Question: the answer is wrong, but provided with formula please help Linda Babeu, who is in a 32% ordinary tax bracket (federal and state combined) and

the answer is wrong, but provided with formula please help

the answer is wrong, but provided with formula please help

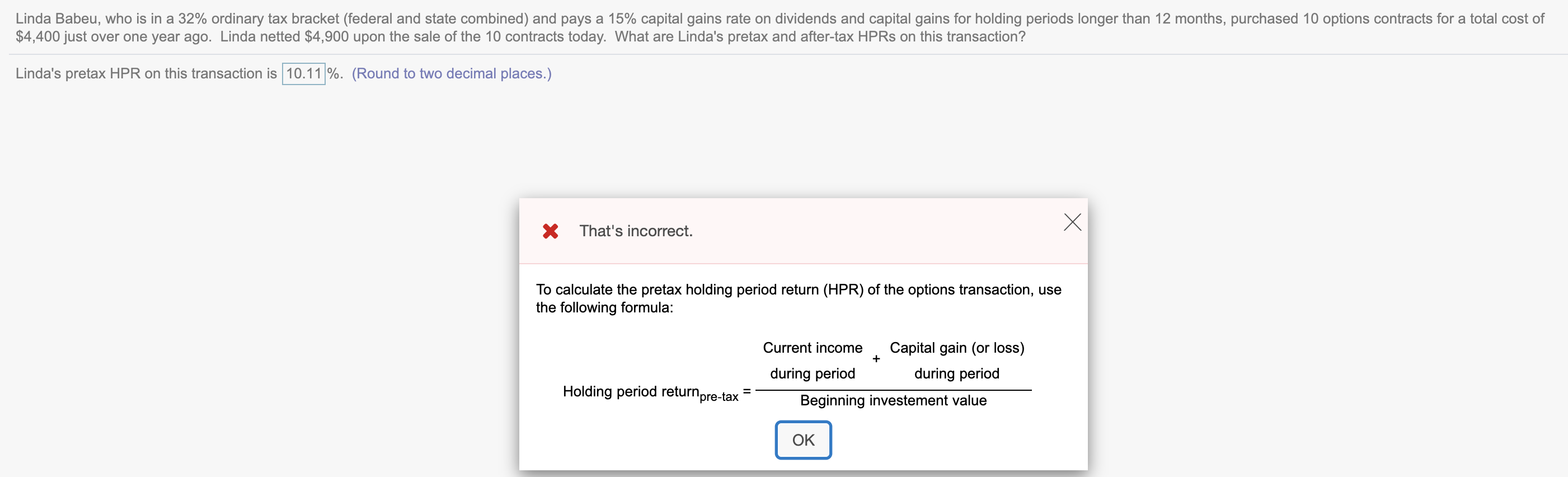

Linda Babeu, who is in a 32% ordinary tax bracket (federal and state combined) and pays a 15% capital gains rate on dividends and capital gains for holding periods longer than 12 months, purchased 10 options contracts for a total cost of $4,400 just over one year ago. Linda netted $4,900 upon the sale of the 10 contracts today. What are Linda's pretax and after-tax HPRs on this transaction? Linda's pretax HPR on this transaction is 10.11 %. (Round to two decimal places.) X That's incorrect. To calculate the pretax holding period return (HPR) of the options transaction, use the following formula: + Current income Capital gain (or loss) during period during period Beginning investement value Holding period returnpre-tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts