Question: the answer is -140,000. how do i get to that number? ReT inc. has decided to manufacture and sell a new line of high-priced commercial

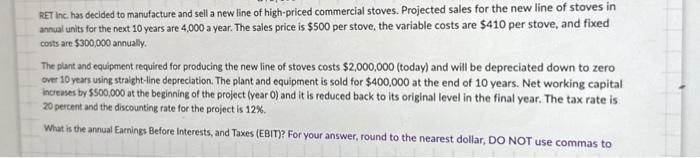

ReT inc. has decided to manufacture and sell a new line of high-priced commercial stoves. Projected sales for the new line of stoves in annual units for the next 10 years are 4,000 a year. The sales price is $500 per stove, the variable costs are $410 per stove, and fixed costs are $300,000 annually. The plant and equipment required for producing the new line of stoves costs $2,000,000 (today) and will be depreciated down to zero ore 10 years using straight-line depreciation. The plant and equipment is sold for $400,000 at the end of 10 years. Net working capital inceases by 5500,000 at the beginning of the project (year 0 ) and it is reduced back to its original level in the final year. The tax rate is 20 percent and the discounting rate for the project is 12%. What is the annual Earnings Before Interests, and Taxes (EBIT)? For your answer, round to the nearest dollar, DO NOT use commas to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts