Question: thats the answer can you write for me the step how to so it 5. Assume that Jones Co. will need to purchase 100,000 Singapore

thats the answer can you write for me the step how to so it

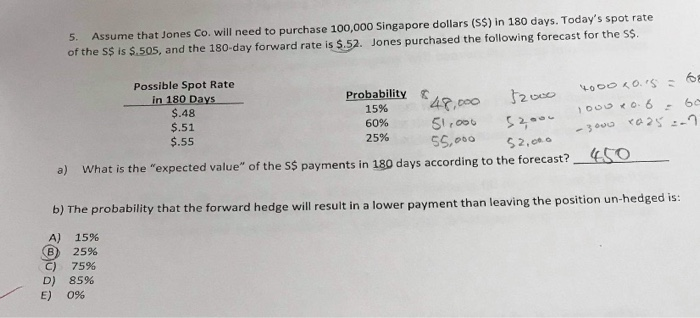

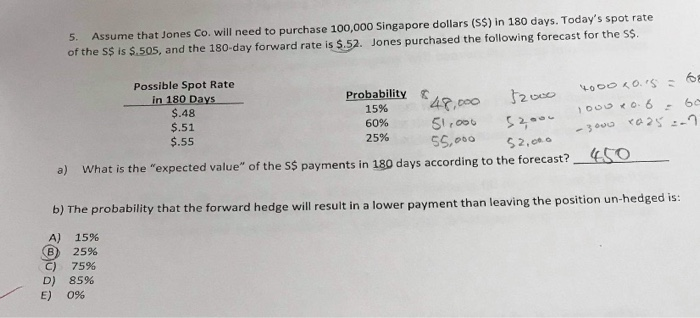

5. Assume that Jones Co. will need to purchase 100,000 Singapore dollars ($) in 180 days. Today's spot rate of the s$ is $.505, and the 180 day forward rate is 5.52. Jones purchased the following forecast for the SS. Possible Spot Rate in 180 Days 66 1000 20.15 $.48 $2000 48,000 15% $.51 60% 1000 eo 6 60 51.000 52.0 $.55 25% - youw 025 .. 55.000 52.000 a) What is the "expected value of the 5$ payments in 180 days according to the forecast?_ESO b) The probability that the forward hedge will result in a lower payment than leaving the position un-hedged is: A) 15% 25% C) 75% 85% 0%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock