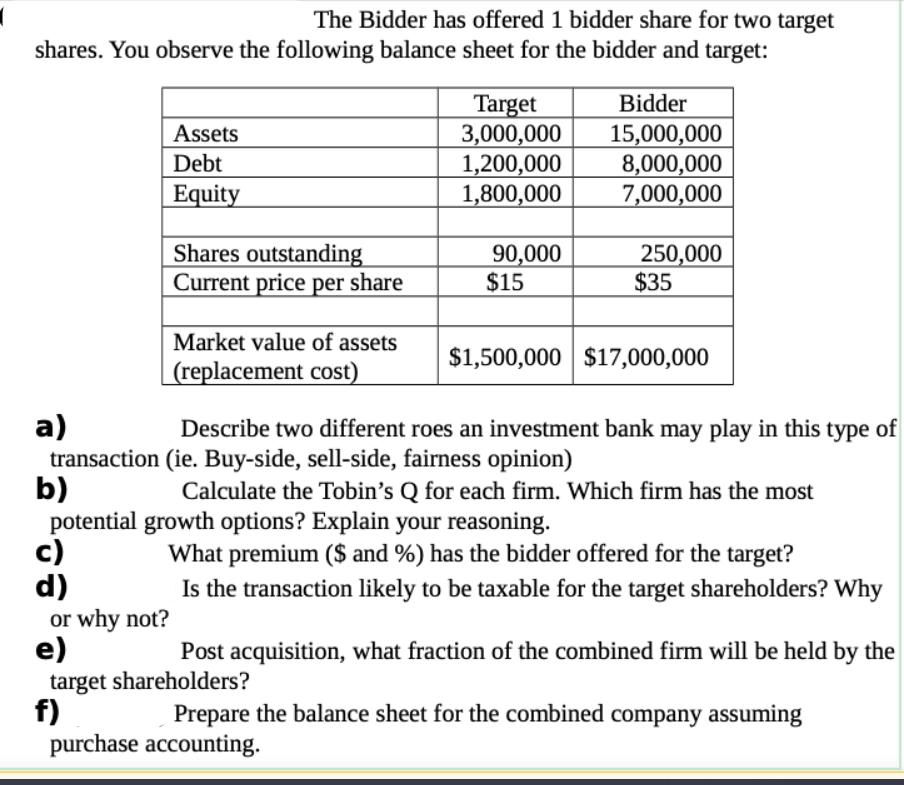

Question: The Bidder has offered 1 bidder share for two target shares. You observe the following balance sheet for the bidder and target: c) d)

The Bidder has offered 1 bidder share for two target shares. You observe the following balance sheet for the bidder and target: c) d) or why not? Assets Debt Equity e) Shares outstanding Current price per share Market value of assets (replacement cost) Target 3,000,000 1,200,000 1,800,000 90,000 purchase accounting. $15 a) Describe two different roes an investment bank may play in this type of transaction (ie. Buy-side, sell-side, fairness opinion) b) Calculate the Tobin's Q for each firm. Which firm has the most potential growth options? Explain your reasoning. What premium ($ and %) has the bidder offered for the target? Is the transaction likely to be taxable for the target shareholders? Why Bidder 15,000,000 8,000,000 7,000,000 250,000 $35 $1,500,000 $17,000,000 Post acquisition, what fraction of the combined firm will be held by the target shareholders? f) Prepare the balance sheet for the combined company assuming

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

The image displays a set of financial data for a bidder and a target company including their balance sheets share information and market values Based on this data several questions are raised each req... View full answer

Get step-by-step solutions from verified subject matter experts