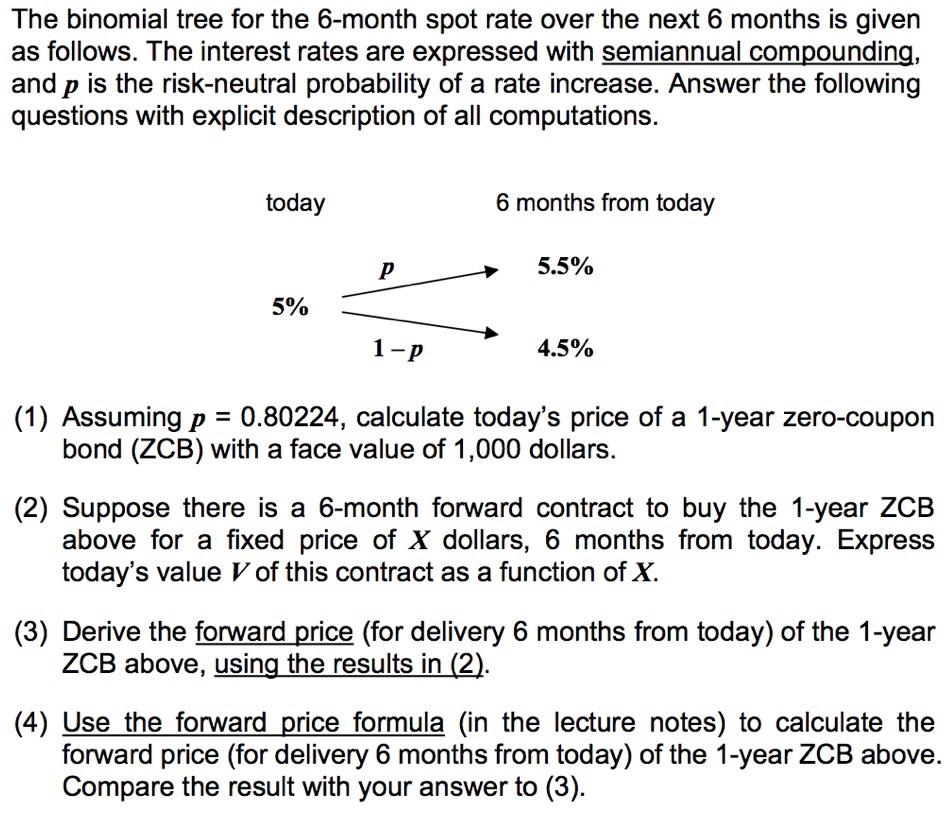

Question: The binomial tree for the 6-month spot rate over the next 6 months is given as follows. The interest rates are expressed with semiannual compounding,

The binomial tree for the 6-month spot rate over the next 6 months is given as follows. The interest rates are expressed with semiannual compounding, and p is the risk-neutral probability of a rate increase. Answer the following questions with explicit description of all computations. today 6 months from today 5.5% 5% 1-P 4.5% (1) Assuming p = 0.80224, calculate today's price of a 1-year zero-coupon bond (ZCB) with a face value of 1,000 dollars. (2) Suppose there is a 6-month forward contract to buy the 1-year ZCB above for a fixed price of X dollars, 6 months from today. Express today's value V of this contract as a function of X. (3) Derive the forward price (for delivery 6 months from today) of the 1-year ZCB above, using the results in (2). (4) Use the forward price formula (in the lecture notes) to calculate the forward price (for delivery 6 months from today) of the 1-year ZCB above. Compare the result with your answer to (3). The binomial tree for the 6-month spot rate over the next 6 months is given as follows. The interest rates are expressed with semiannual compounding, and p is the risk-neutral probability of a rate increase. Answer the following questions with explicit description of all computations. today 6 months from today 5.5% 5% 1-P 4.5% (1) Assuming p = 0.80224, calculate today's price of a 1-year zero-coupon bond (ZCB) with a face value of 1,000 dollars. (2) Suppose there is a 6-month forward contract to buy the 1-year ZCB above for a fixed price of X dollars, 6 months from today. Express today's value V of this contract as a function of X. (3) Derive the forward price (for delivery 6 months from today) of the 1-year ZCB above, using the results in (2). (4) Use the forward price formula (in the lecture notes) to calculate the forward price (for delivery 6 months from today) of the 1-year ZCB above. Compare the result with your answer to (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts