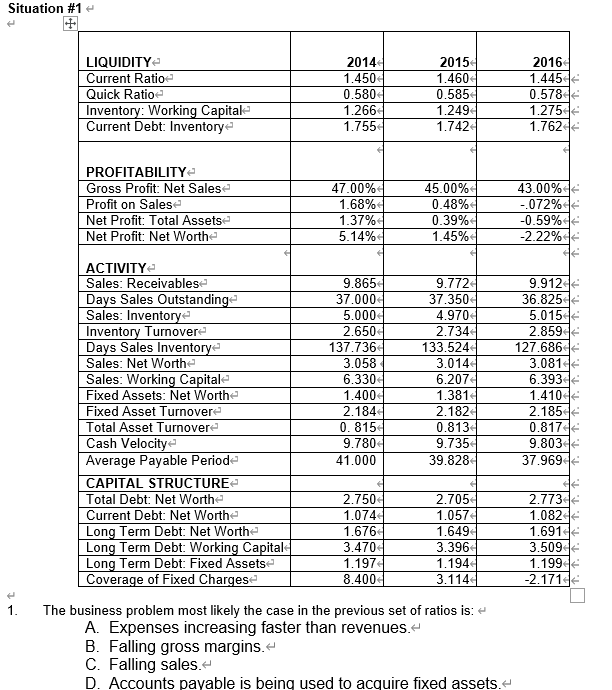

Question: The business problem most likely the case in the previous set of ratios is: Situation #1 LIQUIDITY Current Ratio Quick Ratioe Inventory: Working Capitale Current

The business problem most likely the case in the previous set of ratios is:

Situation #1 LIQUIDITY Current Ratio Quick Ratioe Inventory: Working Capitale Current Debt: Inventory 2014 1.4504 0.580 1.2664 1.7554 2015 1.460 0.585 1.249 1.742 2016 1.445 0.57844 1.2754 1.7624 PROFITABILITY Gross Profit: Net Salese Profit on Salese Net Profit: Total Assets Net Profit: Net Worth 47.00% 1.68% 1.37% 5.14% 45.00% 0.48% 0.39% 1.45% 43.00% - 072% -0.59% -2.22% ACTIVITY Sales: Receivables Days Sales Outstanding Sales: Inventorye Inventory Turnovere Days Sales Inventorye Sales: Net Worth Sales: Working Capitale Fixed Assets: Net Worthe Fixed Asset Turnovere Total Asset Turnovere Cash Velocitye Average Payable Periode CAPITAL STRUCTURE Total Debt: Net Wort Current Debt: Net Worth Long Term Debt: Net Worth Long Term Debt: Working Capital Long Term Debt: Fixed Assets Coverage of Fixed Chargese 9.865 37.000 5.000 2.6504 137.7364 3.058 6.330 1.400 2.184 0.815 9.780 41.000 9.7721 37.350 4.970 2.734 133.524 3.014 6.207 1.381 2.182 0.8134 9.735 39.8284 9.9124 36.82544 5.015 2.8594 127.68644 3.0814 6.39344 1.41044 2.1854 0.81744 9.8034 37.9694 2.750 1.074 1.676 2.7054 1.0574 1.6494 3.396 1.194 3.1144 2.77344 1.082 1.6914 3.50944 1.1994 -2.1716 3.470 1.1974 8.400 1. The business problem most likely the case in the previous set of ratios is: A. Expenses increasing faster than revenues. B. Falling gross margins. C. Falling sales. D. Accounts payable is being used to acquire fixed assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts