Question: the book answer is 8.89% WACC AT OPTIMAL DEBT LEVEL this is what i have so far b. What are BEA's new beta and cost

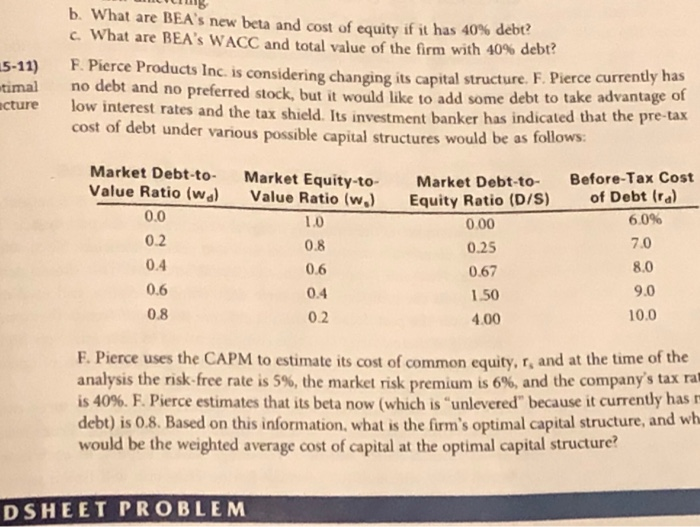

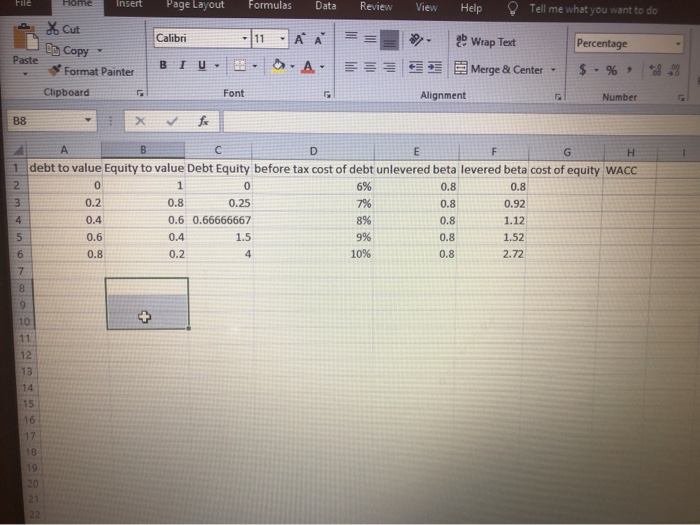

b. What are BEA's new beta and cost of equity if it has 40% debt? c. What are BEA's WACC and total value of the firm with 40% debt? F.Pierce Products Inc. is considering changing its capital structure. F. Pierce currenuy a no debt and no preferred stock, but it would like to add some debt to take advantage of low interest rates and the tax shield. Its investment banker has indicated that the pre-tax cost of debt under various possible capital structures would be as follows: 5-11) wtimal cture Market Debt-to Value Ratio (wa) Market Equity-to Value Ratio (w,) Before-Tax Cost of Debt (ra) Market Debt-to- Equity Ratio (D/S) 0.00 0.0 6.0% 10 0.2 7.0 0.8 0.25 0.4 8.0 0.6 0.67 0.6 9.0 0.4 1.50 0.8 10.0 0.2 4.00 F. Pierce uses the CAPM to estimate its cost of common equity, r, and at the time of the analysis the risk-free rate is 5 % , the market risk premium is 6% , and the company's tax ra is 40%. F. Pierce estimates that its beta now (which is "unlevered" because it currently has n debt) is 0.8. Based on this information, what is the firm's optimal capital structure, and wh would be the weighted average cost of capital at the optimal capital structure? DSHEET PROBLEM File Fome Insert Page Layout Formulas Data Review View Help Tell me what you want to do 26 Cut A A Calibri ab Wrap Text 11 Percentage P Copy Paste B IU A TMerge & Center 00 0 Format Painter Clipboard Font Alignment Number B8 A B C D E F G H. 1 debt to value Equity to value Debt Equity before tax cost of debt unlevered beta levered beta cost of equity WACC 0 1 0 6% 0.8 0.8 0.8 0.2 0.25 7% 0.8 0.92 4 0.4 0.6 0.66666667 8% 0.8 1.12 9% 5 0.6 0.4 1.5 0.8 1.52 10% 6 0.8 0.2 4 0.8 2.72 8 10 11 12 13 14 15 16 17 18 19 20 21 22 00 00 00 00 N m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts