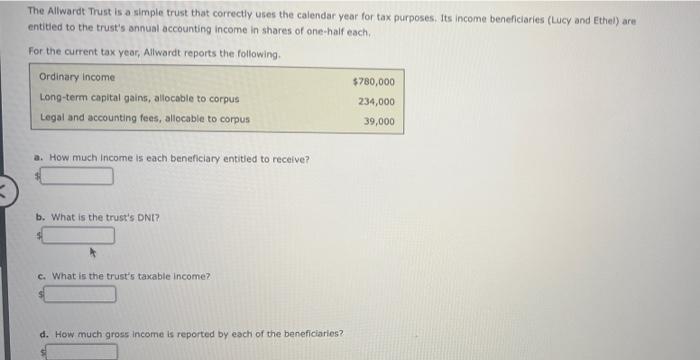

Question: The Allwardt Trust is a simple trust that correctly uses the calendar year for tax purposes. Its income beneficiaries (Lucy and Ethel) are entitied to

The Allwardt Trust is a simple trust that correctly uses the calendar year for tax purposes. Its income beneficiaries (Lucy and Ethel) are entitied to the trust's annual accounting income in shares of one-half each. For the current tax year, Alwardt reports the following. a. How much Income is each beneficiary entited to receive? b. What is the trust's DNt? c. What is the trust's taxable income? d. How much gross income is reported by each of the beneficiaries

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock