Question: The answer Options for these are : Short-Term options OR Warrants OR Swaps OR Convertible fixed income securities. 1. Basic concepts Derivatives are securities whose

The answer Options for these are : Short-Term options OR Warrants OR Swaps OR Convertible fixed income securities.

The answer Options for these are : Short-Term options OR Warrants OR Swaps OR Convertible fixed income securities.

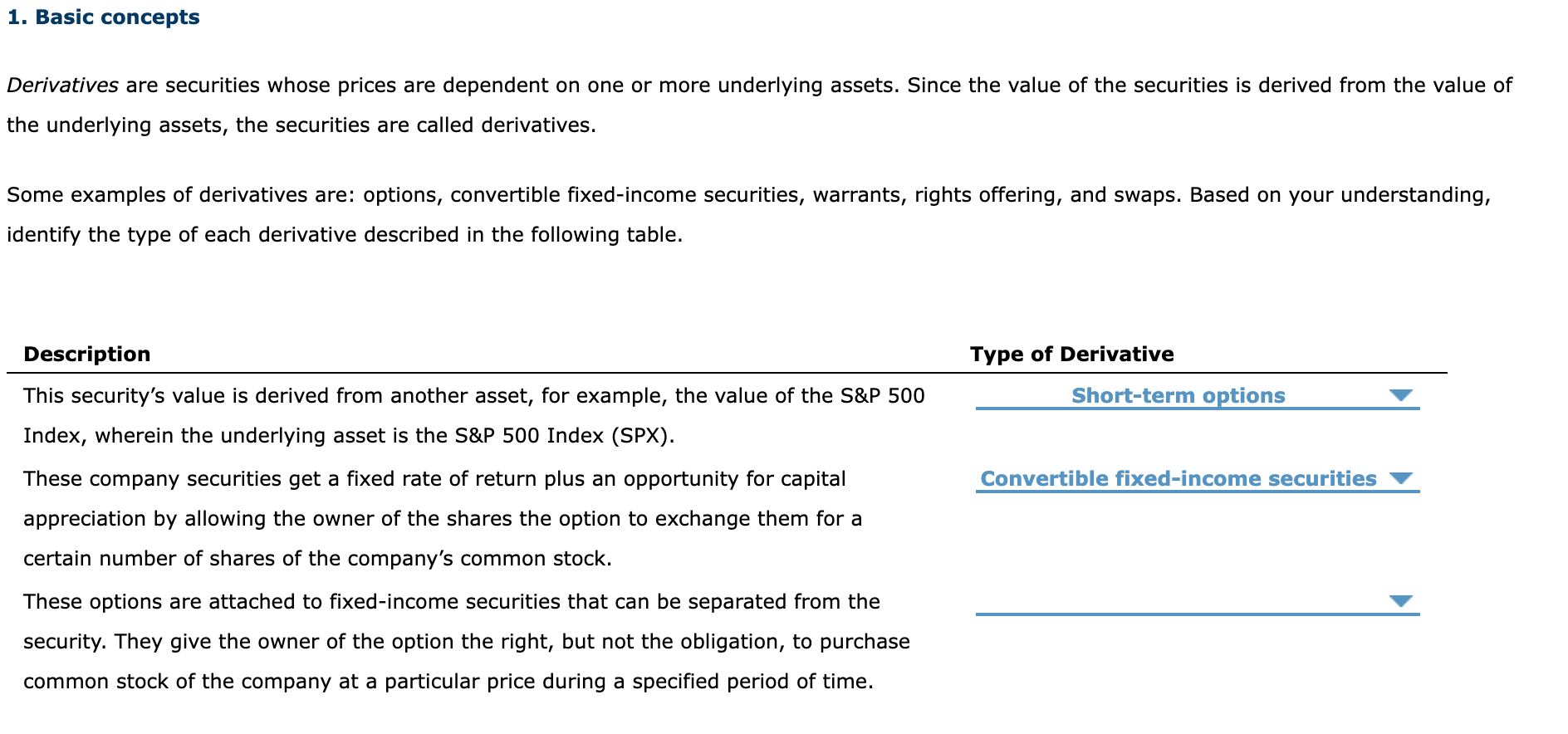

1. Basic concepts Derivatives are securities whose prices are dependent on one or more underlying assets. Since the value of the securities is derived from the value of the underlying assets, the securities are called derivatives. Some examples of derivatives are: options, convertible fixed-income securities, warrants, rights offering, and swaps. Based on your understanding, identify the type of each derivative described in the following table. Description Type of Derivative Short-term options This security's value is derived from another asset, for example, the value of the S&P 500 Index, wherein the underlying asset is the S&P 500 Index (SPX). Convertible fixed-income securities These company securities get a fixed rate of return plus an opportunity for capital appreciation by allowing the owner of the shares the option to exchange them for a certain number of shares of the company's common stock. These options are attached to fixed-income securities that can be separated from the security. They give the owner of the option the right, but not the obligation, to purchase common stock of the company at a particular price during a specified period of time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts