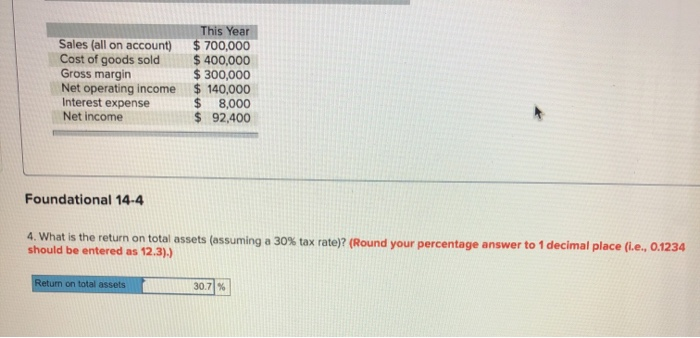

Question: The answer is not 30.7 or 30.8. If you coukd please provide an explination it would be greatly aprecieated. I'm not sure why its not

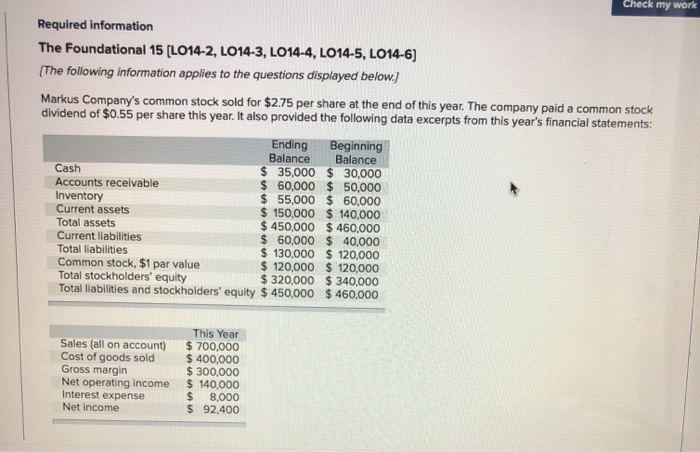

Check my work Required information The Foundational 15 (LO14-2, LO14-3, LO14-4, LO14-5, LO14-6) [The following information applies to the questions displayed below.) Markus Company's common stock sold for $2.75 per share at the end of this year. The company paid a common stock dividend of $0.55 per share this year. It also provided the following data excerpts from this year's financial statements: Ending Beginning Balance Balance Cash $ 35,000 $ 30,000 Accounts receivable $ 60,000 $ 50,000 Inventory $ 55,000 $ 60,000 Current assets $ 150,000 $ 140,000 Total assets $ 450,000 $ 460,000 Current liabilities $ 60,000 $ 40,000 Total liabilities $ 130,000 $ 120,000 Common stock, $1 par value $ 120,000 $ 120,000 Total stockholders' equity $ 320,000 $340,000 Total liabilities and stockholders' equity $ 450,000 $ 460,000 + Sales (all on account) Cost of goods sold Gross margin Net operating income Interest expense Net Income This Year $ 700,000 $ 400,000 $ 300,000 $ 140,000 $ 8,000 $ 92,400 This Year Sales (all on account) $ 700,000 Cost of goods sold $ 400,000 Gross margin $ 300,000 Net operating income $ 140,000 Interest expense $ 8,000 Net income $ 92,400 Foundational 14.4 4. What is the return on total assets (assuming a 30% tax rate)? (Round your percentage answer to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) Return on total assets 30.7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts