Question: The 3rd question should include: - Explain the merit and benefits of each of the two sites. - Reasons substantiating the benefits of each -Includes

The 3rd question should include: - Explain the merit and benefits of each of the two sites. - Reasons substantiating the benefits of each -Includes terminology that aligns with capital investment and present values concept.

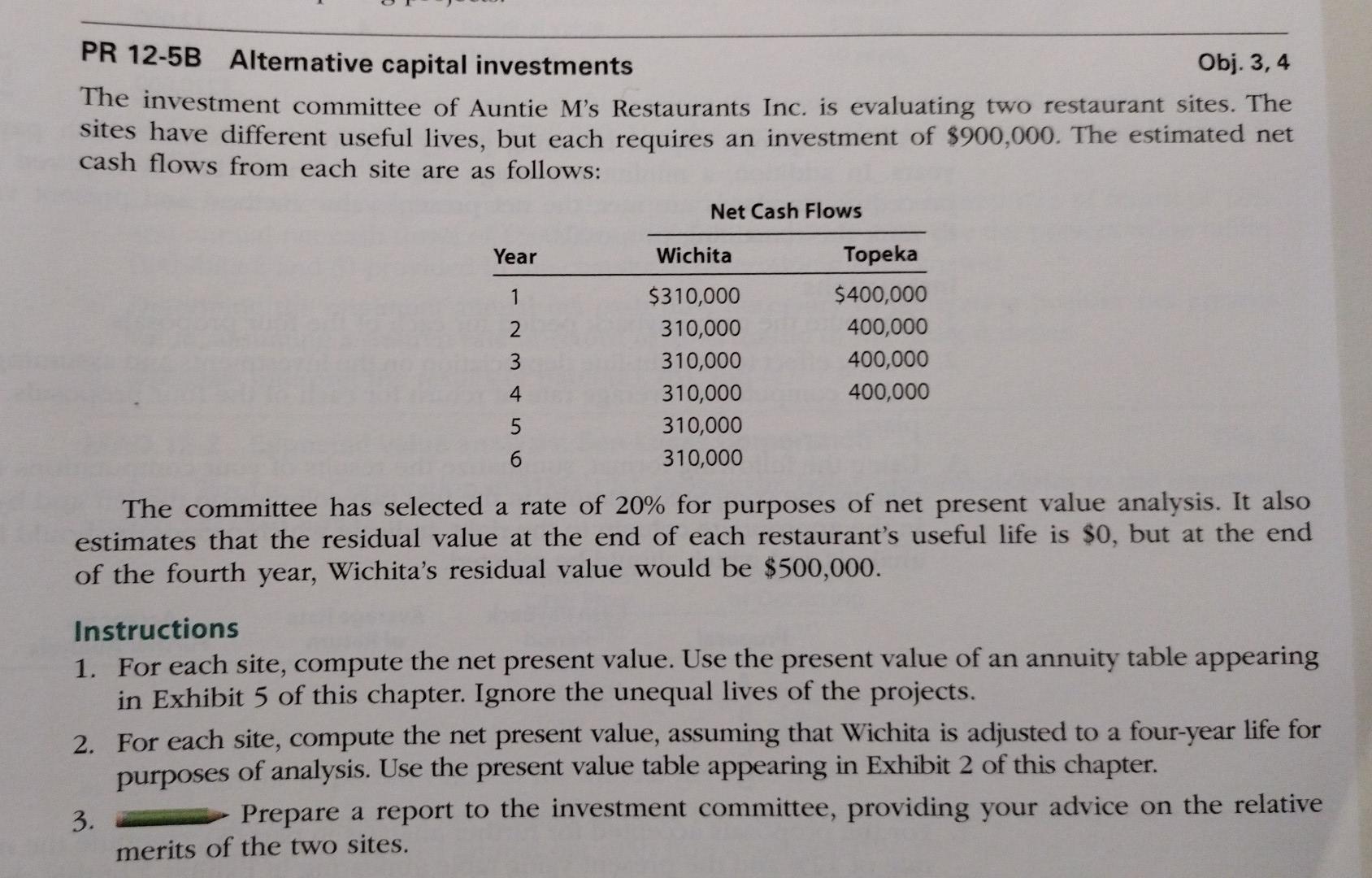

PR 12-5B Alternative capital investments Obj. 3, 4 The investment committee of Auntie M's Restaurants Inc. is evaluating two restaurant sites. The sites have different useful lives, but each requires an investment of $900,000. The estimated net cash flows from each site are as follows: Net Cash Flows Year Wichita Topeka 1 $310,000 $400,000 2 310,000 400,000 3 310,000 400,000 4 310,000 400,000 5 310,000 310,000 The committee has selected a rate of 20% for purposes of net present value analysis. It also estimates that the residual value at the end of each restaurant's useful life is $0, but at the end of the fourth year, Wichita's residual value would be $500,000. Instructions 1. For each site, compute the net present value. Use the present value of an annuity table appearing in Exhibit 5 of this chapter. Ignore the unequal lives of the projects. 2. For each site, compute the net present value, assuming that Wichita is adjusted to a four-year life for purposes of analysis. Use the present value table appearing in Exhibit 2 of this chapter. 3. Prepare a report to the investment committee, providing your advice on the relative merits of the two sites

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts