Question: The better - off test for evaluating whether a particular move to diversify into a new business is likely to produce added long - term

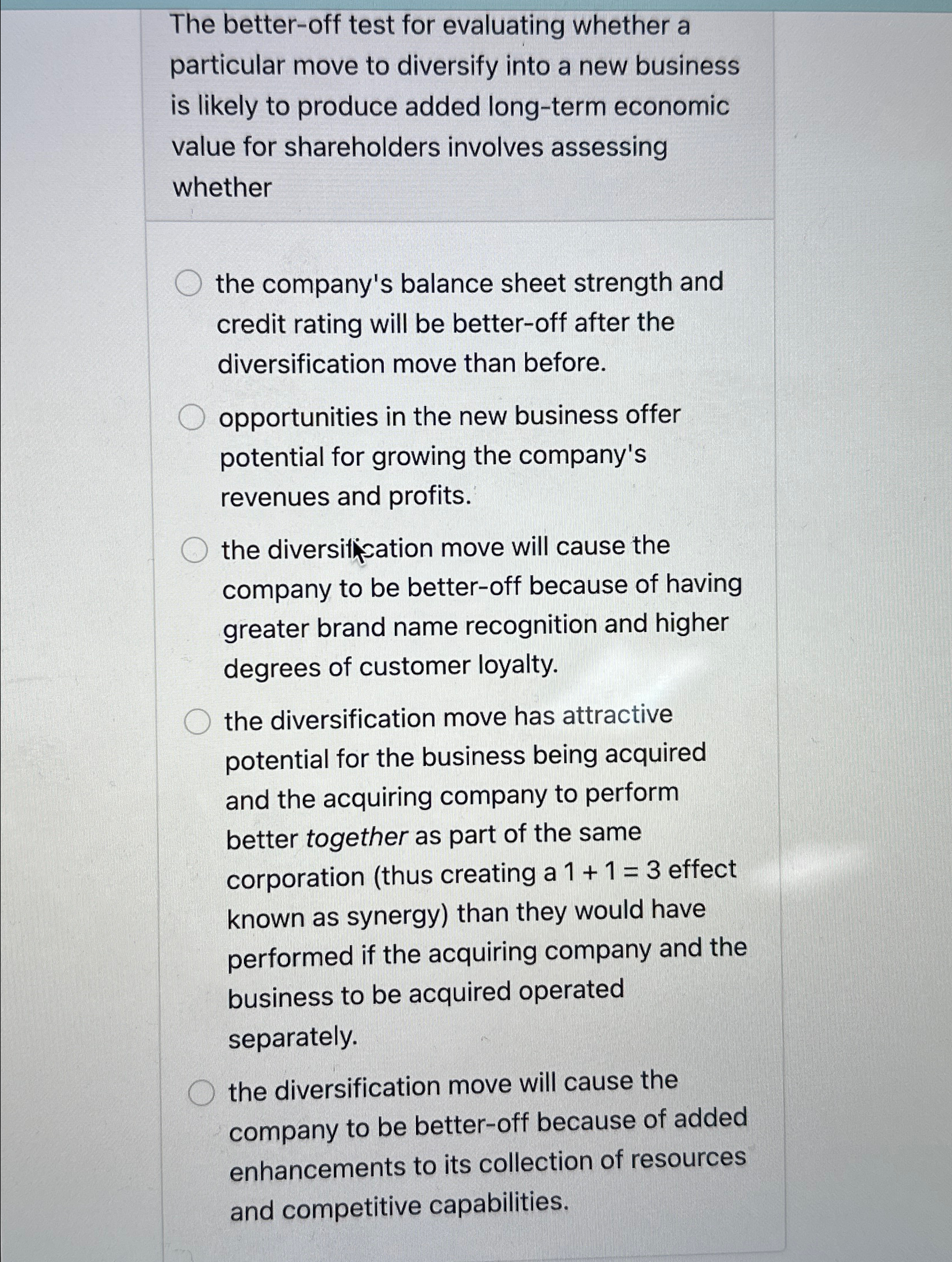

The betteroff test for evaluating whether a particular move to diversify into a new business is likely to produce added longterm economic value for shareholders involves assessing whether

the company's balance sheet strength and credit rating will be betteroff after the diversification move than before.

opportunities in the new business offer potential for growing the company's revenues and profits.

the diversitfcation move will cause the company to be betteroff because of having greater brand name recognition and higher degrees of customer loyalty.

the diversification move has attractive potential for the business being acquired and the acquiring company to perform better together as part of the same corporation thus creating a effect known as synergy than they would have performed if the acquiring company and the business to be acquired operated separately.

the diversification move will cause the company to be betteroff because of added enhancements to its collection of resources and competitive capabilities.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock