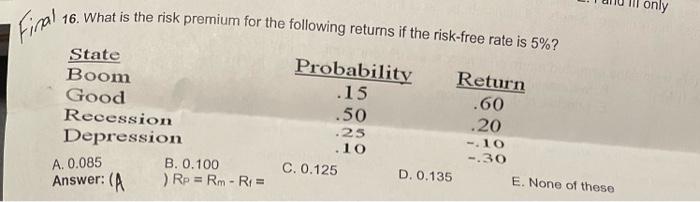

Question: the answer i have is correct, please just show how to get the answer along with the formula, thanks. 16. What is the risk premium

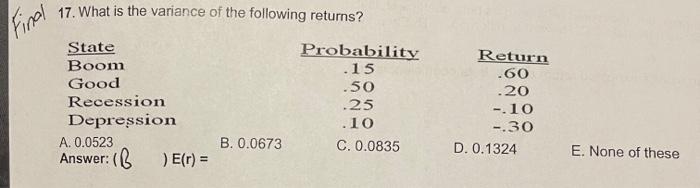

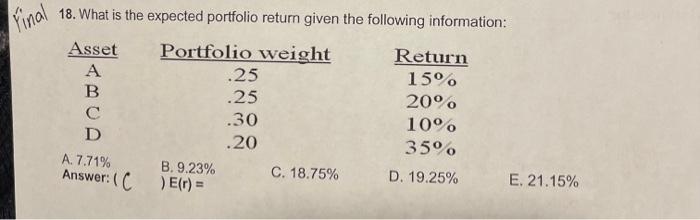

16. What is the risk premium for the following returns if the risk-free rate is 5%? only Final State Boom Good Recession Depression B. 0.100 Answer: (A ) Rp = Rm - Ri= Probability Return .15 .60 .50 .20 .25 -.10 10 -.30 C. 0.125 D. 0.135 E. None of these A. 0.085 17. What is the variance of the following returns? Final State Boom Good Recession Depression A. 0.0523 Answer:( ) E(r) = Probability .15 .50 .25 .10 C. 0.0835 Return .60 .20 -10 -.30 D. 0.1324 B. 0.0673 E. None of these Final 18. What is the expected portfolio return given the following information: Asset Portfolio weight Return A .25 15 B .25 20 .30 10 D .20 35 B.9.23% C. 18.75% D. 19.25% E. 21.15% A. 7.71% Answer: ( CE() =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts