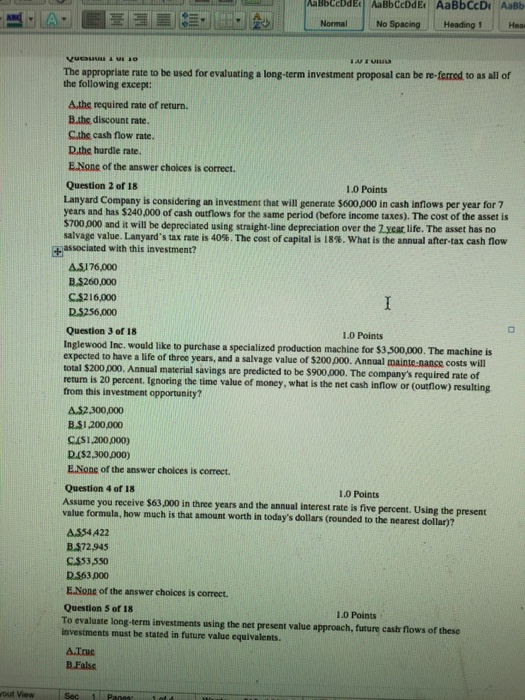

Question: The appropriate rate to be used for evaluating a long-term investment proposal can be referred to as all of the following except: A. the required

The appropriate rate to be used for evaluating a long-term investment proposal can be referred to as all of the following except: A. the required rate of return. B. the discount rate. C. the cash flow rate. D. the hurdle rate. E. None of the answer choices is correct. Lanyard Company is considering an investment that will generate $600,000 in cash inflows per year for 7 years and has $240,000 of cash outflows for the same period (before income taxes). The cost of the asset is $700000 and it will be depreciated using straight-line depreciation over the 7 year life. The asset has no salvage value. Lanyard's tax rate is 40%. The cost of capital is 18%. What is the annual after-tax cash flow associated with this investment? A. $176,000 B. $260,000 C. $216,000 D. $256,000 Inglewood Inc. would like to purchase a specialized production machine for $3, 500,000. The machine is expected to have a life of three years, and a salvage value of $200,000. Annual maintenance costs will total $200,000. Annual material savings are predicted to be $900,000. The company's required rate of return is 20 percent. Ignoring the time value of money, what is the net cash inflow or (outflow) resulting from this investment opportunity? A. $2, 300,000 B. $1, 200,000 C. ($1, 200,000) D. ($2, 300,000) E. None of the answer choices is correct. Assume you receive $63,000 in three years and the annual interest rate is five percent. Using the present value formula, how much is that amount worth in today's dollars (rounded to the nearest dollar)? A. $54, 422 B. $72, 945 C. $53, 550 D. $63,000 E. None of the answer choices is correct. To evaluate long-term investments using the net present value approach, future cash flows of these investments must be stated in future value equivalents. A. True B. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts