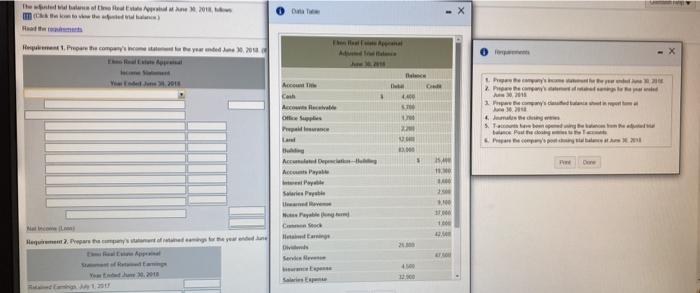

Question: The bottom Precomencemented June 2016 Acco com where 2. Proceed 11 4.400 Ava Office Jone Tabwe Phone Meena Dapaaa aay AP 10. 1 25 Swelle

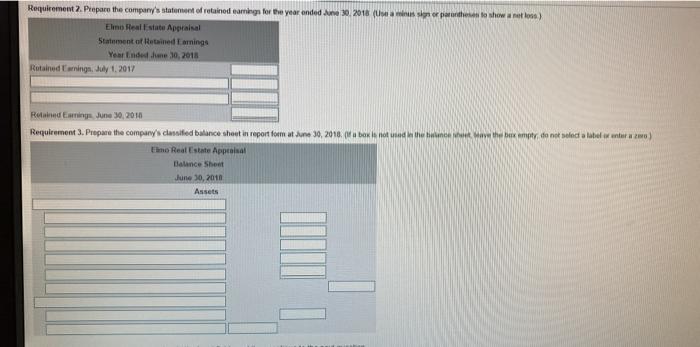

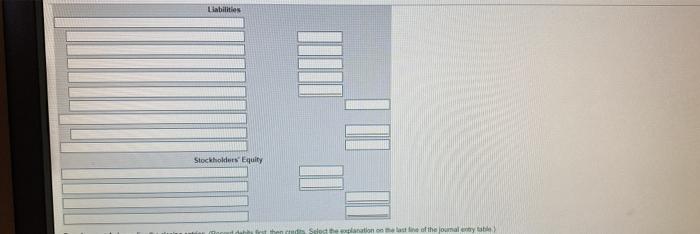

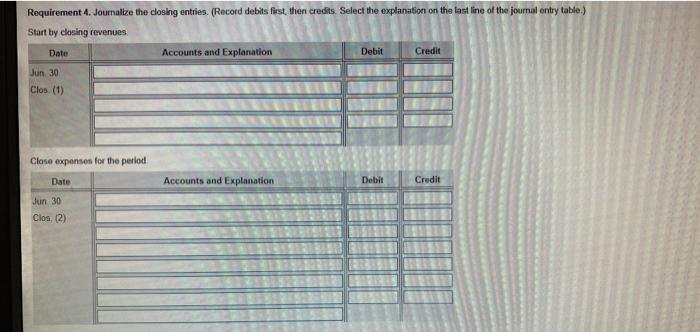

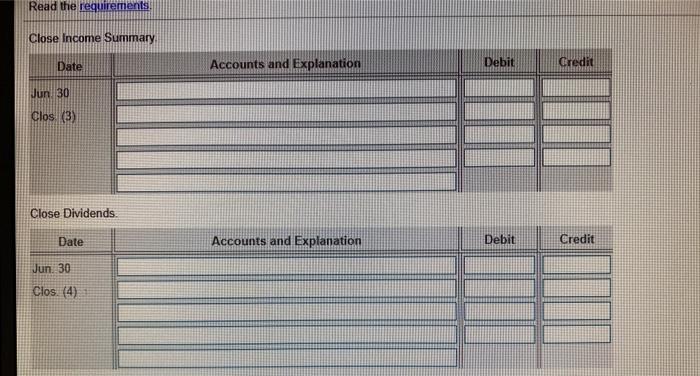

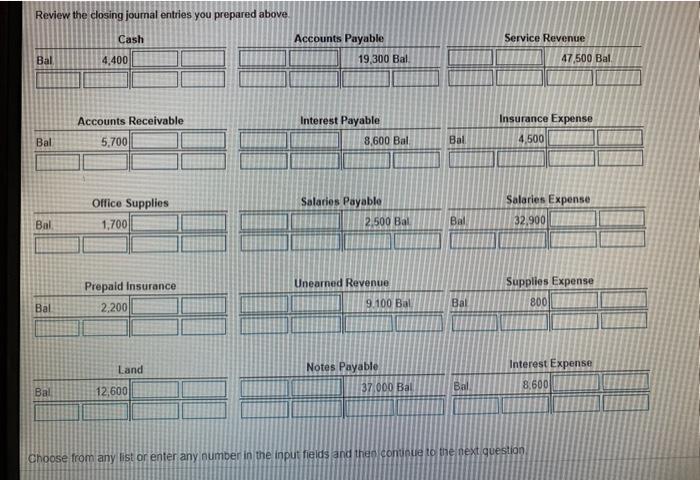

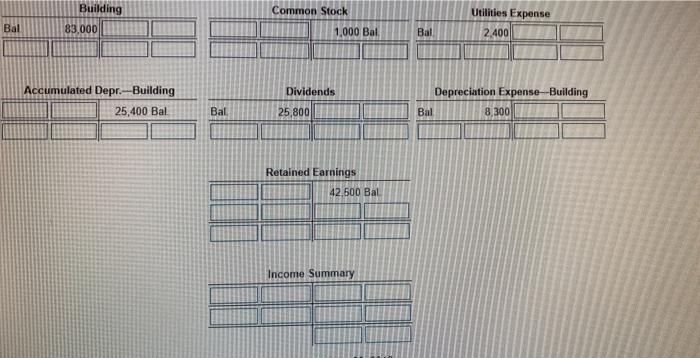

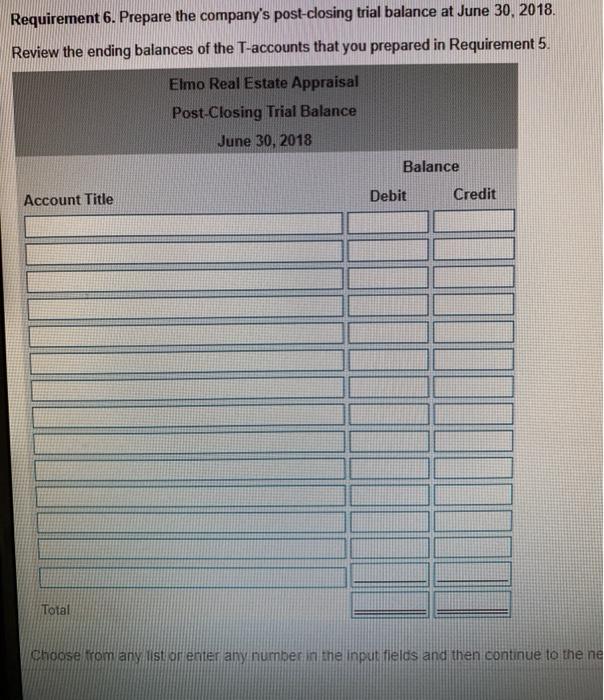

The bottom Precomencemented June 2016 Acco com where 2. Proceed 11 4.400 Ava Office Jone Tabwe Phone Meena Dapaaa aay AP 10. 1 25 Swelle ve 1.00 CS Het Prearada de De 4 Requirement 2. Prepare the company's statoment of retained earnings for the year ended on 30. 2018 (mikror prodhes to show anto) Elmo Real Estate Appraisal Statement of Retained Earnings Year Ende ene 10, 2018 Rotained amnings, July 1, 2017 Retained in June 30, 2016 Requirement 3. Prepare the company's classified balance shot in report format June 30, 2018 (Ma box is not the balance to the box amet, consectelor antara ho Real Estate Appraisal Balance Sheet June 30, 2018 Assets Liabilities MINIO Stockholders Equity II of the journalnya Requirement 4. Journalize the closing entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table) Start by closing revenues Date Accounts and Explanation Debit Credit Jun 30 Clos (1) Close expensen for the period Date Accounts and Explanation Debit Credit Jun 30 Clos (2) Read the requirements Close Income Summary Date Accounts and Explanation Debit Credit Jun 30 Clos (3) Close Dividends Date Accounts and Explanation Debit Credit Jun 30 Clos. (4) Review the closing journal entries you prepared above Cash Service Revenue Accounts Payable 19 300 Bal Bal 4,400 47,500 Bal Accounts Receivable 5.700 Interest Payable 8,600 Bal Insurance Expense 4,500 Bal Bal Salarios Payable Office Supplies 1,700 Salaries Expense 32,900 Bal 2.500 Bal Bal Unearned Revenue Prepaid Insurance 2,200 Supplies Expense 800 Bal Bal 9.100 Bal Land Notes Payable Interest Expense 8,600 Bal 37 000 Bal Bal 12,600 Choose from any list or enter any number in the input fields and then connue to the next question Building Common Stock Utilities Expense 2.400 Bal 83000 1,000 Bal Bal Dividends Accumulated Depr.-Building 25,400 Bal Depreciation Expense-Building Bal 8,300 Bal 25,800 Retained Earnings 42,500 Bal Income Summary Requirement 6. Prepare the company's post-closing trial balance at June 30, 2018. Review the ending balances of the T-accounts that you prepared in Requirement 5 Elmo Real Estate Appraisal Post-Closing Trial Balance June 30, 2018 Balance Debit Credit Account Title Total Choose rom any list or enter any number in the input fields and then continue to the ne The bottom Precomencemented June 2016 Acco com where 2. Proceed 11 4.400 Ava Office Jone Tabwe Phone Meena Dapaaa aay AP 10. 1 25 Swelle ve 1.00 CS Het Prearada de De 4 Requirement 2. Prepare the company's statoment of retained earnings for the year ended on 30. 2018 (mikror prodhes to show anto) Elmo Real Estate Appraisal Statement of Retained Earnings Year Ende ene 10, 2018 Rotained amnings, July 1, 2017 Retained in June 30, 2016 Requirement 3. Prepare the company's classified balance shot in report format June 30, 2018 (Ma box is not the balance to the box amet, consectelor antara ho Real Estate Appraisal Balance Sheet June 30, 2018 Assets Liabilities MINIO Stockholders Equity II of the journalnya Requirement 4. Journalize the closing entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table) Start by closing revenues Date Accounts and Explanation Debit Credit Jun 30 Clos (1) Close expensen for the period Date Accounts and Explanation Debit Credit Jun 30 Clos (2) Read the requirements Close Income Summary Date Accounts and Explanation Debit Credit Jun 30 Clos (3) Close Dividends Date Accounts and Explanation Debit Credit Jun 30 Clos. (4) Review the closing journal entries you prepared above Cash Service Revenue Accounts Payable 19 300 Bal Bal 4,400 47,500 Bal Accounts Receivable 5.700 Interest Payable 8,600 Bal Insurance Expense 4,500 Bal Bal Salarios Payable Office Supplies 1,700 Salaries Expense 32,900 Bal 2.500 Bal Bal Unearned Revenue Prepaid Insurance 2,200 Supplies Expense 800 Bal Bal 9.100 Bal Land Notes Payable Interest Expense 8,600 Bal 37 000 Bal Bal 12,600 Choose from any list or enter any number in the input fields and then connue to the next question Building Common Stock Utilities Expense 2.400 Bal 83000 1,000 Bal Bal Dividends Accumulated Depr.-Building 25,400 Bal Depreciation Expense-Building Bal 8,300 Bal 25,800 Retained Earnings 42,500 Bal Income Summary Requirement 6. Prepare the company's post-closing trial balance at June 30, 2018. Review the ending balances of the T-accounts that you prepared in Requirement 5 Elmo Real Estate Appraisal Post-Closing Trial Balance June 30, 2018 Balance Debit Credit Account Title Total Choose rom any list or enter any number in the input fields and then continue to the ne

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts