Question: The Camel Company is considering two mutually exclusive projects with the following cash flows. Project A cash flow: Year 0 $-75; Year 1 $30; Year

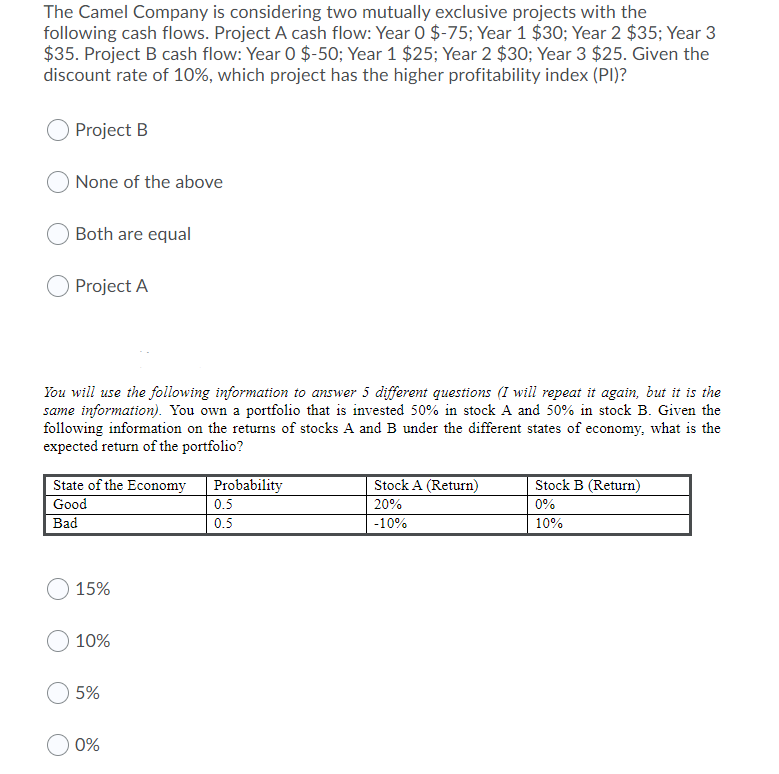

The Camel Company is considering two mutually exclusive projects with the following cash flows. Project A cash flow: Year 0 $-75; Year 1 $30; Year 2 $35; Year 3 $35. Project B cash flow: Year 0 $-50; Year 1 $25; Year 2 $30; Year 3 $25. Given the discount rate of 10%, which project has the higher profitability index (PI)? Project B None of the above Both are equal Project A You will use the following information to answer 5 different questions (I will repeat it again, but it is the same information). You own a portfolio that is invested 50% in stock A and 50% in stock B. Given the following information on the returns of stocks A and B under the different states of economy, what is the expected return of the portfolio? Probability State of the Economy Good Bad 0.5 Stock A (Return) 20% -10% Stock B (Return) 0% 10% 0.5 15% 10% 5% 0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts