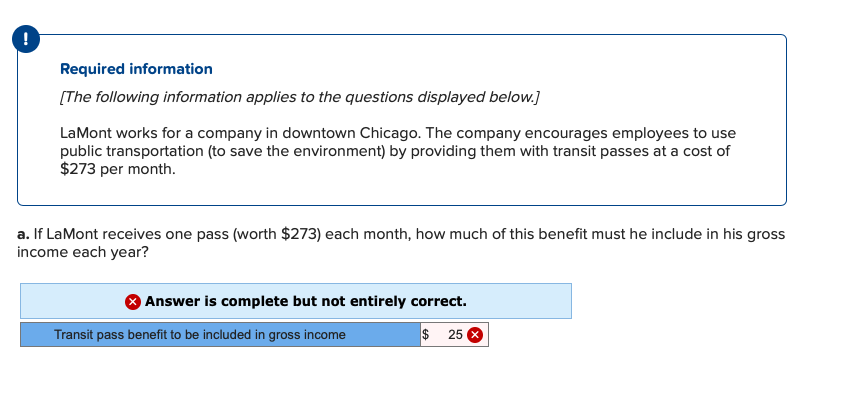

Question: The answer is not 36!!! ! Required information [The following information applies to the questions displayed below.) LaMont works for a company in downtown Chicago.

The answer is not 36!!!

! Required information [The following information applies to the questions displayed below.) LaMont works for a company in downtown Chicago. The company encourages employees to use public transportation (to save the environment) by providing them with transit passes at a cost of $273 per month. a. If LaMont receives one pass (worth $273) each month, how much of this benefit must he include in his gross income each year? Answer is complete but not entirely correct. Transit pass benefit to be included in gross income $ 25 ! Required information [The following information applies to the questions displayed below.] LaMont works for a company in downtown Chicago. The company encourages employees to use public transportation (to save the environment) by providing them with transit passes at a cost of $273 per month b. If the company provides each employee with $273 per month in parking benefits, how much of the parking benefit must LaMont include in his gross income each year? Parking benefit to be included in gross income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts