as of December 31,2022 6= The comparative consolidated income and cash flow statement information presented in this document has been restated to reflect the classification of Carrefour Taiwan in discontinued operations in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations. These restatements are described in Note 4. Argentina is classified as a hyperinflationary economy within the meaning of IFRS. IAS 29 - Financial Reporting in Hyperinflationary Economies is therefore applicable to the consolidated financial statements for the year ended December 31,2022 . Comparative data for 2021 have also been adjusted for inflation. The consolidated financial statements are presented in millions of euros, rounded to the nearest million. As a result, there may be rounding differences between the amounts reported in the various statements. Finance costs and other financiat income and expenses, net Finance costs, net Net interests related to lease commitments Other tinanciaf income and expenses, net Income before taxes Income tax expense Net income/ (loss) from continuing operations Net income/(loss) from discontinued operations Net income/ (loss) for the year Group share of which net income/(loss) from continuing operations - Group share of which net income/(loss) from discontinued operations - Group share Attributable to non-controlling interests of which net income/(loss) from continuing operations - attributable to noncontrolling interests of which net income/(loss) from discontinued operations - attributable to noncontrolling interests ASSETS (in minons of euros) Goodwill Other intanglble assets Property and equipment Investment property Right-of-use assets Investments in companics accounted for by the equity method Other non-current financial assets Consumer credit granted by the financial services companies - portion more than one year Deferred tax assets Other non-current assets Non-current assets Inventories Trade receivables Consumer credit granted by the financial services companies - portion less than one year Other current financial assets Tax receivables Other current assets Cash and cash equivalents Assets held for sale Current assets TOTAL ASSETS SHAREHOLDERS' EQUITY AND LIABILITIES (in miWions of curos) 2021 restated IFRS 5 Income before taxes OPERATING ACTIVITIES Income tax paid Depreciation and amortisation expense Gains and losses on disposal of assets and other Change in provisions and impairment Finance costs, net Net interests related to lease commitments Share of profit and dividends received from equity-accounted companies Impact of discontinued operations 1 Cash flow from operations Change in working capital requirement 2 Impoct of discontinued operations 1 Net cash from/ (used in) operating activities (excluding financial services companies) Change in consumer credit granted by the financial services companies Net cash from/ (used in) operating activities - total INVESTING ACTIVITIES Acquistions of property and equipment and intangible assets 3 Acquisitions of non-current financial assets * Acquistions of subsidiaries and investments in associates 3 Proceeds from the disposal of subsidiaries and investments in associstes * Proceeds from the disposal of property and equipment and intangible assets ? Proceeds from the disposal of non-current financial assets Change in amounts recelvable from disposals of non-current assets and due to supplers of non-current assets ? Investments net of disposals - subtotal Other cash flows from investing activities Impact of discontinued operations 1 Net cash from/ (used in) investing activities - total Change in amounts recelvable from disposals of non-current assets and due to suppliers of non-current assets ? Investments net of disposals - subtotal Other cash flows from investing activities Impact of discontinued operations 1 Net cash from/( used in) investing activities - total FINANCING ACTIVITIES Carrefour SA capital increase / (decrease) * Proceeds from share issues to non-controlling interests Dividends paid by Carrefour SA Dividends paid to non-controlling interests Change in treasury stock and other equity instruments * Change in current financial assets 10 Issuance of bonds 10 Repayments of bonds to Net financial interests paic Other changes in borrowings 10 Payments related to leases (principal) 11 Net interest related to leases 11 Impact of discontinued operations 3 Net cash from/ (used in) financing activities - total Net change in cash and cash equivalents before the effect of changes in exchange rates Effect of changes in exchange rates Net change in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year of which cash and cash equivalents at end of period from continuing operations of which cash and cash equivalents at end of period from discontinued operations (1) Restatements made to refiect the classification of cash flows relating to discontinued operations in accordance with IFRS 5 are detailed in Note 4. Ther correspond almost exclusively to the disposal in progress of Carrefour Taiwan. (2) The change in working capital requirement is set out in Note 6.4. (3) Acquisitions include operational investments in growth formats, in particular those relating to the first Grupo BIG store con versions, the Group's digitalisation and the rolf-out of a leading omni-channel offering. (4) In 2021, this item mainly corresponded to the downpayment of 900 milion Brazilian reals in March 2021 (approximateiy 139 million euros) relating to the acquisition of Grupo BIG in Brazil (see Note 2.1). (5) This line mainly corresponds to the cash payment in respect of the acquisition or Grupo BJG in Brazil (excluding the downpayment in March 2021. see above) for 866 milion euros (4,392 milion Brazillan reals, see Note 2.1). In 2021, this line mainly corresponded to the acquisition or Supersol franchise stores in Sotain. (6) This line mainly corresponds to the sale of the Group's interest in a variety of equity-accounted compaties, including Mestdagh in Beigium for 41 mimon euros, Ploiesti Shopping City in Romania for 30 milion euros and CarrefourSA in Turkey for 14 million euros (see Note 9 ). In 2021, this line corresponded to the 189 milion-euro cash payment (before transaction costs) recelved on the sale of 60\% of Market Pay. (7) This line corresponds mainly to the sale and leaseback of 9 hypermarkets and 5 supermarkets in Spain (see Note 2, 1) and the sale of store premises and businesses to franchisees in France and italy. In 2021, this item comesponded mainly to the sale and leasebuck of ten hypermarkets in Spain, the sale of the San Giuliano and Thiene hypermarkets in Italy, and the sale of businesses to franchisees in France. Fill in the boxes using the excerpts from Carrefour's financial statements below. Financial statements of Carrefour Financial Ratios (for AY enling on Dec. 31, 100% Total assets Liabilities and equity Notes payable (short-term debt) Accounts payable Accrued items Other current liabilities Long-term debt Other liabilities Preferred stock Equity Total liabilities and equity 100% Income statement Original numbers (in units) Revenue Costs of goods sold Total liabilities and equity Financial ratios Ratios Current ratio (round to two decimal places) Quick ratio (round to two decimal places) Inventory turnover (round to one decimal place) Receivables collection period (days) (round to units Debt to assets (round to two decimal places) Long term debt to capitalization (round to two decimal places) Asset turnover (round to three decimal places) Profit margin (round to three decimal places) Return on assets (round to three decimal places) Total assets to shareholders' equity (round to two decimal places) Return on equity (round to three decimal places) Interest coverage ratio (round to two decimal places) EBITDA margin (round to two decimal places) The comparative consolidated income and cash fiow statement information presented in this document has been restated to reflect the classification of Carrefour Taiwan in discontinued operations in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operabons. These restatements are described in Note 4. Argentina is classified as a hyperinflationary economy within the meaning of IFRS. LAS 29 - Financial Reporting in Hyperinfationary Economies is therefore applicable to the consolidated financial statements for the year ended December 31, 2022, Comparative data for 2021 have also been adjusted for inflation. The consolidated financial statements are presented in millions of euros, rounded to the nearest milion. As a result, there may be rounding differences between the amounts reported in the various statements. SHAREHOLDERS' EQUITY AND LIABTUTIIES (in mimions of euros) Acquisitions of property and equipment and intangible assets 3 Acquisitions of non-current financial assets * Acqulsitions of subsidiaries and investments in associates s Proceeds from the disposal of subsidiaries and investments in associates 6 Proceeds from the disposal of property and equipment and intangible assets? Proceeds from the disposal of non-current financial assets Change in amounts receivable from disposals of non-curnent assets and due to supplers of non-current assets ? FINANCING ACTIVITIES Carrefour SA capital increase / (decrease) " (657) (702) Proceeds from share issues to non-controlling interests Dividends paid by Carrefour 5A ? Dividends paid to non-controlling interests Change in treasury stock and other equity instruments " Change in current financial assets 10 Issuance of bonds 10 Repayments of bonds 10 Net financial interests paid Other changes in borrowings 10 Payments related to leases (principal) is Net interest related to leases 11 Impact of discontinued operations 1 \begin{tabular}{l} Impact of discontinued operations 1 \\ Net cash from/(used in) financing activities - total \\ (3,060) \\ (326) change in cash and cash equivalents before the effect of changes in exchange rates \\ Effect of changes in exchange rates \\ (733) \\ Net change in cash and cash equivalents \\ (2) \\ (1159) \\ (735) \\ \hline Cash and cash equivalents at end of year \\ \hline \end{tabular} (1) Restatements made to reflect the classification of cash flows relating to discontinued operations in accordance with IFRS 5 are detailed in Note 4. They correspond aimost exclusively to the disposal in progress of Carrefour Taiwan. (2) The change in working capital requirement is set out in Note 6.4. (3) Acquisitions indude operational investments in growth formats, in particular those relating to the first Grupo BlG store conversions, the Group's digitalisation and the roll-out of a leading omni-channel offering. (4) In 2021, this item mainly corresponded to the downpayment of 900 mimon Brazilan reats in March 2021 (approximately 139 mikion euros) relating to the acquisition of Grupo BIG in Brazil (see Note 2.1). (5) This line mainly corresponds to the cash payment in respect of the acquisition of Grupo arG in Brazil (exciuding the downpayment in March 2021, see above) for 866 milion euros (4,392 milion Brazilian reais, see Note 2.1). In 2021, this line mainiy corresponded to the acquisition of Supersol franchise stores in Spain. (6) This line mainly corresponds to the sale of the Group's interest in a variety of equity-accounted companies, induding Mestdagn in Belgium for 41 million euros, Plolesti Shopping City in Romania for 30 million euros and CarrefoursA in Rurkey for 14 mullion euros (see Note 9). In 2021, this line corresponded to the 189 million-euro cash payment (before transaction costs) received on the sale of 60% of Market Pay. (7) This line corresponds mainly to the sale and leaseback of 9 hypermarkets and 5 supermarkets in Spain (sce Note 2.1) and the sale of store premises and businesses to franchisees in France and Italy. In 2021, this item corresponded mainly to the sale and icascback of ten hypermarkets in Spain, the sale of the San Giuliano and Thiene hypermarkets in ftaly, and the sale of businesses to franchiseets in France. Carrefour group - Consolidated financial statements as of December 31,2022 6= The comparative consolidated income and cash flow statement information presented in this document has been restated to reflect the classification of Carrefour Taiwan in discontinued operations in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations. These restatements are described in Note 4. Argentina is classified as a hyperinflationary economy within the meaning of IFRS. IAS 29 - Financial Reporting in Hyperinflationary Economies is therefore applicable to the consolidated financial statements for the year ended December 31,2022 . Comparative data for 2021 have also been adjusted for inflation. The consolidated financial statements are presented in millions of euros, rounded to the nearest million. As a result, there may be rounding differences between the amounts reported in the various statements. Finance costs and other financiat income and expenses, net Finance costs, net Net interests related to lease commitments Other tinanciaf income and expenses, net Income before taxes Income tax expense Net income/ (loss) from continuing operations Net income/(loss) from discontinued operations Net income/ (loss) for the year Group share of which net income/(loss) from continuing operations - Group share of which net income/(loss) from discontinued operations - Group share Attributable to non-controlling interests of which net income/(loss) from continuing operations - attributable to noncontrolling interests of which net income/(loss) from discontinued operations - attributable to noncontrolling interests ASSETS (in minons of euros) Goodwill Other intanglble assets Property and equipment Investment property Right-of-use assets Investments in companics accounted for by the equity method Other non-current financial assets Consumer credit granted by the financial services companies - portion more than one year Deferred tax assets Other non-current assets Non-current assets Inventories Trade receivables Consumer credit granted by the financial services companies - portion less than one year Other current financial assets Tax receivables Other current assets Cash and cash equivalents Assets held for sale Current assets TOTAL ASSETS SHAREHOLDERS' EQUITY AND LIABILITIES (in miWions of curos) 2021 restated IFRS 5 Income before taxes OPERATING ACTIVITIES Income tax paid Depreciation and amortisation expense Gains and losses on disposal of assets and other Change in provisions and impairment Finance costs, net Net interests related to lease commitments Share of profit and dividends received from equity-accounted companies Impact of discontinued operations 1 Cash flow from operations Change in working capital requirement 2 Impoct of discontinued operations 1 Net cash from/ (used in) operating activities (excluding financial services companies) Change in consumer credit granted by the financial services companies Net cash from/ (used in) operating activities - total INVESTING ACTIVITIES Acquistions of property and equipment and intangible assets 3 Acquisitions of non-current financial assets * Acquistions of subsidiaries and investments in associates 3 Proceeds from the disposal of subsidiaries and investments in associstes * Proceeds from the disposal of property and equipment and intangible assets ? Proceeds from the disposal of non-current financial assets Change in amounts recelvable from disposals of non-current assets and due to supplers of non-current assets ? Investments net of disposals - subtotal Other cash flows from investing activities Impact of discontinued operations 1 Net cash from/ (used in) investing activities - total Change in amounts recelvable from disposals of non-current assets and due to suppliers of non-current assets ? Investments net of disposals - subtotal Other cash flows from investing activities Impact of discontinued operations 1 Net cash from/( used in) investing activities - total FINANCING ACTIVITIES Carrefour SA capital increase / (decrease) * Proceeds from share issues to non-controlling interests Dividends paid by Carrefour SA Dividends paid to non-controlling interests Change in treasury stock and other equity instruments * Change in current financial assets 10 Issuance of bonds 10 Repayments of bonds to Net financial interests paic Other changes in borrowings 10 Payments related to leases (principal) 11 Net interest related to leases 11 Impact of discontinued operations 3 Net cash from/ (used in) financing activities - total Net change in cash and cash equivalents before the effect of changes in exchange rates Effect of changes in exchange rates Net change in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year of which cash and cash equivalents at end of period from continuing operations of which cash and cash equivalents at end of period from discontinued operations (1) Restatements made to refiect the classification of cash flows relating to discontinued operations in accordance with IFRS 5 are detailed in Note 4. Ther correspond almost exclusively to the disposal in progress of Carrefour Taiwan. (2) The change in working capital requirement is set out in Note 6.4. (3) Acquisitions include operational investments in growth formats, in particular those relating to the first Grupo BIG store con versions, the Group's digitalisation and the rolf-out of a leading omni-channel offering. (4) In 2021, this item mainly corresponded to the downpayment of 900 milion Brazilian reals in March 2021 (approximateiy 139 million euros) relating to the acquisition of Grupo BIG in Brazil (see Note 2.1). (5) This line mainly corresponds to the cash payment in respect of the acquisition or Grupo BJG in Brazil (excluding the downpayment in March 2021. see above) for 866 milion euros (4,392 milion Brazillan reals, see Note 2.1). In 2021, this line mainly corresponded to the acquisition or Supersol franchise stores in Sotain. (6) This line mainly corresponds to the sale of the Group's interest in a variety of equity-accounted compaties, including Mestdagh in Beigium for 41 mimon euros, Ploiesti Shopping City in Romania for 30 milion euros and CarrefourSA in Turkey for 14 million euros (see Note 9 ). In 2021, this line corresponded to the 189 milion-euro cash payment (before transaction costs) recelved on the sale of 60\% of Market Pay. (7) This line corresponds mainly to the sale and leaseback of 9 hypermarkets and 5 supermarkets in Spain (see Note 2, 1) and the sale of store premises and businesses to franchisees in France and italy. In 2021, this item comesponded mainly to the sale and leasebuck of ten hypermarkets in Spain, the sale of the San Giuliano and Thiene hypermarkets in Italy, and the sale of businesses to franchisees in France

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts