Question: the answer is wrong, please help with formula provided that was the full question already Linda Babeu, who is in a 32% ordinary tax bracket

the answer is wrong, please help with formula provided

the answer is wrong, please help with formula provided

that was the full question already

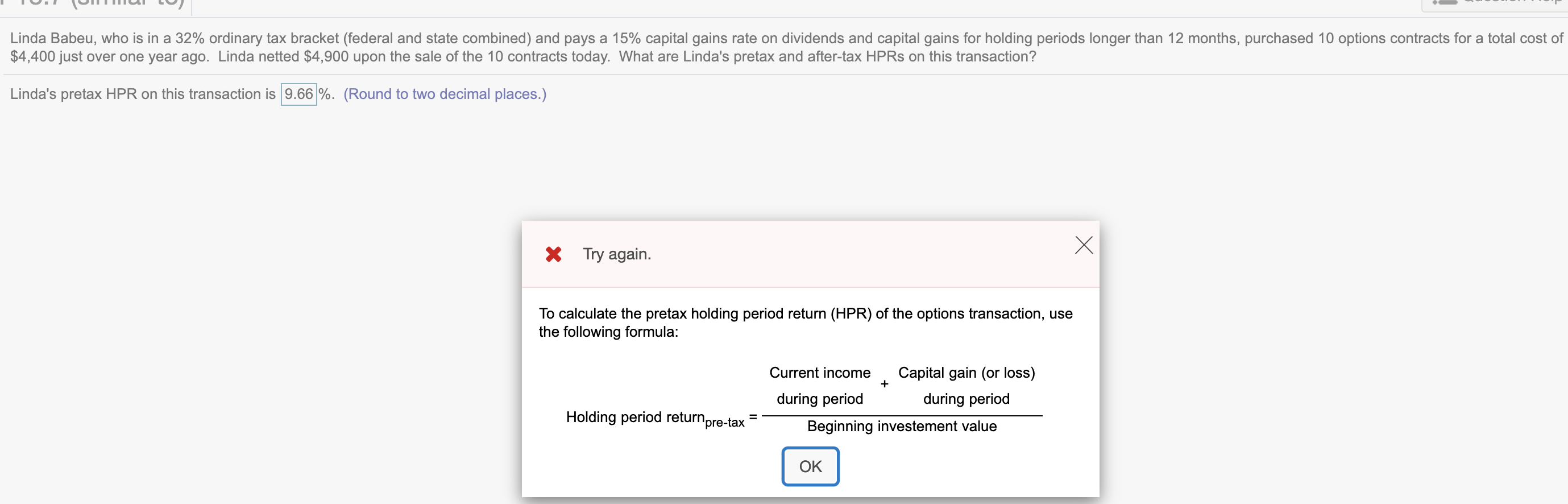

Linda Babeu, who is in a 32% ordinary tax bracket (federal and state combined) and pays a 15% capital gains rate on dividends and capital gains for holding periods longer than 12 months, purchased 10 options contracts for a total cost of $4,400 just over one year ago. Linda netted $4,900 upon the sale of the 10 contracts today. What are Linda's pretax and after-tax HPRs on this transaction? Linda's pretax HPR on this transaction is 9.66 %. (Round to two decimal places.) X Try again. To calculate the pretax holding period return (HPR) of the options transaction, use the following formula: + Current income Capital gain (or loss) during period during period Beginning investement value Holding period returnpre-tax OK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts