Question: thanks Required Journalise the adjusting entry needed on 31 December 2019 for each of the following independent cases affecting Metz Marketing Concepts. a. Each Friday,

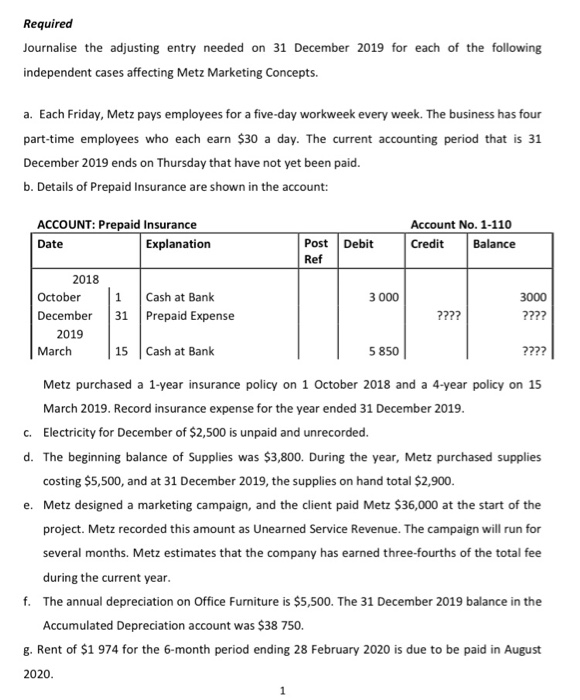

Required Journalise the adjusting entry needed on 31 December 2019 for each of the following independent cases affecting Metz Marketing Concepts. a. Each Friday, Metz pays employees for a five-day workweek every week. The business has four part-time employees who each earn $30 a day. The current accounting period that is 31 December 2019 ends on Thursday that have not yet been paid. b. Details of Prepaid Insurance are shown in the account: ACCOUNT: Prepaid Insurance Date Explanation Account No. 1-110 Credit Balance Post Debit Ref 3 000 2018 October December 2019 March 1 Cash at Bank 31 Prepaid Expense 3000 ???? ???? 15 Cash at Bank 5 850 ???? Metz purchased a 1-year insurance policy on 1 October 2018 and a 4-year policy on 15 March 2019. Record insurance expense for the year ended 31 December 2019. C. Electricity for December of $2,500 is unpaid and unrecorded. d. The beginning balance of Supplies was $3,800. During the year, Metz purchased supplies costing $5,500, and at 31 December 2019, the supplies on hand total $2,900. e. Metz designed a marketing campaign, and the client paid Metz $36,000 at the start of the project. Metz recorded this amount as Unearned Service Revenue. The campaign will run for several months. Metz estimates that the company has earned three-fourths of the total fee during the current year. f. The annual depreciation on Office Furniture is $5,500. The 31 December 2019 balance in the Accumulated Depreciation account was $38 750. g. Rent of $1 974 for the 6-month period ending 28 February 2020 is due to be paid in August 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts