Question: The Bruin Stock Fund sells Class A shares that have a front-end load of 5.5 percent, a 12b1 fee of 28 percent, and other fees

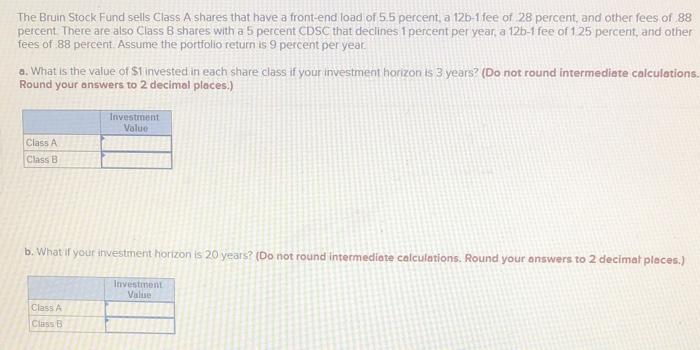

The Bruin Stock Fund sells Class A shares that have a front-end load of 5.5 percent, a 12b1 fee of 28 percent, and other fees of 88 percent. There are also Class B shares with a 5 percent CDSC that declines 1 percent per year, a 12b1 fee of 125 percent, and other fees of 88 percent. Assume the portfolio return is 9 percent per year. a. What is the value of $1 invested in each share class if your investment horizon is 3 years? (Do not round intermediate calculations Round your answers to 2 decimal places.) b. What if your investment horizon is 20 years? (Do not round intermediate calculations. Round your answers to 2 decimat places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts