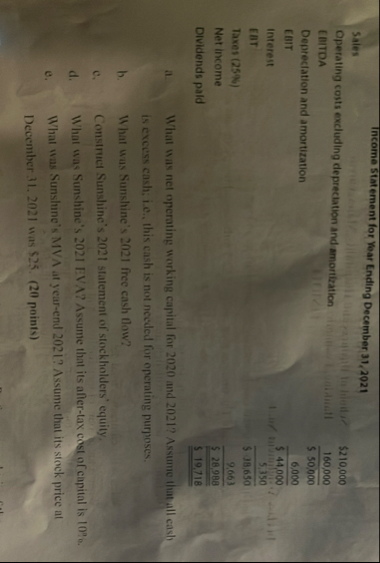

Question: Thcome Statement for Year Ending December 3 1 , 2 0 2 1 Sales table [ [ Operating costs excluding deprectation and amorization,$ 2

Thcome Statement for Year Ending December

Sales

tableOperating costs excluding deprectation and amorization,$COITDADepreclation and amortization,$ EBITInterest$ EBT$ Taxes Net income,$ Dividends pald,$

a What was net operating working capital for and Assume that all cash is execes cashi.e this cash is not needed for operating purposes.

b What uns Sumshine's free eash flow?

e Construet Sunshine's statement of stockholders' equity.

d What was Sunshine's EVA? Assume that its aftertax cost of copital is

e What was Sunslune's MVA at yearend A ssume that its stock price at December was $ pointsWhat is the explanation for the difference in your answers to pars and points

Sunshine Corporation's financial statements dollars and shares are in millions are provided here:

Balance Sheets as of December

tableAssetsCash and equivalents,$ $ Accounts receivable,InvertoriesTotal current assets,$ $ Net plant and equipment,Total assets,$$Liabilities and EquityAccounts payable,$ $ AccrualsNotes payable,Total current liabilities,$ $ Longterm bonds,Total llabilities,$ $ Common stock sharesRetained earnings,Common equity,$ $ Total llabilities and equity,$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock