Question: The Acct 201 Co. uses the periodic inventory method and had the following inventory information available: #of Units Unit Cost ($). Total Cost ($) 1/1

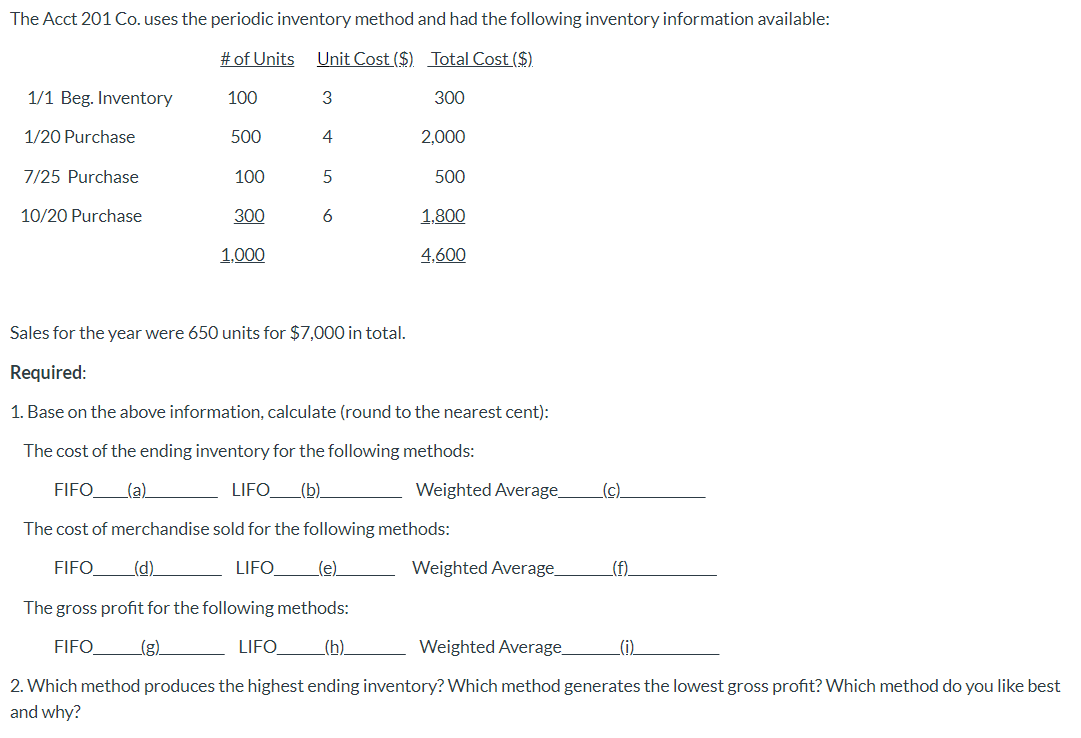

The Acct 201 Co. uses the periodic inventory method and had the following inventory information available: #of Units Unit Cost ($). Total Cost ($) 1/1 Beg. Inventory 100 3 300 1/20 Purchase 500 4 2,000 7/25 Purchase 100 5 500 10/20 Purchase 300 6 1,800 1.000 4,600 Sales for the year were 650 units for $7,000 in total. Required: 1. Base on the above information, calculate (round to the nearest cent): The cost of the ending inventory for the following methods: FIFO LIFO (b). Weighted Average (c) The cost of merchandise sold for the following methods: FIFO_(d) LIFO Lle) Weighted Average_ (f). The gross profit for the following methods: FIFO LIFO (h) Weighted Average (0) 2. Which method produces the highest ending inventory? Which method generates the lowest gross profit? Which method do you like best and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts