Question: The allocation bases used by above three companies for computing their predetermined overhead rates are: . Company A: Direct labor hours - Company B: Machine

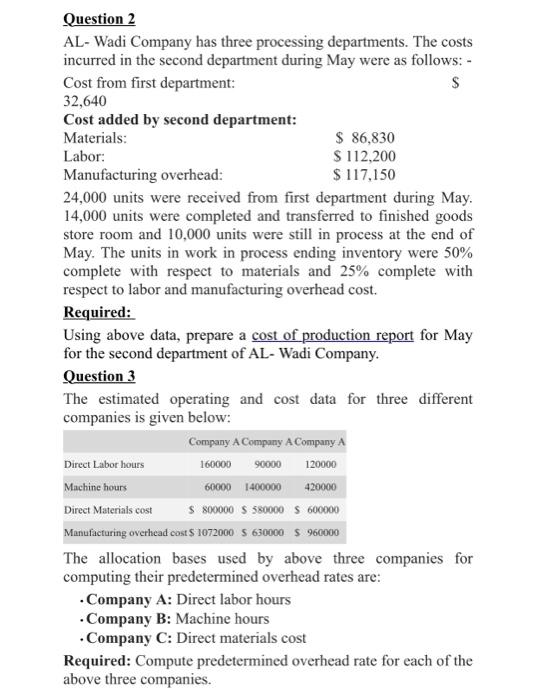

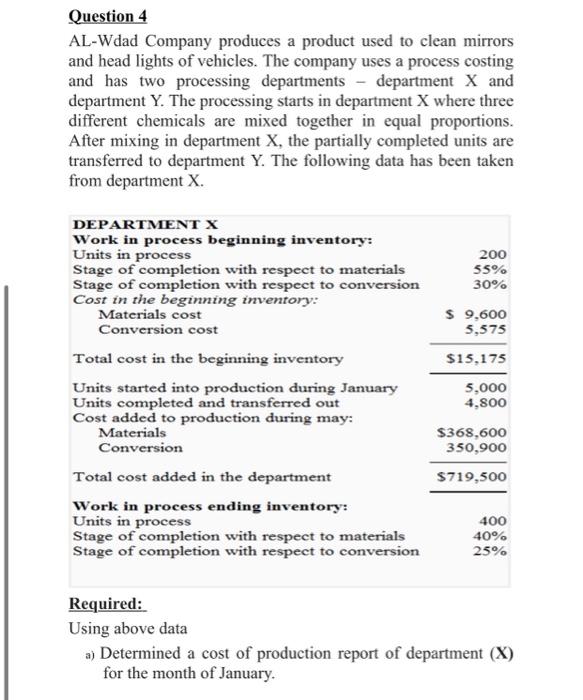

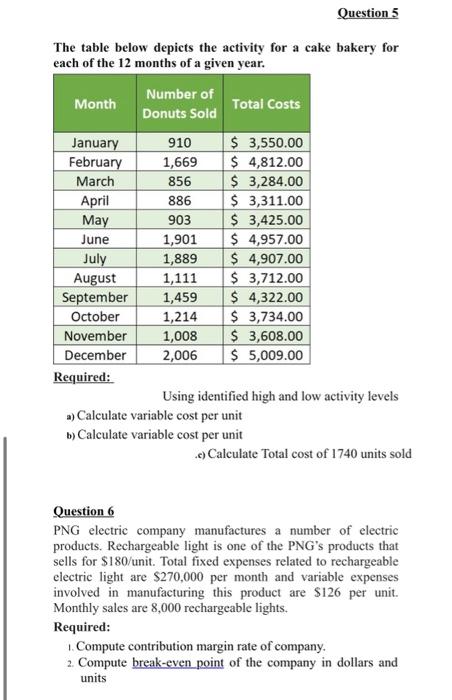

The allocation bases used by above three companies for computing their predetermined overhead rates are: . Company A: Direct labor hours - Company B: Machine hours - Company C: Direct materials cost Required: Compute predetermined overhead rate for each of the above three companies. Question 4 AL-Wdad Company produces a product used to clean mirrors and head lights of vehicles. The company uses a process costing and has two processing departments - department X and department Y. The processing starts in department X where three different chemicals are mixed together in equal proportions. After mixing in department X, the partially completed units are transferred to department Y. The following data has been taken from department X. Required: Using above data a) Determined a cost of production report of department (X) for the month of January. The table below depicts the activity for a cake bakery for each of the 12 months of a given year. Required: Using identified high and low activity levels a) Calculate variable cost per unit b) Calculate variable cost per unit .) Calculate Total cost of 1740 units sold Question 6 PNG electric company manufactures a number of electric products. Rechargeable light is one of the PNG's products that sells for $180 /unit. Total fixed expenses related to rechargeable electric light are $270,000 per month and variable expenses involved in manufacturing this product are $126 per unit. Monthly sales are 8,000 rechargeable lights. Required: 1. Compute contribution margin rate of company. 2. Compute break-even point of the company in dollars and units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts