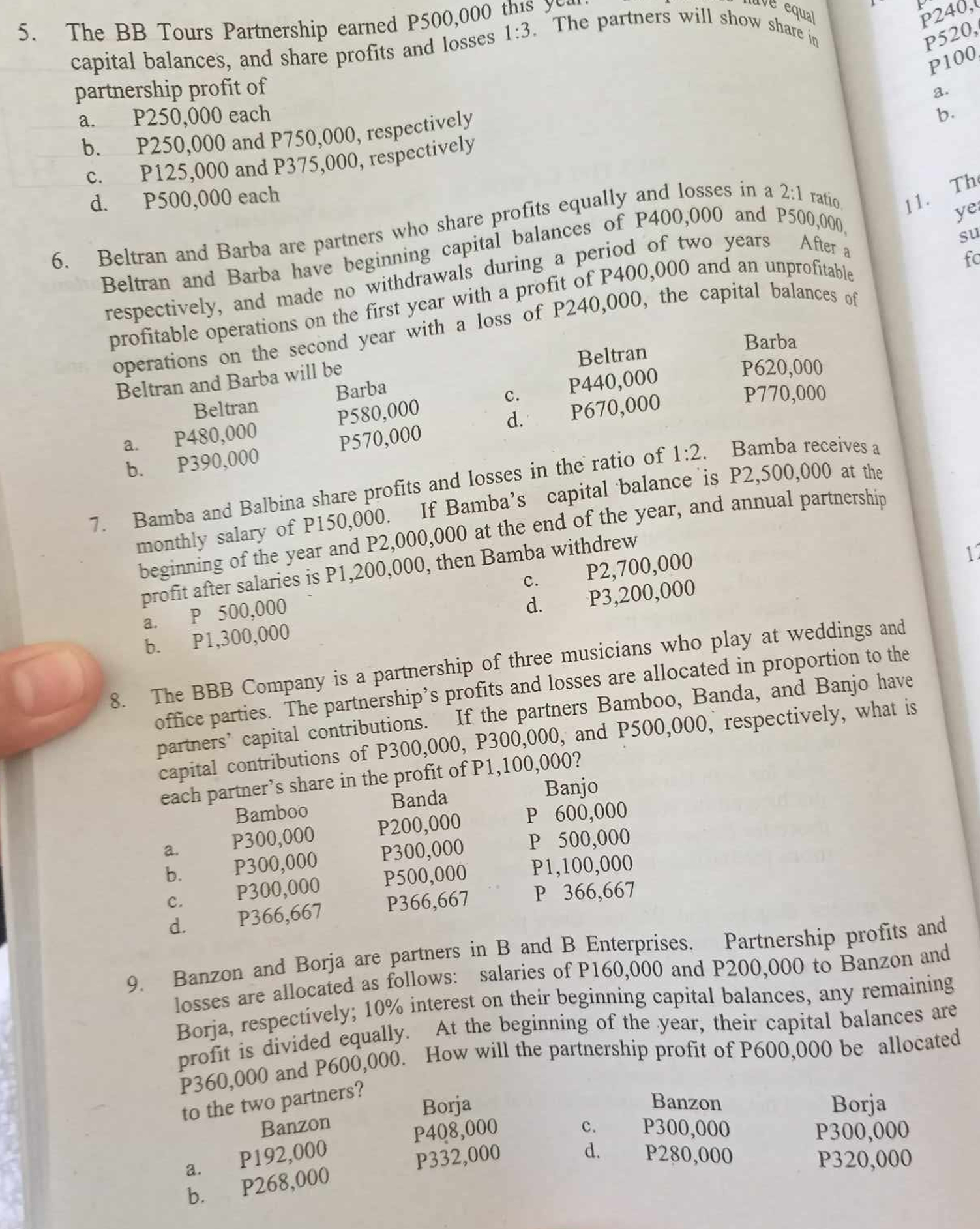

Question: The BB Tours Partnership earned P 5 0 0 , 0 0 0 this the partners will show share in capital balances, and share profits

The BB Tours Partnership earned this the partners will show share in

capital balances, and share profits and losses

partnership profit of

a P each

b and respectively

c P and respectively

Beltran and Barba are partners who share profits equally and losses in a : ratio

d P each

Beltran and Barba have beginning capital balances of and

respectively, and made no withdrawals during a period of and an unprofitita

profitable operations on the first year with a profit of P the capital balances

operations on the second year with a loss of P

Beltran and Barba will be

Bamba and Balbina share profits and losses in the ratio of : Bamba receives a

monthly salary of If Bamba's capital balance is at the

beginning of the year and at the end of the year, and annual partnership

profit after salaries is then Bamba withdrew

c

a P

d

The BBB Company is a partnership of three musicians who play at weddings and

b

office parties. The partnership's profits and losses are allocated in proportion to the

partners' capital contributions. If the partners Bamboo, Banda, and Banjo have

capital contributions of and respectively, what is

each partner's share in the profit of

Banzon and Borja are partners in B and B Enterprises. Partnership profits and

losses are allocated as follows: salaries of P and P to Banzon and

Borja, respectively; interest on their beginning capital balances, any remaining

profit is divided equally. At the beginning of the year, their capital balances are

and How will the partnership profit of be allocated

to the two partners?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock