Question: The answer is 26.24 For Projected Year 3, calculate the additional amount of synergies (beyond the $100 million already included in the projections) needed to

The answer is 26.24

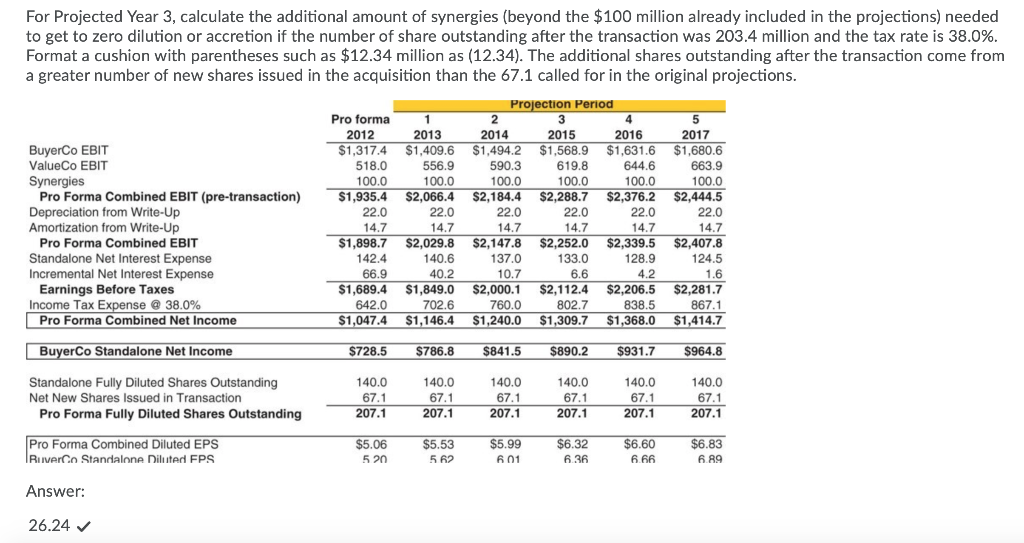

For Projected Year 3, calculate the additional amount of synergies (beyond the $100 million already included in the projections) needed to get to zero dilution or accretion if the number of share outstanding after the transaction was 203.4 million and the tax rate is 38.0%. Format a cushion with parentheses such as $12.34 million as (12.34). The additional shares outstanding after the transaction come from a greater number of new shares issued in the acquisition than the 67.1 called for in the original projections. Projection Period Pro forma 2 3 4 5 2012 2013 2014 2015 2016 2017 BuyerCo EBIT $1,317.4 $1,409.6 $1,494.2 $1,568.9 $1,631.6 $1,680.6 ValueCo EBIT 518.0 556.9 590.3 619.8 644.6 663,9 Synergies 100.0 100.0 100.0 100.0 100.0 100.0 Pro Forma Combined EBIT (pre-transaction) $1,935.4 $2,066.4 $2,184.4 $2,288.7 $2,376.2 $2,444.5 Depreciation from Write-Up 22.0 22.0 22.0 22.0 22.0 22.0 Amortization from Write-Up 12 14 14.7 14.7 14.7 14.7 14.7 14.7 Pro Forma Combined EBIT $1,898.7 $2,029.8 $2,147.8 $2,252.0 $2,339.5 $2,407.8 Standalone Net Interest Expense 142.4 140.6 137.0 133.0 128.9 124.5 Incremental Net Interest Expense 66.9 40.2 10.7 6.6 4.2 1.6 Earnings Before Taxes $1,689.4 $1,849.0 $2,000.1 $2,112.4 $2,206.5 $2,281.7 Income Tax Expense @ 38.0% 642.0 702.6 760.0 802.7 838.5 867.1 Pro Forma Combined Net Income $1,047.4 $1,146.4 $1,240.0 $1,309.7 $1,368.0 $1,414.7 BuyerCo Standalone Net Income $728.5 $786.8 $841.5 $890.2 $931.7 $964.8 Standalone Fully Diluted Shares Outstanding Net New Shares Issued in Transaction Pro Forma Fully Diluted Shares Outstanding 140.0 67.1 207.1 140.0 67.1 207.1 140.0 67.1 207.1 140.0 67.1 207.1 140.0 67.1 207.1 140.0 67.1 207.1 Pro Forma Combined Diluted EPS Ruverco Standalone Diluted FPS $5.06 5 20 $5.53 5 62 $5.99 601 $6.32 6.36 $6.60 6.66 $6.83 6.89 Answer: 26.24 For Projected Year 3, calculate the additional amount of synergies (beyond the $100 million already included in the projections) needed to get to zero dilution or accretion if the number of share outstanding after the transaction was 203.4 million and the tax rate is 38.0%. Format a cushion with parentheses such as $12.34 million as (12.34). The additional shares outstanding after the transaction come from a greater number of new shares issued in the acquisition than the 67.1 called for in the original projections. Projection Period Pro forma 2 3 4 5 2012 2013 2014 2015 2016 2017 BuyerCo EBIT $1,317.4 $1,409.6 $1,494.2 $1,568.9 $1,631.6 $1,680.6 ValueCo EBIT 518.0 556.9 590.3 619.8 644.6 663,9 Synergies 100.0 100.0 100.0 100.0 100.0 100.0 Pro Forma Combined EBIT (pre-transaction) $1,935.4 $2,066.4 $2,184.4 $2,288.7 $2,376.2 $2,444.5 Depreciation from Write-Up 22.0 22.0 22.0 22.0 22.0 22.0 Amortization from Write-Up 12 14 14.7 14.7 14.7 14.7 14.7 14.7 Pro Forma Combined EBIT $1,898.7 $2,029.8 $2,147.8 $2,252.0 $2,339.5 $2,407.8 Standalone Net Interest Expense 142.4 140.6 137.0 133.0 128.9 124.5 Incremental Net Interest Expense 66.9 40.2 10.7 6.6 4.2 1.6 Earnings Before Taxes $1,689.4 $1,849.0 $2,000.1 $2,112.4 $2,206.5 $2,281.7 Income Tax Expense @ 38.0% 642.0 702.6 760.0 802.7 838.5 867.1 Pro Forma Combined Net Income $1,047.4 $1,146.4 $1,240.0 $1,309.7 $1,368.0 $1,414.7 BuyerCo Standalone Net Income $728.5 $786.8 $841.5 $890.2 $931.7 $964.8 Standalone Fully Diluted Shares Outstanding Net New Shares Issued in Transaction Pro Forma Fully Diluted Shares Outstanding 140.0 67.1 207.1 140.0 67.1 207.1 140.0 67.1 207.1 140.0 67.1 207.1 140.0 67.1 207.1 140.0 67.1 207.1 Pro Forma Combined Diluted EPS Ruverco Standalone Diluted FPS $5.06 5 20 $5.53 5 62 $5.99 601 $6.32 6.36 $6.60 6.66 $6.83 6.89 Answer: 26.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts