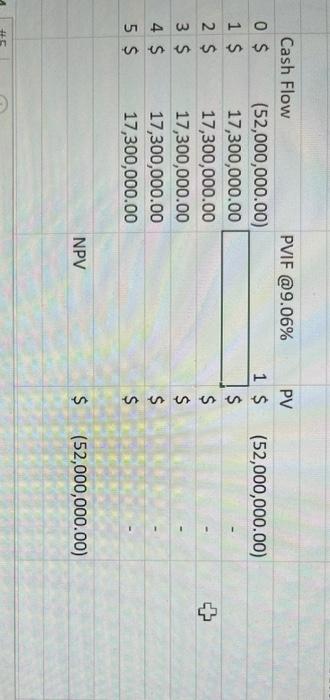

Question: The answer shown is correct. The WACC is 9.06%. I need to know how to get the numbers for PVIF @ 9.06%? First and Ten

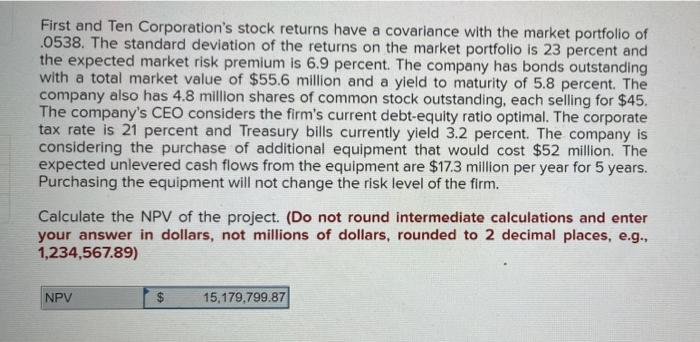

First and Ten Corporation's stock returns have a covariance with the market portfolio of 0538. The standard deviation of the returns on the market portfolio is 23 percent and the expected market risk premium is 6.9 percent. The company has bonds outstanding with a total market value of $55.6 million and a yield to maturity of 5.8 percent. The company also has 4.8 million shares of common stock outstanding, each selling for $45. The company's CEO considers the firm's current debt-equity ratio optimal. The corporate tax rate is 21 percent and Treasury bills currently yield 3.2 percent. The company is considering the purchase of additional equipment that would cost $52 million. The expected unlevered cash flows from the equipment are $17.3 million per year for 5 years. Purchasing the equipment will not change the risk level of the firm. Calculate the NPV of the project. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) NPV 15,179,799.87 (52,000,000.00) Cash Flow PVIF @9.06% 0 $ (52,000,000.00) 1 $ 17,300,000.00 2 $ 17,300,000.00 3 $ 17,300,000.00 4 $ 17,300,000.00 5 s 17,300,000.00 PV 1 $ $ $ $ + niniai NPV $ (52,000,000.00) #t 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts