Question: Research the tax computations based on latest BIR rules / TRAIN Law to answer the given problems Round your final answer to 2 decimal places.

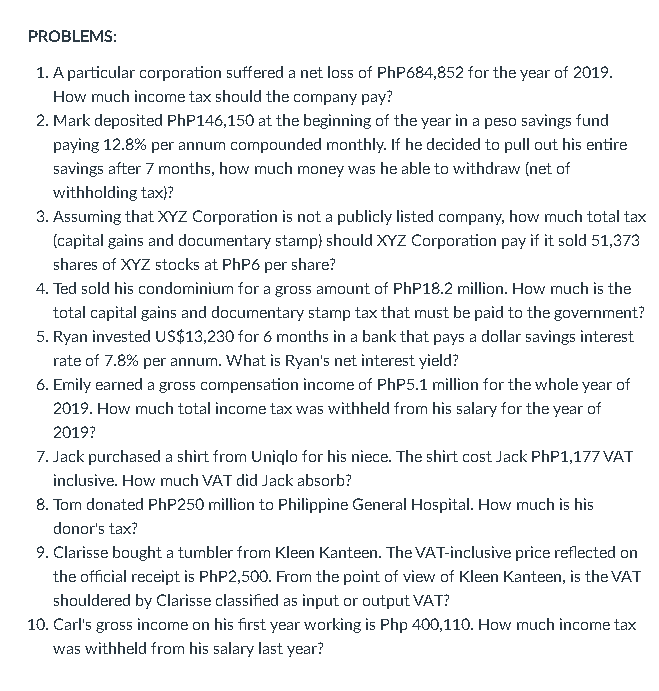

Research the tax computations based on latest BIR rules / TRAIN Law to answer the given problems Round your final answer to 2 decimal places. Do not round your intermediate (middle) solutions. PROBLEMS: 1. A particular corporation suffered a net loss of PhP684,852 for the year of 2019. How much income tax should the company pay? 2. Mark deposited PhP146,150 at the beginning of the year in a peso savings fund paying 12.8% per annum compounded monthly. If he decided to pull out his entire savings after 7 months, how much money was he able to withdraw (net of withholding tax)? 3. Assuming that XYZ Corporation is not a publicly listed company, how much total tax (capital gains and documentary stamp) should XYZ Corporation pay if it sold 51,373 shares of XYZ stocks at PhP6 per share? 4. Ted sold his condominium for a gross amount of Php18.2 million. How much is the total capital gains and documentary stamp tax that must be paid to the government? 5. Ryan invested US$13,230 for 6 months in a bank that pays a dollar savings interest rate of 7.8% per annum. What is Ryan's net interest yield? 6. Emily earned a gross compensation income of PhP5.1 million for the whole year of 2019. How much total income tax was withheld from his salary for the year of 2019? 7. Jack purchased a shirt from Uniqlo for his niece. The shirt cost Jack Php1,177 VAT inclusive. How much VAT did Jack absorb? 8. Tom donated Php250 million to Philippine General Hospital. How much is his donor's tax? 9. Clarisse bought a tumbler from Kleen Kanteen. The VAT-inclusive price reflected on the official receipt is PhP2,500. From the point of view of Kleen Kanteen, is the VAT shouldered by Clarisse classified as input or output VAT? 10. Carl's gross income on his first year working is Php 400,110. How much income tax was withheld from his salary last year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts