Question: The answer is not 652. ! Required information [The following information applies to the questions displayed below.] Christopher is a self-employed cash-method, calendar-year taxpayer, and

The answer is not 652.

The answer is not 652.

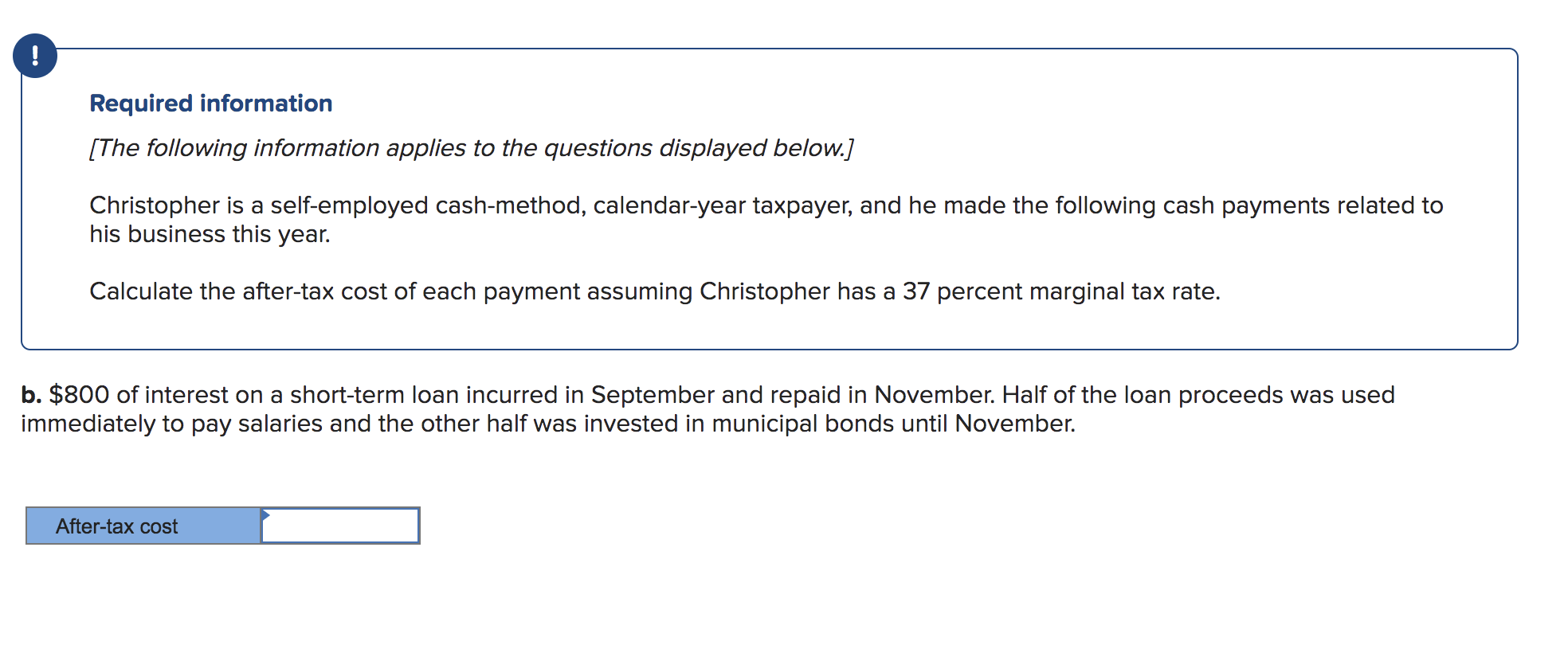

! Required information [The following information applies to the questions displayed below.] Christopher is a self-employed cash-method, calendar-year taxpayer, and he made the following cash payments related to his business this year. Calculate the after-tax cost of each payment assuming Christopher has a 37 percent marginal tax rate. b. $800 of interest on a short-term loan incurred in September and repaid in November. Half of the loan proceeds was used immediately to pay salaries and the other half was invested in municipal bonds until November. After-tax cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts