Question: The answer to this MCQ is option b. please explain why this is the case 4. An Australian FI that invests 75m in 4-year maturity

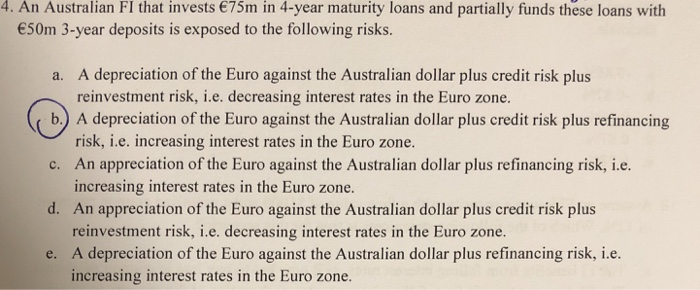

4. An Australian FI that invests 75m in 4-year maturity loans and partially funds these loans with 50m 3-year deposits is exposed to the following risks. a. A depreciation of the Euro against the Australian dollar plus credit risk plus b.) A depreciation of the Euro against the Australian dollar plus credit risk plus refinancing c. An appreciation of the Euro against the Australian dollar plus refinancing risk, i.e d. An appreciation of the Euro against the Australian dollar plus credit risk plus e. A depreciation of the Euro against the Australian dollar plus refinancing risk, i.e. reinvestment risk, i.e. decreasing interest rates in the Euro zone. risk, i.e. increasing interest rates in the Euro zone. increasing interest rates in the Euro zone reinvestment risk, i.e. decreasing interest rates in the Euro zone. increasing interest rates in the Euro zone

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts