Question: The appropriate rate to be used for evaluating a long-term investment proposal can be re-ferred to as all of the following except: A. the required

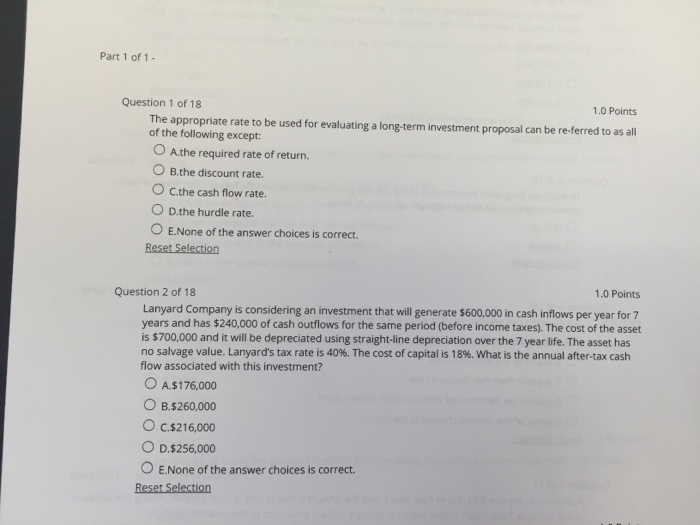

The appropriate rate to be used for evaluating a long-term investment proposal can be re-ferred to as all of the following except: A. the required rate of return. B. the discount rate. C. the cash flow rate. D. the hurdle rate. E. None of the answer choices is correct. Reset Selection Lanyard Company is considering an investment that will generate $600,000 in cash inflows per year for 7 years and has $240,000 of cash outflows for the same period (before income taxes). The cost of the asset is $700,000 and it will be depreciated using straight-line depreciation over the 7 year life. The asset has no salvage value. Lanyard's tax rate is 40%. The cost of capital is 18%. What is the annual after-tax cash flow associated with this investment? A. $176,000 B. $260,000 C. $216,000 D. $256,000 E. None of the answer choices is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts