Question: the answer i have is correct, please just show how to get the answer along with the formula, thanks. 5% lize on this investment? B.

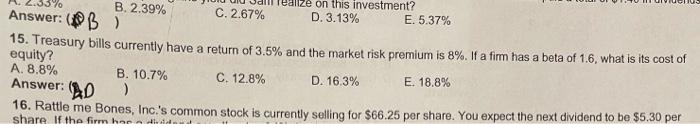

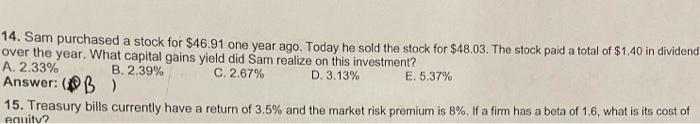

5% lize on this investment? B. 2.39% C. 2.67% D. 3.13% E. 5.37% Answer: (B) 15. Treasury bills currently have a return of 3.5% and the market risk premium is 8%. If a firm has a beta of 1.6, what is its cost of equity? A. 8.8% B. 10.7% C. 12.8% D. 16.3% ) 16. Rattle me Bones, Inc.'s common stock is currently selling for $66.25 per share. You expect the next dividend to be $5.30 per Answer: (AD E. 18.8% share If the firm har distinta 14. Sam purchased a stock for $46.91 one year ago. Today he sold the stock for $48.03. The stock paid a total of $1.40 in dividend over the year. What capital gains yield did Sam realize on this investment? A. 2.33% B. 2.39% C. 2.67% D. 3.13% E. 5.37% Answer: B) 15. Treasury bills currently have a return of 3.5% and the market risk premium is 8%. If a firm has a beta of 1.6, what is its cost of equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts