Question: The appendix file is very big and so I was hoping to just get steps on how to solve the problem. Appendix A contains financial

The appendix file is very big and so I was hoping to just get steps on how to solve the problem. Appendix A contains financial information and Appendix B contains DL, Processing Time, Headcount, and Floorspace.

The appendix file is very big and so I was hoping to just get steps on how to solve the problem. Appendix A contains financial information and Appendix B contains DL, Processing Time, Headcount, and Floorspace.

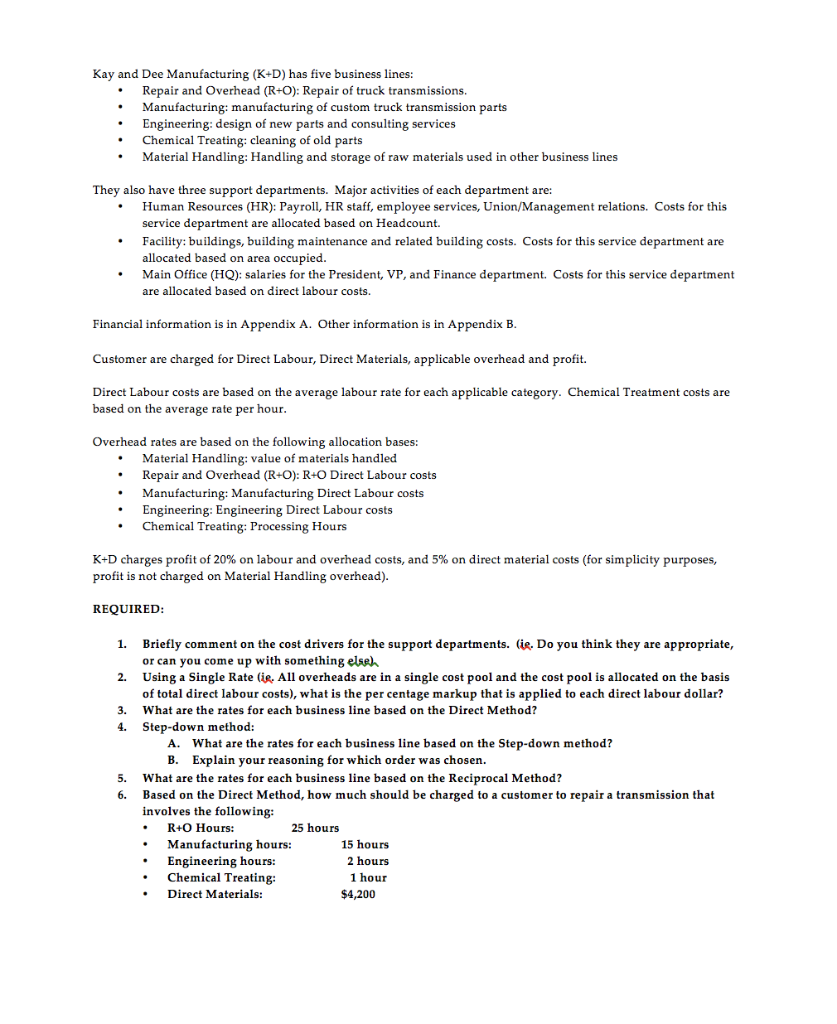

Kay and Dee Manufacturing (K+D) has five business lines Repair and Overhead (R+O): Repair of truck transmissions Manufacturing: manufacturing of custom truck transmission parts Engineering: design of new parts and consulting services Chemical Treating: cleaning of old parts Material Handling: Handling and storage of raw materials used in other business lines They also have three support departments. Major activities of each department are: Human Resources (HR): Payroll, HR staff, employee services, Union/Management relations. Costs for this service department are allocated based on Headcount Facility: buildings, building maintenance and related building costs. Costs for this service department are allocated based on area occupied. Main Office (HQ): salaries for the President, VP, and Finance department. Costs for this service department are allocated based on direct labour costs. Financial information is in Appendix A. Other information is in Appendix B. Customer are charged for Direct Labour, Direct Materials, applicable overhead and profit Direct Labour costs are based on the average labour rate for each applicable category. Chemical Treatment costs are based on the average rate per hour Overhead rates are based on the following allocation bases: Material Handling: value of materials handled Repair and Overhead (R+O): R+O Direct Labour costs Manufacturing: Manufacturing Direct Labour costs Engineering: Engineering Direct Labour costs Chemical Treating: Processing Hours K+D charges profit of 20 % on labour and overhead costs, and 5% on direct material costs (for simplicity purposes, snot charged on Material Handling overhead) profit REQUIRED Briefly comment on the cost drivers for the support departments. (ie. Do you think they are appropriate, or can you come up with something elsek Using a Single Rate (ig, All overheads are in a single cost pool and the cost pool is allocated on the basis of total direct labour costs), what is the per centage markup that is applied to each direct labour dollar? 1. 2. What are the rates for each business line based on the Direct Method? 3. 4. Step-down method: A. What are the rates for each business line based on the Step-down method? Explain your reasoning for which order was chosen. B What are the rates for each business line based on the Reciprocal Method? Based on the Direct Method, how much should be charged to a customer to repair a transmission that involves the following: R+O Hours 5. 6. 25 hours Manufacturing hours: Engineering hours Chemical Treating 15 hours 2 hours 1 hour Direct Materials: $4,200 Kay and Dee Manufacturing (K+D) has five business lines Repair and Overhead (R+O): Repair of truck transmissions Manufacturing: manufacturing of custom truck transmission parts Engineering: design of new parts and consulting services Chemical Treating: cleaning of old parts Material Handling: Handling and storage of raw materials used in other business lines They also have three support departments. Major activities of each department are: Human Resources (HR): Payroll, HR staff, employee services, Union/Management relations. Costs for this service department are allocated based on Headcount Facility: buildings, building maintenance and related building costs. Costs for this service department are allocated based on area occupied. Main Office (HQ): salaries for the President, VP, and Finance department. Costs for this service department are allocated based on direct labour costs. Financial information is in Appendix A. Other information is in Appendix B. Customer are charged for Direct Labour, Direct Materials, applicable overhead and profit Direct Labour costs are based on the average labour rate for each applicable category. Chemical Treatment costs are based on the average rate per hour Overhead rates are based on the following allocation bases: Material Handling: value of materials handled Repair and Overhead (R+O): R+O Direct Labour costs Manufacturing: Manufacturing Direct Labour costs Engineering: Engineering Direct Labour costs Chemical Treating: Processing Hours K+D charges profit of 20 % on labour and overhead costs, and 5% on direct material costs (for simplicity purposes, snot charged on Material Handling overhead) profit REQUIRED Briefly comment on the cost drivers for the support departments. (ie. Do you think they are appropriate, or can you come up with something elsek Using a Single Rate (ig, All overheads are in a single cost pool and the cost pool is allocated on the basis of total direct labour costs), what is the per centage markup that is applied to each direct labour dollar? 1. 2. What are the rates for each business line based on the Direct Method? 3. 4. Step-down method: A. What are the rates for each business line based on the Step-down method? Explain your reasoning for which order was chosen. B What are the rates for each business line based on the Reciprocal Method? Based on the Direct Method, how much should be charged to a customer to repair a transmission that involves the following: R+O Hours 5. 6. 25 hours Manufacturing hours: Engineering hours Chemical Treating 15 hours 2 hours 1 hour Direct Materials: $4,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts