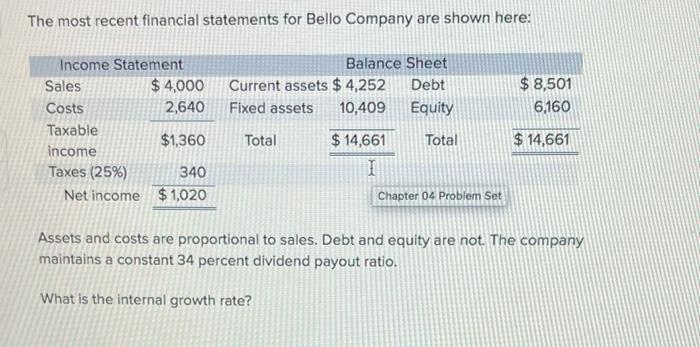

Question: that answer is wrong The most recent financial statements for Bello Company are shown here: $ 8,501 6,160 Income Statement Sales $ 4,000 Costs 2,640

The most recent financial statements for Bello Company are shown here: $ 8,501 6,160 Income Statement Sales $ 4,000 Costs 2,640 Taxable $1,360 income Taxes (25%) 340 Net income $1,020 Balance Sheet Current assets $ 4,252 Debt Fixed assets 10,409 Equity Total $ 14,661 Total I Chapter 04 Problem Set $ 14,661 Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 34 percent dividend payout ratio. What is the internal growth rate? 4.71% 4.81% I 4.91% 2.42% 12.27%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts