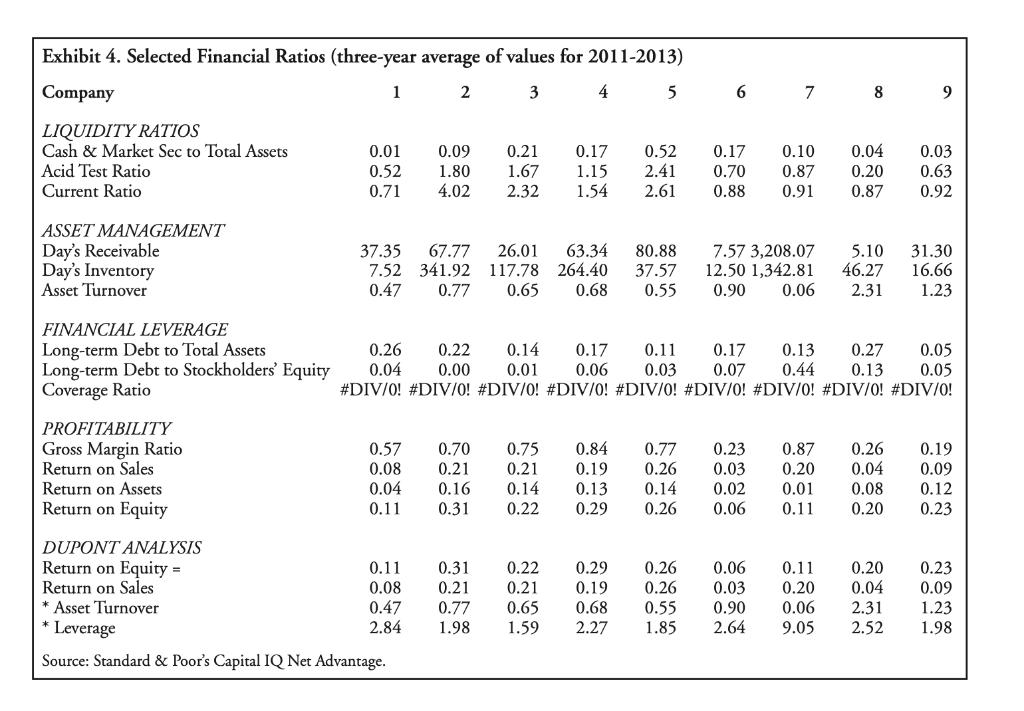

The 9 companies are drawn from the following 9 different industries: Liquor producer and distributor Discount airline

Fantastic news! We've Found the answer you've been seeking!

Question:

The 9 companies are drawn from the following 9 different industries:

Liquor producer and distributor

Discount airline

Commercial bank (items fitted into the same categories as the non-financial firms)

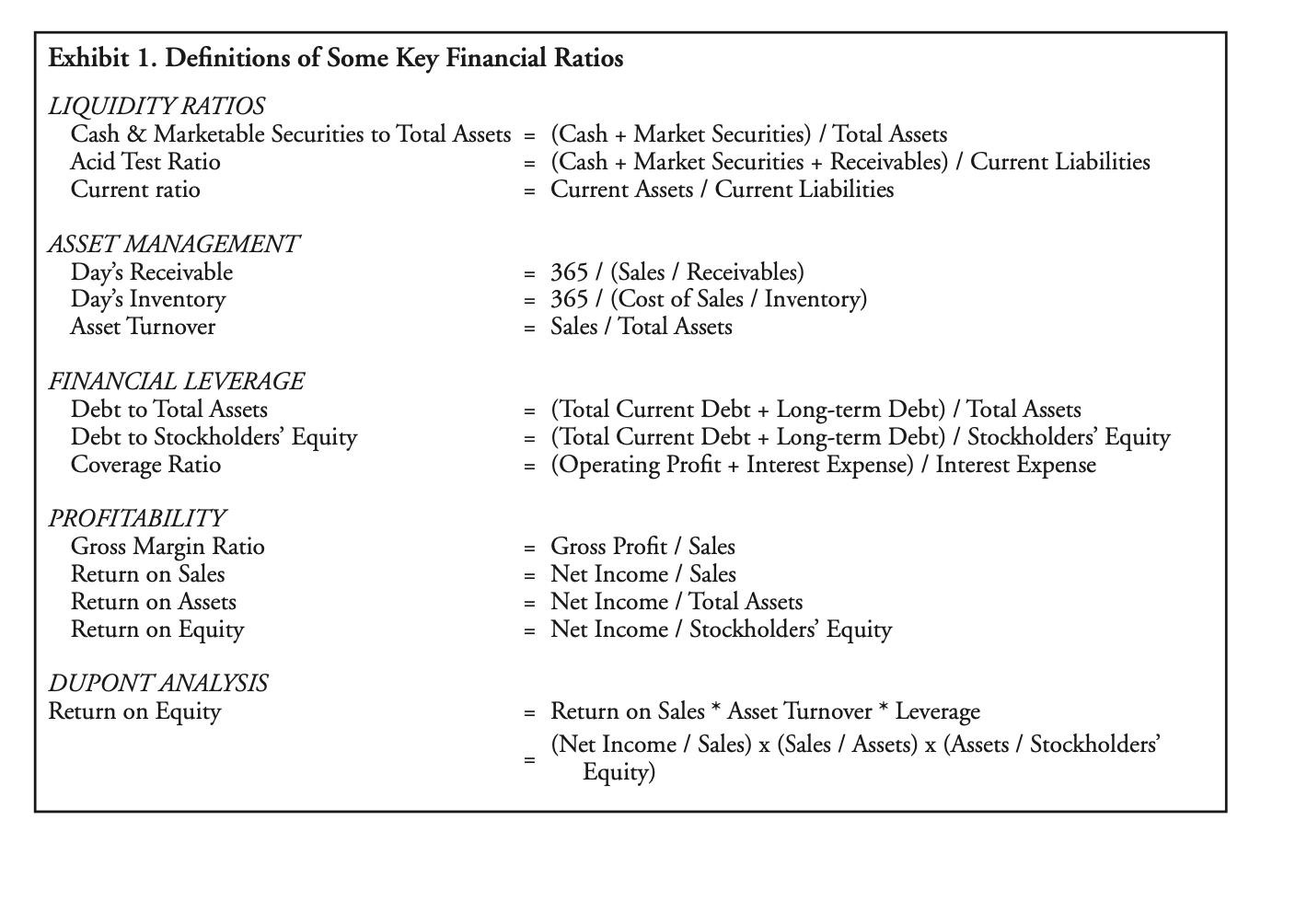

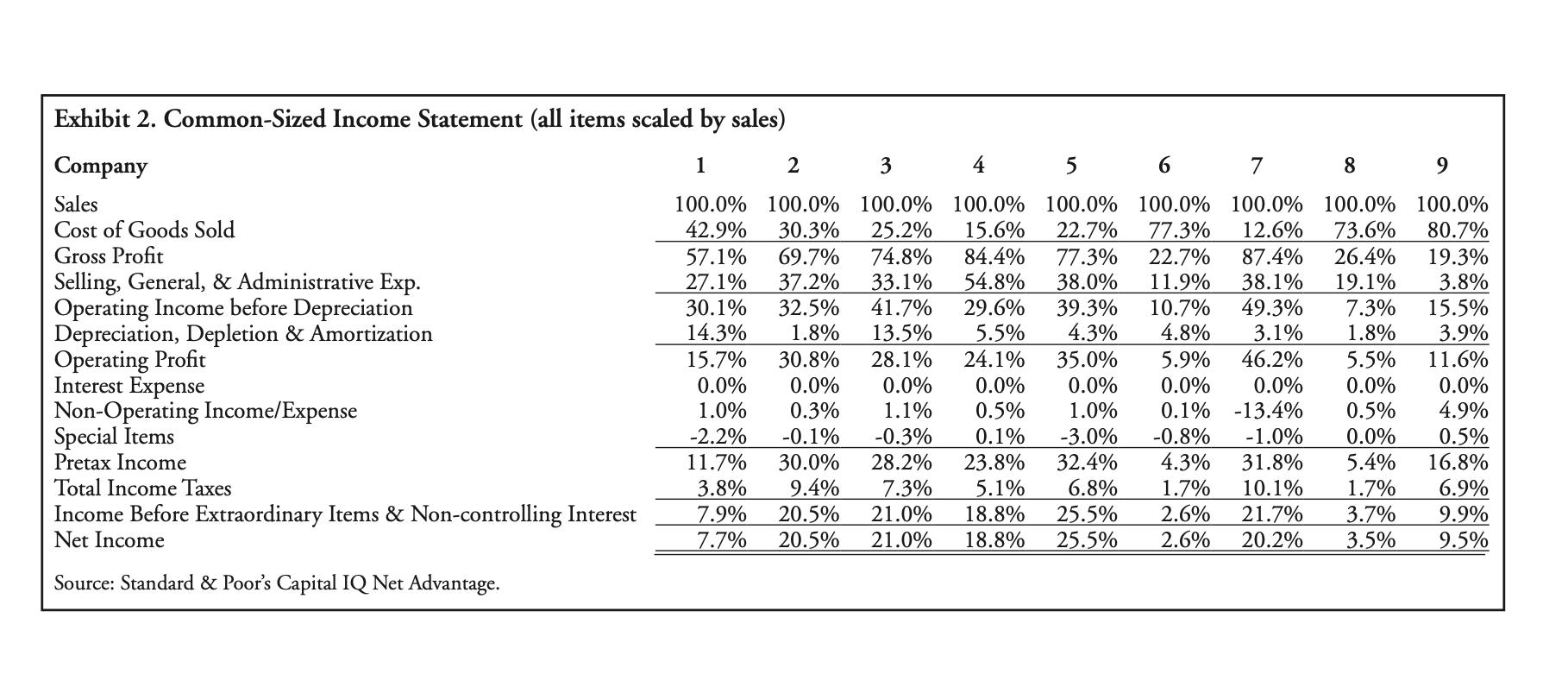

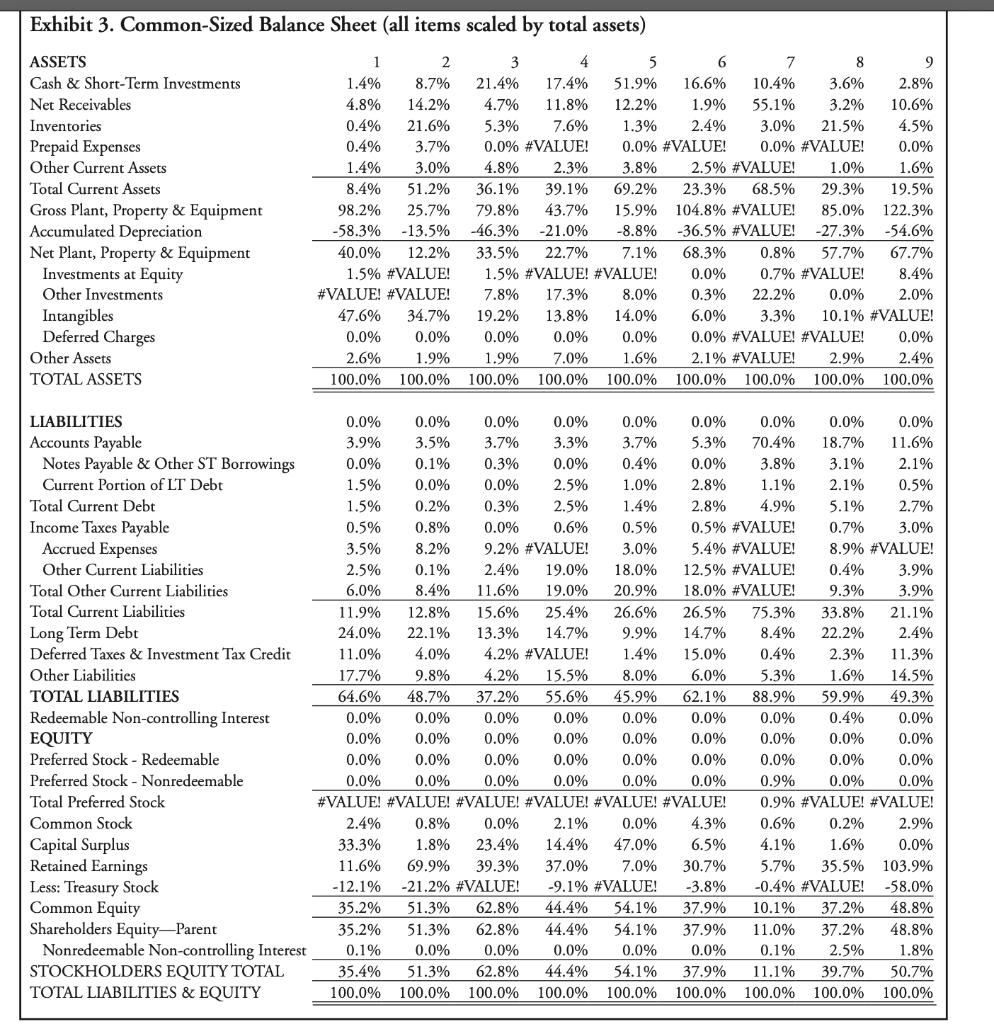

Match with the information below. and give some explanation.

Computer software company

Large integrated oil and gas company

The mobile phone service operator

R&D-based pharmaceutical manufacturer

Retail grocery company

R&D-based semiconductor manufacturer

this is all information estimate base on this info

Related Book For

Financial Reporting and Analysis

ISBN: 978-0078025679

6th edition

Authors: Flawrence Revsine, Daniel Collins, Bruce, Mittelstaedt, Leon

Posted Date: