Question: The binomial interest rate tree below misprices the following callable bond: $100 par value, 3 years of maturity, annual coupon rate of 5.25% payable yearly,

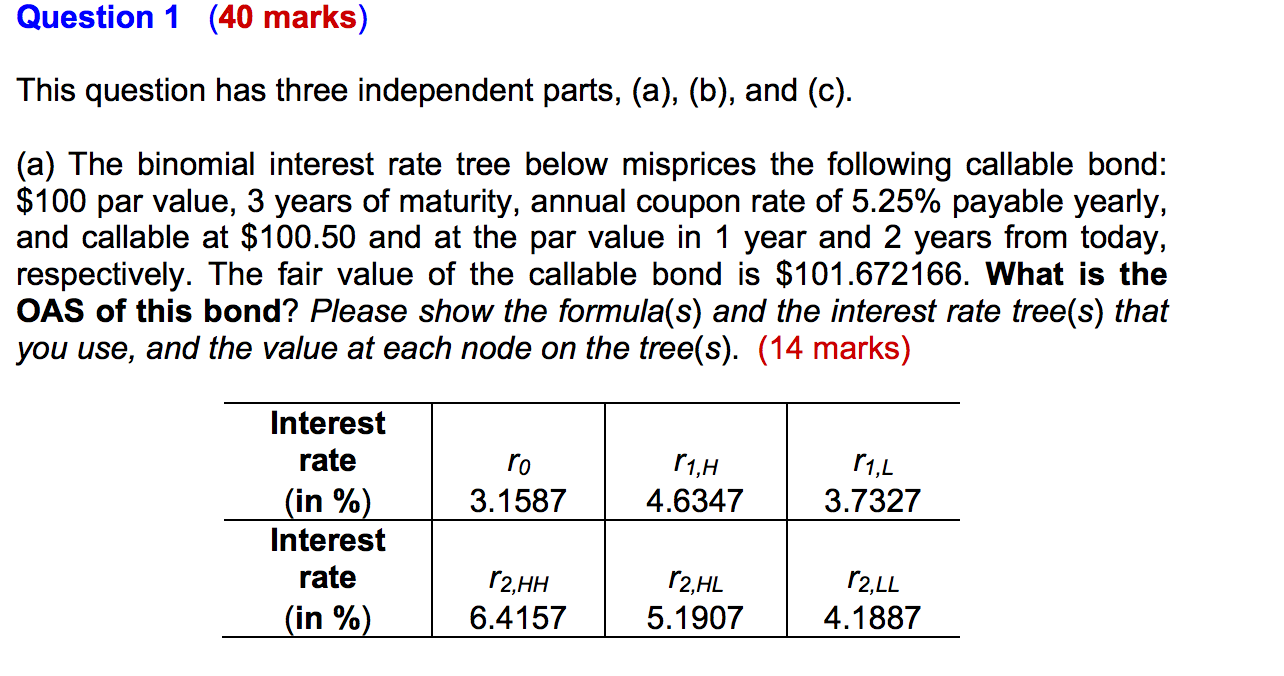

The binomial interest rate tree below misprices the following callable bond: $100 par value, 3 years of maturity, annual coupon rate of 5.25% payable yearly, and callable at $100.50 and at the par value in 1 year and 2 years from today, respectively. The fair value of the callable bond is $101.672166. What is the OAS of this bond? Please show the formula(s) and the interest rate tree(s) that you use, and the value at each node on the tree(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts