Question: The amortization table below shows the first two periods for a $200,000 face value bond that sold for $160,000. The bonds were sold on April

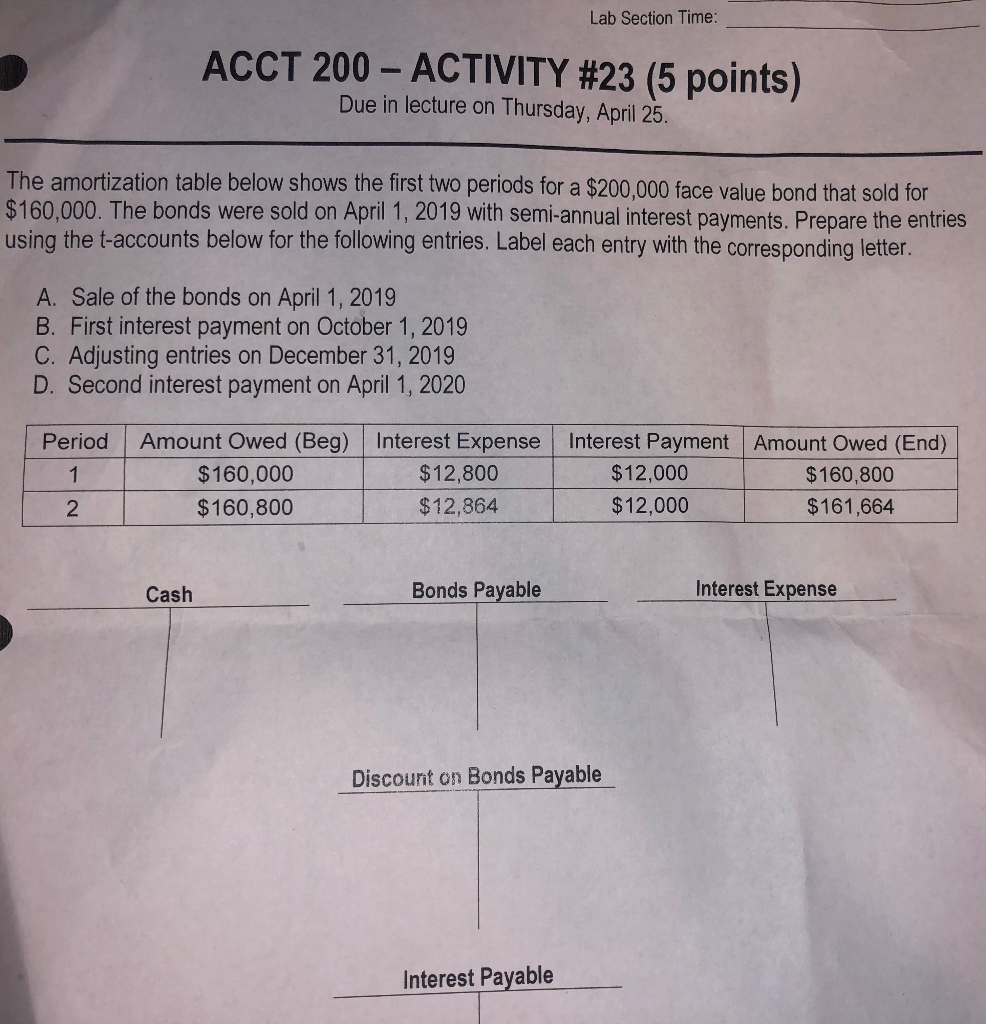

The amortization table below shows the first two periods for a $200,000 face value bond that sold for $160,000. The bonds were sold on April 1, 2019 with semi...

please show every account with the credit and debit, prefer if written on paper

Lab Section Time: ACCT 200-ACTIVITY #23 (5 points) Due in lecture on Thursday, April 25. The amortization table below shows the first two periods for a $200,000 face value bond that sold for $160,000. The bonds were sold on April 1, 2019 with semi-annual interest payments. Prepare the entries using the t-accounts below for the following entries. Label each entry with the corresponding letter A. Sale of the bonds on April 1, 2019 B. First interest payment on October 1, 2019 C. Adjusting entries on December 31, 2019 D. Second interest payment on April 1, 2020 Period Amount Owed (Beg) $160,000 $160,800 Interest Expense $12,800 $12,864 Interest Payment $12,000 $12,000 Amount Owed (End) $160,800 $161,664 2 Interest Expense Bonds Payable Cash Discount on Bonds Payable Interest Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts