Question: The average measures the average return over the past four years and is while the average of better reflects the change in the stock's value

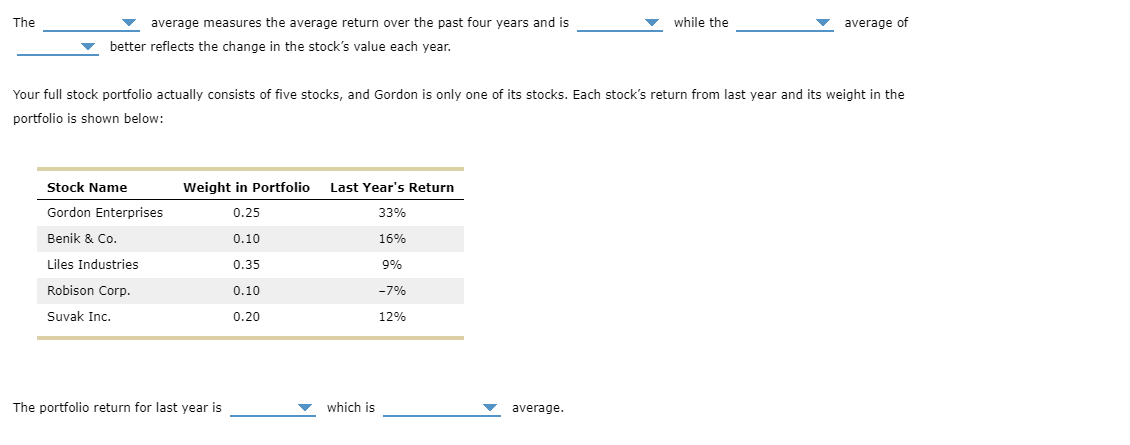

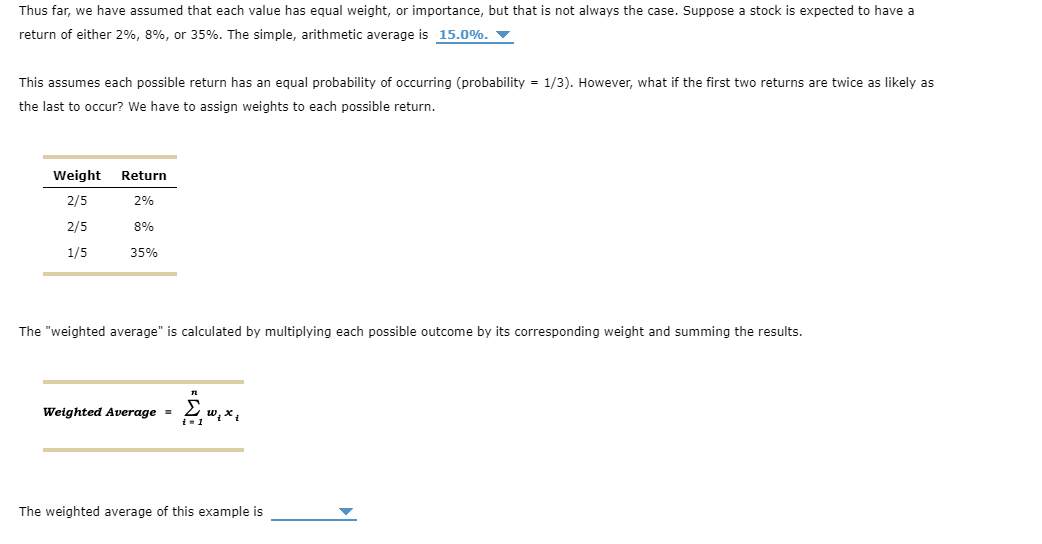

The average measures the average return over the past four years and is while the average of better reflects the change in the stock's value each year. Your full stock portfolio actually consists of five stocks, and Gordon is only one of its stocks. Each stock's return from last year and its weight in the portfolio is shown below: The portfolio return for last year is which is average. Thus far, we have assumed that each value has equal weight, or importance, but that is not always the case. Suppose a stock is expected to have a return of either \2, or \35. The simple, arithmetic average is This assumes each possible return has an equal probability of occurring (probability \\( =1 / 3 \\) ). However, what if the first two returns are twice as likely as the last to occur? We have to assign weights to each possible return. The \"weighted average\" is calculated by multiplying each possible outcome by its corresponding weight and summing the results. \\[ \\text { Weighted Average }=\\sum_{i=1}^{n} w_{i} x_{i} \\] The weighted average of this example is The average measures the average return over the past four years and is while the average of better reflects the change in the stock's value each year. Your full stock portfolio actually consists of five stocks, and Gordon is only one of its stocks. Each stock's return from last year and its weight in the portfolio is shown below: The portfolio return for last year is which is average. Thus far, we have assumed that each value has equal weight, or importance, but that is not always the case. Suppose a stock is expected to have a return of either \2, or \35. The simple, arithmetic average is This assumes each possible return has an equal probability of occurring (probability \\( =1 / 3 \\) ). However, what if the first two returns are twice as likely as the last to occur? We have to assign weights to each possible return. The \"weighted average\" is calculated by multiplying each possible outcome by its corresponding weight and summing the results. \\[ \\text { Weighted Average }=\\sum_{i=1}^{n} w_{i} x_{i} \\] The weighted average of this example is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts