Question: The answer should be 0.73 Please explain the concepts behind, not only numerical solution Suppose we have a factor model with two factors f1 and

The answer should be 0.73

Please explain the concepts behind, not only numerical solution

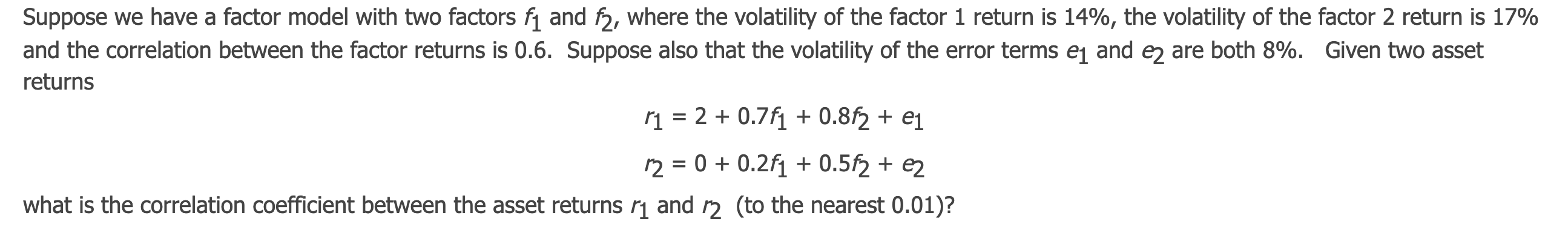

Suppose we have a factor model with two factors f1 and f2, where the volatility of the factor 1 return is 14%, the volatility of the factor 2 return is 17% and the correlation between the factor returns is 0.6. Suppose also that the volatility of the error terms ej and ez are both 8%. Given two asset returns r1 = 2 + 0.7f1 + 0.872 + e1 r2 = 0 + 0.2f1 + 0.5f2 + 2 what is the correlation coefficient between the asset returns 11 and 12 (to the nearest 0.01)? Suppose we have a factor model with two factors f1 and f2, where the volatility of the factor 1 return is 14%, the volatility of the factor 2 return is 17% and the correlation between the factor returns is 0.6. Suppose also that the volatility of the error terms ej and ez are both 8%. Given two asset returns r1 = 2 + 0.7f1 + 0.872 + e1 r2 = 0 + 0.2f1 + 0.5f2 + 2 what is the correlation coefficient between the asset returns 11 and 12 (to the nearest 0.01)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts