The bookkeeper of Cinnamon Ltd. who is usually responsible for the bank reconciliation is on holiday....

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

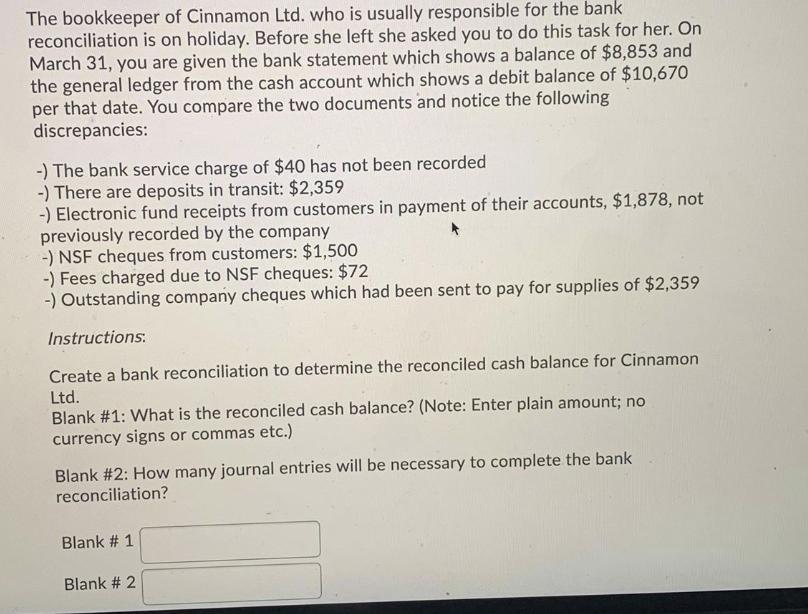

The bookkeeper of Cinnamon Ltd. who is usually responsible for the bank reconciliation is on holiday. Before she left she asked you to do this task for her. On March 31, you are given the bank statement which shows a balance of $8,853 and the general ledger from the cash account which shows a debit balance of $10,670 per that date. You compare the two documents and notice the following discrepancies: -) The bank service charge of $40 has not been recorded -) There are deposits in transit: $2,359 -) Electronic fund receipts from customers in payment of their accounts, $1,878, not previously recorded by the company -) NSF cheques from customers: $1,500 -) Fees charged due to NSF cheques: $72 -) Outstanding company cheques which had been sent to pay for supplies of $2,359 Instructions: Create a bank reconciliation to determine the reconciled cash balance for Cinnamon Ltd. Blank #1: What is the reconciled cash balance? (Note: Enter plain amount; no currency signs or commas etc.) Blank #2: How many journal entries will be necessary to complete the bank reconciliation? Blank # 1 Blank # 2 The bookkeeper of Cinnamon Ltd. who is usually responsible for the bank reconciliation is on holiday. Before she left she asked you to do this task for her. On March 31, you are given the bank statement which shows a balance of $8,853 and the general ledger from the cash account which shows a debit balance of $10,670 per that date. You compare the two documents and notice the following discrepancies: -) The bank service charge of $40 has not been recorded -) There are deposits in transit: $2,359 -) Electronic fund receipts from customers in payment of their accounts, $1,878, not previously recorded by the company -) NSF cheques from customers: $1,500 -) Fees charged due to NSF cheques: $72 -) Outstanding company cheques which had been sent to pay for supplies of $2,359 Instructions: Create a bank reconciliation to determine the reconciled cash balance for Cinnamon Ltd. Blank #1: What is the reconciled cash balance? (Note: Enter plain amount; no currency signs or commas etc.) Blank #2: How many journal entries will be necessary to complete the bank reconciliation? Blank # 1 Blank # 2

Expert Answer:

Related Book For

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta

Posted Date:

Students also viewed these accounting questions

-

Who is usually responsible for sales-activity variances? Why?

-

Who is usually responsible for sales-volume variances? Why?

-

Who is usually responsible for running the affairs of the corporation?

-

In Chapter 12 (p. 432), we described a study reporting that college students who are on Facebook (or have it running in the background) while studying had lower grades than students who did not use...

-

What are the components of the initiation complex in protein synthesis? How do they interact with one another?

-

A lease valued at $32 000 requires payments of $4000 every three months. If the first payment is due three years after the lease was signed and interest is 12% com- pounded quarterly, what is the...

-

Using the wine quality data from Table B.11, fit a model relating wine quality $y$ to flavor $x_{4}$ using region as an allocated code, taking on the values shown in the table $(1,2,3)$. Discuss the...

-

A penny of mass 3.10 g rests on a small 20.0-g block supported by a spinning disk (Fig. P6.60). The coefficients of friction between block and disk are 0.750 (static) and 0.640 (kinetic) while those...

-

On January 1 of Year 1, Alpha Corporation issued $400,000 of 8% (cash payable semiannually on June 30 and December 31), three-year bonds to yield 10%. Required a. Compute the selling price of the...

-

On December 31, 2023, RCA Companys Allowance for Doubtful Accounts had an unadjusted debit balance of $7,800. The accountant for RCA has prepared a schedule of the December 31, 2023, accounts...

-

This introduction to corporate finance course will give an overview of all the key concepts you need for a high-powered career investment banking, equity research, private equity, corporate...

-

What is lactose intolerance? Also why is it, emically spea 7) When lactose and water react, what are the products? Where in the digestive system does this reaction 8) What is the group of disorders...

-

An ultrafiltration membrane has a pure water flux of 210 l/mh at 3 bars. When an oil-water emulsion is concentrated at 4.5 bars the flux reduces to 35 due to a build-up of a cake layer. The specific...

-

Titration of a 100.0 ml solution of certain weak acid and a strong base resulted in the below titration curve that asymptotically tends towards 12.0 at infinite strong base volumes. Using the curve,...

-

Using coils, turbine, or compressor, to draw a simple flow diagram for a typical power production cycle and an air conditioning or refrigeration cycle, respectively. Then, redraw the air conditioning...

-

1. Values of K, as a function of temperature are as follows: Temp (C) 0 25 35 40 Kw 1.14 x 10- 1.00 x 10-14 2.09 x 10-4 2.92 x 10-4 5.47 x 10-14 50 Is the auto ionization of water exothermic or...

-

Discretionary fixed costs are also known as Select one: A. committed fixed costs. B. mixed costs. C. capacity costs. D. managed fixed costs.

-

Suppose that the electrical potential at the point (x, y, z) is E(x, y, z) = x + y - 2z. What is the direction of the acceleration at the point (1,3,2)?

-

Leeds Tool Company produces and sells a variety of machine-tooled products. The company employs a standard cost accounting system for record-keeping purposes. At the beginning of 20X0, the president...

-

Valencia Company had the following income statements for 20X1 and 20X2: Valencia Company generally paid dividends approximately equal to its net income. This resulted in the companys stockholders...

-

Gap, Inc. is a leading global specialty apparel company with 3,263 Company-operated and franchise store locations in 2012. The company was established in 1969 and has several well-known brand names...

-

The primary problem with the hypothesis that life on Earth originated on Mars is that (a) Mars has never had water. (b) the proposed Martian fossils are much smaller than the tiniest bacteria on...

-

Which of these statements regarding the origin of life is false? (a) Life originated on an Earth whose atmosphere contained high levels of oxygen. (b)Miller and Urey obtained amino acids and other...

-

Which of the following mechanisms of evolution consistently causes populations to become more adapted to their environments? (a) natural selection (b)mutation pressure (c) genetic drift (d) gene flow

Study smarter with the SolutionInn App