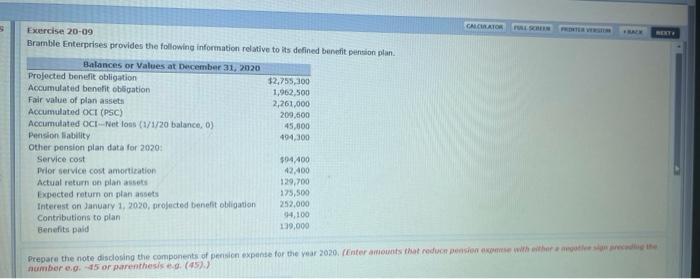

Question: CALCULATOR SCHE TE Exercise 20-09 Bramble Enterprises provides the following information relative to its defined benefit pension plan. Balances or Values at December 31, 2020

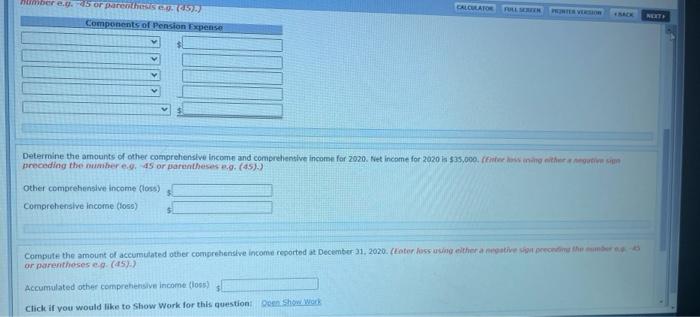

CALCULATOR SCHE TE Exercise 20-09 Bramble Enterprises provides the following information relative to its defined benefit pension plan. Balances or Values at December 31, 2020 Projected benefit obligation $2,755,300 Accumulated benefit obligation 1,962,500 Fair value of plan assets 2,261,000 Accumulated OCT (PSC) 209.000 Accumulated OC Netloss (1/1/20 balance. ) 45,000 Pension ability 494,300 Other pension plan data for 2020 Service cost $94.400 Prior service cost amortization 42.400 Actual return on plan assets 129,700 Expected return on plan assets 175,500 Interest on January 1, 2020, projected benefit obligation 252,000 Contributions to plan 14,100 139,000 Benefits pald Prepare the note disclosing the components of pension expense for the year 2020. Enter amounts that reduction with the number eg 45 or parenthesise (45)) CALCULATOS imber egs or parenthese 15 Components of Pension Expense TER NETE v Determine the amounts of other comprehensive Income and comprehensive income for 2020. Net Income for 2020 is $35.000.com preceding the number .. 15 or parentheses (45) Other comprehensive Income (los) Comprehensive Income (10) $ Compute the amount of accumulated other comprehensive income reported at December 31, 2020. (ater loss in either active in the or parentheseseo (45)) Accumulated other comprehensive income (106) Click if you would like to show Work for this question Don Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts