Question: The above spreadsheet provides a generic format for completing the analysis. In your analysis, address the following questions: 1. What after-tax cash flows are relevant

The above spreadsheet provides a generic format for completing the analysis.

In your analysis, address the following questions:

1. What after-tax cash flows are relevant to the purchase option, and what discount rate should be used?

2. What after-tax cash flows are relevant to the sale and leaseback option, and what discount rate should be used for those cash flows?

3. Which option did you choose? Use your analysis to address this question.

4. Perform a sensitivity analysis using:

A. A range of residual values from $1.5 million to 3 million to calculate the corresponding NPVs

B. Escalation rates of 1, 3, and 5 percent

C. The combination of the above to complete the table below with the NPVs

| 1% | 3% | 5% | |

| 3,000,000 | |||

| 2,150,000 | |||

| 1,678,000 | |||

| 1,500,000 |

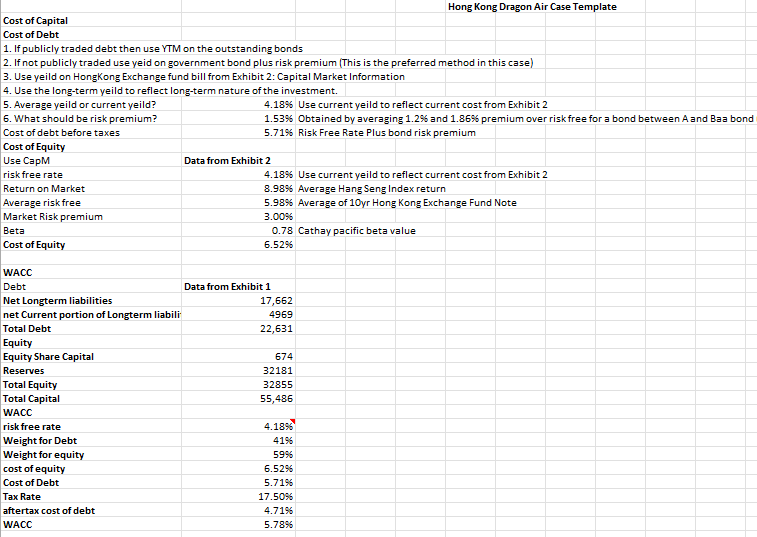

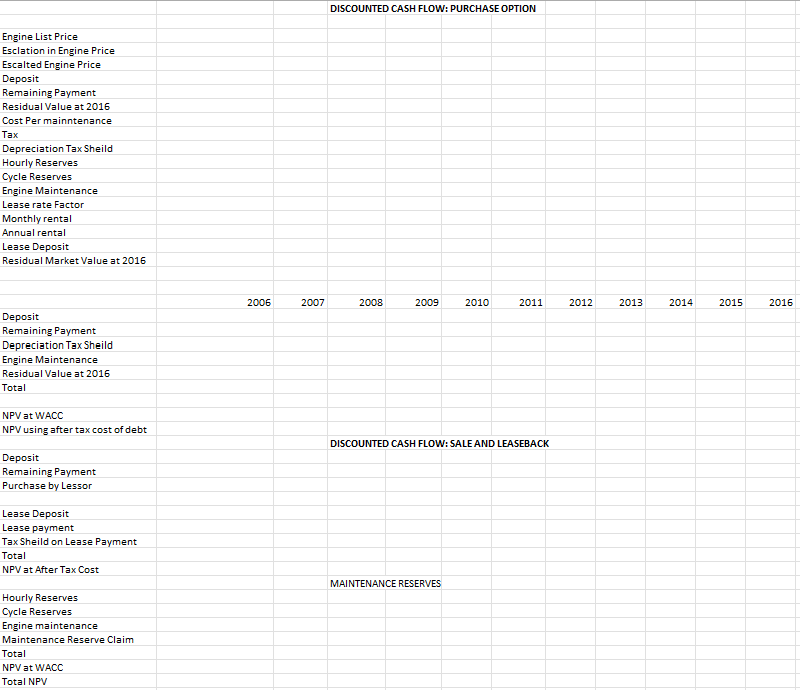

Hong Kong Dragon Air Case Template Cost of Capital Cost of Debt 1. If publicly traded debt then use YTM on the outstanding bonds 2. If not publicly traded use yeid on government bond plus risk premium (This is the preferred method in this case) 3. Use yeild on HongKong Exchange fund bill from Exhibit 2: Capital Market Information 4. Use the long-term yeild to reflect long-term nature of the investment. 5. Average yeild or current yeild? 4.1896 Use current yeild to reflect current cost from Exhibit 2 6. What should be risk premium? 1.53% Obtained by averaging 1.2% and 1.86% premium over risk free for a bond between A and Baa bond Cost of debt before taxes 5.71% Risk Free Rate Plus bond risk premium Cost of Equity Use CapM Data from Exhibit 2 risk free rate 4.18\% Use current yeild to reflect current cost from Exhibit 2 Return on Market 8.98% Average Hang Seng Index return Average risk free 5.98% Average of 10yr Hong Kong Exchange Fund Note Market Risk premium 3.0056 Beta 0.78 Cathay pacific beta value Cost of Equity 6.52% WACC \begin{tabular}{l|r} Debt & Data from Exhibit 1 \\ \hline Net Longterm liabilities & 17,662 \\ net Current portion of Longterm liabili & 4969 \\ \hline Total Debt & 22,631 \end{tabular} Equity \begin{tabular}{l|r} Equity Share Capital & 674 \\ \hline Reserves & 32181 \\ \hline Total Equity & 32855 \\ \hline Total Capital & 55,486 \end{tabular} WACC \begin{tabular}{l|r} risk free rate & 4.18% \\ \hline Weight for Debt & 4196 \\ \hline Weight for equity & 59% \\ \hline cost of equity & 6.52% \\ \hline Cost of Debt & 5.7196 \\ Tax Rate & 17.50% \end{tabular} aftertax cost of debt 4.7196 WACC 5.78% DISCOUNTED CASH FLOW: PURCHASE OPTION Engine List Price Esclation in Engine Price Escalted Engine Price Deposit Remaining Payment Residual Value at 2016 Cost Permainntenance Tax Depreciation Tax Sheild Hourly Reserves Cycle Reserves Engine Maintenance Lease rate Factor Monthly rental Annual rental Lease Deposit Residual Market Value at 2016 Deposit Remaining Payment Depreciation Tax Sheild Engine Maintenance Residual Value at 2016 Total NPV at WACC NPV using after tax cost of debt DISCOUNTED CASH FLOW: SALE AND LEASEBACK Deposit Remaining Payment Purchase by Lessor Lease Deposit Lease payment Tax Sheild on Lease Payment Total NPV at After Tax Cost MAINTENANCE RESERVES Hourly Reserves Cycle Reserves Engine maintenance Maintenance Reserve Claim Total NPV at WACC Total NPV Hong Kong Dragon Air Case Template Cost of Capital Cost of Debt 1. If publicly traded debt then use YTM on the outstanding bonds 2. If not publicly traded use yeid on government bond plus risk premium (This is the preferred method in this case) 3. Use yeild on HongKong Exchange fund bill from Exhibit 2: Capital Market Information 4. Use the long-term yeild to reflect long-term nature of the investment. 5. Average yeild or current yeild? 4.1896 Use current yeild to reflect current cost from Exhibit 2 6. What should be risk premium? 1.53% Obtained by averaging 1.2% and 1.86% premium over risk free for a bond between A and Baa bond Cost of debt before taxes 5.71% Risk Free Rate Plus bond risk premium Cost of Equity Use CapM Data from Exhibit 2 risk free rate 4.18\% Use current yeild to reflect current cost from Exhibit 2 Return on Market 8.98% Average Hang Seng Index return Average risk free 5.98% Average of 10yr Hong Kong Exchange Fund Note Market Risk premium 3.0056 Beta 0.78 Cathay pacific beta value Cost of Equity 6.52% WACC \begin{tabular}{l|r} Debt & Data from Exhibit 1 \\ \hline Net Longterm liabilities & 17,662 \\ net Current portion of Longterm liabili & 4969 \\ \hline Total Debt & 22,631 \end{tabular} Equity \begin{tabular}{l|r} Equity Share Capital & 674 \\ \hline Reserves & 32181 \\ \hline Total Equity & 32855 \\ \hline Total Capital & 55,486 \end{tabular} WACC \begin{tabular}{l|r} risk free rate & 4.18% \\ \hline Weight for Debt & 4196 \\ \hline Weight for equity & 59% \\ \hline cost of equity & 6.52% \\ \hline Cost of Debt & 5.7196 \\ Tax Rate & 17.50% \end{tabular} aftertax cost of debt 4.7196 WACC 5.78% DISCOUNTED CASH FLOW: PURCHASE OPTION Engine List Price Esclation in Engine Price Escalted Engine Price Deposit Remaining Payment Residual Value at 2016 Cost Permainntenance Tax Depreciation Tax Sheild Hourly Reserves Cycle Reserves Engine Maintenance Lease rate Factor Monthly rental Annual rental Lease Deposit Residual Market Value at 2016 Deposit Remaining Payment Depreciation Tax Sheild Engine Maintenance Residual Value at 2016 Total NPV at WACC NPV using after tax cost of debt DISCOUNTED CASH FLOW: SALE AND LEASEBACK Deposit Remaining Payment Purchase by Lessor Lease Deposit Lease payment Tax Sheild on Lease Payment Total NPV at After Tax Cost MAINTENANCE RESERVES Hourly Reserves Cycle Reserves Engine maintenance Maintenance Reserve Claim Total NPV at WACC Total NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts