Question: The CET function is often used to describe a transformation frontier between two or more outputs. For example, a producer may produce two or more

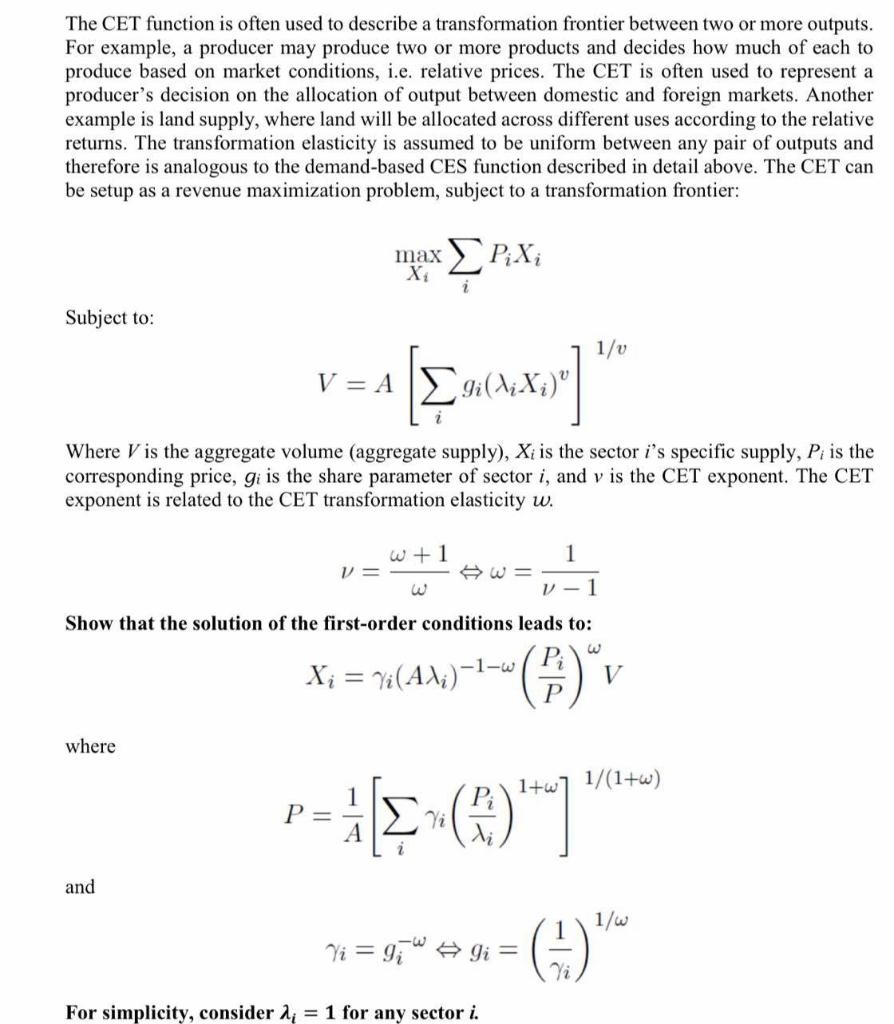

The CET function is often used to describe a transformation frontier between two or more outputs. For example, a producer may produce two or more products and decides how much of each to produce based on market conditions, i.e. relative prices. The CET is often used to represent a producer's decision on the allocation of output between domestic and foreign markets. Another example is land supply, where land will be allocated across different uses according to the relative returns. The transformation elasticity is assumed to be uniform between any pair of outputs and therefore is analogous to the demand-based CES function described in detail above. The CET can be setup as a revenue maximization problem, subject to a transformation frontier: max X Pix ; Subject to: 1/v V = A 9i(1;X;)" Where V is the aggregate volume (aggregate supply), Xi is the sector i's specific supply, Pi is the corresponding price, gi is the share parameter of sector i, and v is the CET exponent. The CET exponent is related to the CET transformation elasticity w. W +1 1 V= w= V-1 Show that the solution of the first-order conditions leads to: w -1-w P X; = Vi(Ali)-1- V where 1+w] 1/(1+w) and re *)" N= q***= e)" For simplicity, consider di = 1 for any sector i. The CET function is often used to describe a transformation frontier between two or more outputs. For example, a producer may produce two or more products and decides how much of each to produce based on market conditions, i.e. relative prices. The CET is often used to represent a producer's decision on the allocation of output between domestic and foreign markets. Another example is land supply, where land will be allocated across different uses according to the relative returns. The transformation elasticity is assumed to be uniform between any pair of outputs and therefore is analogous to the demand-based CES function described in detail above. The CET can be setup as a revenue maximization problem, subject to a transformation frontier: max X Pix ; Subject to: 1/v V = A 9i(1;X;)" Where V is the aggregate volume (aggregate supply), Xi is the sector i's specific supply, Pi is the corresponding price, gi is the share parameter of sector i, and v is the CET exponent. The CET exponent is related to the CET transformation elasticity w. W +1 1 V= w= V-1 Show that the solution of the first-order conditions leads to: w -1-w P X; = Vi(Ali)-1- V where 1+w] 1/(1+w) and re *)" N= q***= e)" For simplicity, consider di = 1 for any sector

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts